Excerpts from latest analyst reports.....

CIMB says ASP cuts in China should not be focus, it pays to consider how BIOSENSORS can become a prime M&A candidate

Analyst: Gary Ng

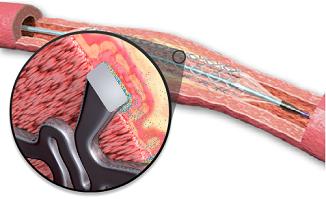

(Note: Biosensors International is the world’s fourth-largest manufacturer of drug-eluting stents. Such a stent consists of a Bare Metal Stent coated with a polymer that gradually releases a drug over three to six months to inhibit the cell proliferation that causes a recurrence of narrowing of a blood vessel.)

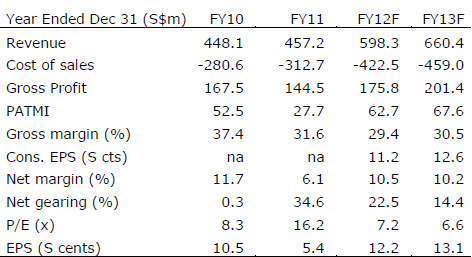

Even with ASP cuts in China, we believe mid-term earnings will remain solid. We believe the single biggest catalyst for BIG will be SFDA approval for the launch of BioMatrix.

On top of that, there is the potential for collaboration/JVs with international players. We keep our estimates, SOP target price ($1.82) and Outperform rating.

Potential licensing uplift. BIG’s global non-exclusive agreement with Terumo will expire at end-2012.

Royalty income from Terumo is between US$4m and US$5m a quarter, ever since 2008.

With BIG now operating more successfully in all its key markets worldwide, it will be in Terumo’s interest to renegotiate a newer and much more lucrative deal for BIG, to ensure the continuity of this arrangement.

While that does not move the dial much in BIG’s revenue, its effects on margins could be more prominent as this is a 100% GP-margin contributor.

Assuming successful re-negotiations to a licensing agreement whereby royalties double, the accretion to BIG’s core PATMI could be 7%.

The M&A scene. BIG has been taking away market share from peers in the international market, with its game-changing product.

For these larger players to look at what BIG is doing and not offer to collaborate with it or even acquire it is nearly inconceivable to us, though any such deal will depend on how major shareholder, Shangdong Weigao, plays the card.

Recent story: NAM CHEONG, BIOSENSORS: Analysts initiate coverage

OCBC Investment Research says CSE GLOBAL is a turnaround story

Analysts: Chia Jiunyang, CFA, and Low Pei Han, CFA.

We continue to like CSE Global (CSE) and believe that it is still in the early stages of its turnaround story.

As a brief recap, CSE was previously hit by a confluence of negative events. In 2Q11, the group incurred cost overrun of S$22m involving several telecommunications projects.

In Feb 2012, it announced that the former Group MD (and a key shareholder with a 13% stake) Tan Mok Koon would be going on a sabbatical leave. Shortly after, CSE issued a profit warning and lowered its 4Q12 profit guidance on unexpected customer delays.

Understandably, investor confidence took a hit then. However, we noted several operational and financial improvements over the past two quarters, reaffirming our view that the group is turning around.

Repairing the Telecom division. The telecom division that encountered the cost over-run issues appeared to be on the road to recovery. A new MD joined the division last year, and operations have been stable so far.

Having achieved operational breakeven (EBIT) in 1Q12, CSE Transtel reported profit after tax of S$0.7m in 2Q12. The division is still working on the two difficult Middle East projects, scheduled for completion by Mar 2013.

But we believe the worst is over and the group’s gross margin should revert to its typical 33-37% over the medium term horizon (FY11: 32%; 1H12: 30%).

Stronger financials. Meanwhile, the group has strengthened its balance sheet by (i) selling off its non-core assets to pare down loans, and (ii) refinancing its short-term borrowing with long-term debt. As a result, CSE now has more flexibility in financing larger projects or pursuing M&A deals.

Maintain BUY with S$1.09. The group recently announced that former Group MD Tan Mok Koon will end his sabbatical leave and return as Non-Executive Deputy Chairman to look into investment opportunities. We believe CSE would benefit from his rich experience. Maintain BUY with an unchanged S$1.09 fair value estimate.

OCBC expects SHENG SIONG's share price to appreciate ahead of 3Q results

Analyst: Lim Siyi

Growth in retail space continues. Since our last update on 27 Jul 2012, Sheng Siong Group (SSG) has added an additional store in Yishun Central on top of the three stores at Geylang, Bukit Batok and Bedok North, which brings the total number of stores to 31 and gross retail space to 391 sf (385K sf previously).

Although retail space has grown by 12.4% on a YTD basis, exceeding its 10% target, management is showing no signs of letting up.

With a minimum target of 33 stores by year-end, there are plans to further increase SSG’s presence in locations with lower representations such as Ghim Moh and Clementi.

Maintain BUY on resilience. Ahead of its 3Q12 results release (expected by early to mid-Nov), SSG’s share price has held firm despite fluctuating investor sentiment.

With SSG likely to experience a traditionally seasonal bump in 3Q revenue contribution, we can expect its share price to appreciate gradually ahead of its results release.

Maintain BUY at an unchanged fair value estimate of S$0.49.

Recent story: BROADWAY and SHENG SIONG: 1-c a share interim dividend