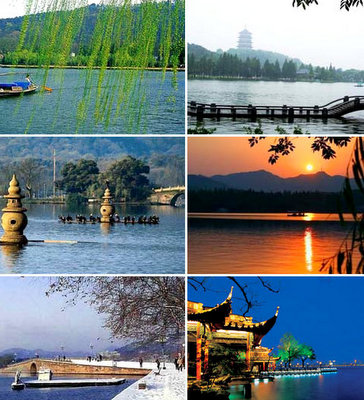

Photos: Zhejiang Tourism Bureau

Translated by Andrew Vanburen from a Chinese-language blog by Yong Dao in Sinafinance

WHILE A WELL-BUILT and safe home offers the ultimate sense of security for you and your loved ones, the same is not always true for those investing in housing developments.

Sometimes, no matter how livable or leading edge a development might be, it still has to exist within a marketplace – one which is not always stable and never predictable.

With this in mind, given the current property price climate in Mainland China, investors only have around a 50% chance of making any money.

This is not just a random sentiment, but a growing trend that can be supported by the following five observations, all of which are not likely to prompt investors to go running toward listed developers.

I recently found myself in Zhejiang Province, ranked by most polls as being the country’s most affluent region.

I also spend some time this month in Jiangsu Province as well, itself no slouch and usually ranked within the top three in terms of per capita GDP.

So what better a place to gauge the state of the nation’s property sector, as these two heavily industrialized and developed provinces not only straddle the country’s biggest and most important financial center – Shanghai – but the two maritime regions are home to a high percentage of the upwardly mobile.

This makes denizens of these two provinces more likely than others to attempt to improve their lot and move up in the world, primarily through the purchase (or rental) of one of the many mushrooming developments in the region under the management of a listed real estate enterprise.

I noticed the following trends, either through speaking with buyers and sellers on the ground or observing the relative activity – or inactivity – in property markets across the two regions.

Firstly, there is a perceptible slowdown in development construction – both in terms of breaking new ground or promptly completing existing projects. There was a noticeable tapering off in activity around sites that I don’t remember seeing my last pass through the region.

Also, there is less enthusiasm toward investing in these projects, regardless of their rate of completion. The excitement and optimism that I remember last time is conspicuously absent this time around.

Photo: CNTD

Secondly, as least as far as developers and sellers are concerned, there is very little anticipation of any property price increases being seen in the near term, with the bulk expecting sector-wide declines.

This has led to less capital pouring into projects and stocks in the industry which exasperates the downside pressure on selling prices for homes and, by extension, rental units.

Thirdly, through both footwork and frank discussions, it has become apparent that the price softening trend we are currently witnessing has already begun in the suburbs.

And there is no evidence to suggest that this downside pricing pressure won’t spread inward to the urban residential market, and it is quite possible the process is currently underway.

Fourthly, inflation continues to rise a bit ahead of expectations as are construction material cost pressures.

This not only dissuades home- and apartment-seekers from upgrading their living venues to something newer and better, but also presents a dangerous double-edged sword for developers who were hoping to offset higher building material costs with rising home selling prices.

Finally, many of the major, higher-end mega-projects are at or near completion.

Therefore, assistance from Beijing to the all-important property sector in the form of subsidies, tax relief or additional interest rate action may be simply too little and too late for many developers.

The sum total of my talks and walks around the property sites in Zhejiang and Jiangsu left me with this impression, albeit not scientific: There's only around a one-in-two chance that investors in projects here will end up making money over the near term.

See also:

CHINA NEW TOWN Inks Landmark Beijing Fund Deal

SING HOLDINGS: Stock Price Is No Reason For Shareholders To Sing

HOUSE MONEY: Top 500 PRC Developers Assets Up 50% To 5 Trillion Yuan

SHOW ME THE MONEY: What Happens To SOE Profits In PRC?