ABCI: ‘Underweight’ Call for Solar Stocks

ABC International said it is rating Hong Kong-listed solar sector firms “Underweight.”

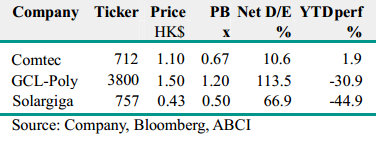

However, some plays are far better off than others, including Comtec Solar (HK: 712) with its very manageable gearing ratio and sunny YTD performance.

The rating decision also comes in the wake of the solar sector trade spat heating up between the PRC and the EU.

“China has filed a World Trade Organization (WTO) case challenging subsidies provided by some EU members to promote the solar panel industry.

“However, the market urgently needs strong catalysts to boost domestic and overseas demand,” ABCI said.

The research house added that “no bottoming-out signal” is observable on product prices and cash call risks of highly-leveraged players is mounting.

On November 5, China’s Ministry of Commerce (MOFCOM) filed a complaint with the WTO claiming EU member states “illegally” subsidized PV manufacturers.

In particular, solar projects in Italy and Greece, which consumed domestically produced solar components, receive additional subsidies of 10% by law.

These subsidies are said to violate WTO rules on import subsidies which negatively affect Chinese PV exports.

China PV exports to Italy dropped by 78.8% y-o-y to 800 million usd for the first nine months in 2012 after the new subsidy rule was announced in 2011, and MOFCOM has asked for consultations with the EU.

Should no solution be reached within 60 days, China has the right to demand that the WTO pass a final ruling.

Photos: Solargiga

“We believe the anti-subsidy compliant filed by MOFCOM is in response to the EU’s decision to launch a similar investigation against Chinese manufacturers on September 6. The complaint might make the case of EU tariffs weaker,” ABCI said.

Since the EU accounts for 70% of global solar demand, any evidence that weakens the EU cases against Chinese exporters provides short term catalysts to the industry.

“In addition, the new move from China has showed its determination to promote solar industry growth in the country.”

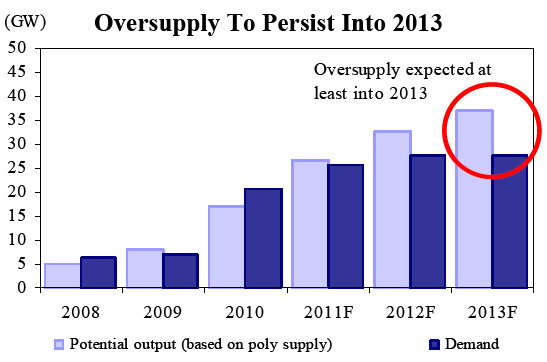

Product price trends are a “good yardstick” to indicate supply significantly outstripping demand.

“Solar stocks rebounded after the Chinese government announced on October 25 that they are planning to provide further subsidies for solar power projects in China.

“Domestic demand is expected to be boosted subsequently,” ABCI said.

However, the research house said it believes the over-supply phenomenon cannot be turned around in the short term and the rebound of share prices could be short-lived.

According to PV Insights, average polysilicon prices dropped 3.4% to 16.6 usd/ton, while solar modules dropped 0.5% to 0.67 usd/watt for the week ended Oct 31.

“We expect seasonality factors will affect installation demand and will continue to put pressure on solar component prices.

Also, cash call risks for highly leveraged stocks is mounting.”

That is less alarming news for some of the more financially sound solar plays like Comtec Solar.

Comtec Solar has one of the lowest net debt/equity ratios in the sector at just 10.6%, significantly better than GCL-Poly’s (HK: 3800) 113.5% ratio.

See also:

ANWELL: Completes US$25 M Solar Power Plant In Thailand

COMTEC SOLAR: Doubles Shipments, But Swings To Loss

Guoco: COMTEC SOLAR Rated ‘Buy’

Guoco Capital said it is giving photovoltaic play Comtec Solar (HK: 712) a “Buy” recommendation thanks to a resurgence of interest in the Hong Kong-listed firm’s shares.

“Last Friday, Comtec’s share price surged by 7.1% with turnover volume being the fourth largest since its listing in late 2009,” Guoco said.

Comtec Solar manufactures solar grade silicon ingots and wafers.

Guoco’s target price on Comtec is 1.39 hkd (recently 1.21).

The consensus target price is 0.93 hkd and the consensus 2013 P/E is 11.2x.

See also:

COMTEC ‘Outperform’ On Wafer Niche

UOB: GCL-POLY ‘Plunging into Red’

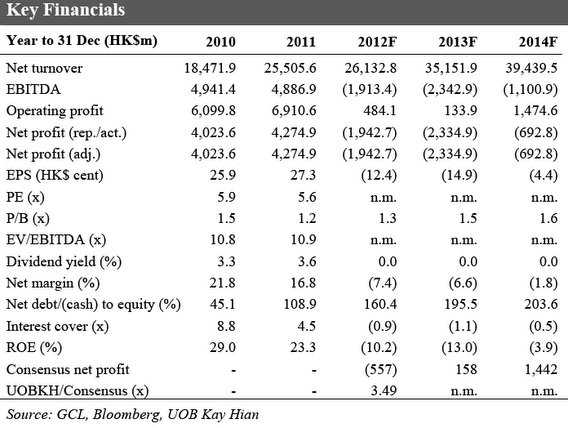

UOB Kay Hian said it is maintaining its “Sell” recommendation on solar play GCL-Poly Energy Hldgs (HK: 3800) due to high debt and grim prospects.

The target price is 0.85 hkd (recently 1.53).

“GCL-Poly is plunging into the red with no end in sight. It is seeing ASP freefall and expects a 2H12 gross loss,” UOB said.

Polysilicon and wafer ASPs have fallen by 28 and 21%, respectively, since end-2Q12 and is now below GCL-Poly’s (GCL) cost levels.

“We expect ASPs to maintain at tier-1 cash cost levels and for GCL to report a loss in 2H12.”

Ballooning A/R highlights collection risks

Accounts receivables (A/R) ballooned by 74% h-o-h in 1H12 as slowing payments by GCL’s tier-1 clients persisted.

“The spate of rumored small/mid-sized player closures during the national holidays increase collection risks and imply further write-down risks ahead,” UOB said.

Inventory write-down risks

“We expect GCL to face potentially significant inventory write-downs in end-12 given a) a drop in ASP below historical cost levels in 2H12 and b) over 1.5 billion hkd of unaddressed inventory against published figures.”

UOB said that in its view, short-term fundamentals continue to be very challenging.

“Share prices across the solar sector have rebounded recently, driven by China’s recent pro-solar announcement. However, government support is inadequate to address prevailing structural oversupply and slowing growth in the established markets.”

GCL-Poly has a dangerously high net debt/equity ratio of 113.5%.

See also:

COMTEC Kept ‘Buy’ By Bocom On Tariff Immunity