TO UNDERSTAND Singapore-listed Sapphire Corporation's business, start with the steel industry in China.

If infrastructure development in China slows down, as it already has, demand for steel goes down and so will steel prices.

In fact, steel prices in China are at a two-year low currently, no thanks also to an oversupply of steel.

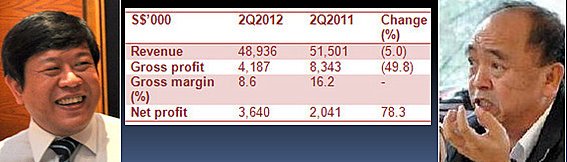

Against this backdrop, Sapphire has had a challenging time this year. Its profit excluding non-operating significant items was negative S$737,000 in 2Q and negative S$7.5 million in the first half of the year.

Given the challenging circumstances, its stock price was recently at 12.5 cents, nearly unchanged from 13 cents at the start of this year. The stock trades at a big discount to NAV of 31.12 cents a share.

Sapphire operates in niches in the steel industry, a few of which are doing relatively fine:

> Vanadium pentoxide flakes: Sapphire produces these flakes for use in the production of light-weight, high-tensile steel for constructing infrastructure.

This segment enjoyed a 21% gross margin in 2Q, although the margin was more juicy a few years ago when the selling price was around RMB200,0000 per tonne compared to RMB60,000 recently.

> Rebar processing was the star business segment with a 44% gross margin.

> Hot rolled coils and other steel products: However, these products were loss-making, incurring -11% margin.

> Mineral trading was also loss-making with a -5% margin.

The question of whether Sapphire would pay a dividend for FY12 came up during a lunch briefing for analysts and investors last Friday.

Mr Roger Foo, an executive director, replied: "It will be subject to our cashflow needs. We have a loan to repay to Credit Suisse early next year and we will need to inject capex to facilitate the production of silicon steel."

The latter business (ie, silicon steel) is a proposed new venture which Sapphire envisages going into via its proposed acquisition of 100% interest of Longwei Medal Product Co.

Two acquisitions -- to boost profit and revenue

Sapphire announced two proposed acquisitions which will be funded by internal resources (and/or external borrowings). In other words, there won't be a rights issue or share placement.

Sapphire had S$26.3 milllion in the bank as at end-June 2012.

"The proposed acquistions will address our immediate and mid-term objectives of improving our revenue stream," said Angeline Lim, Sapphire's corporate communications manager.

a. Acquisition of Longwei Metal Product Co. for RMB152 million at its revalued net asset value.

Sapphire said with vendor support, the interest cost is only 3% (about half of the China banks' rates).

The acquisition will enable Sapphire to immediately offer up to 200,000 tonnes a year of cold rolled coil steel production.

The business is located in Chengdu, a distribution hub and gateway for major industries in the southwest region.

The business was loss-making last year but Sapphire aims to restructure it and, ultimately, to upgrade Longwei's auxillary assets to produce silicon steel.

The latter is a premium product which can reap RMB2,000-3,000 in proft per tonne, compared to a few hundred RMB for other steel products, said CFO Ng Hoi-Gee.

The capex for that has not been disclosed.

b. Acquisition of a rebar production line from an associate company (11.69% stake), Chengyu Vanadium & Titanium (CVTT) for RMB155.2 million.

The rebar processing business is a high-margin business.

Sapphire expects a steady income stream and a gross margin of about 40% from this business segment over the next five years.

The return on investment for Sapphire is only 2.5 years based on a CVTT guarantee that it would buy a minimum of 500,000 tonnes per annum at RMB300 per tonne.

That works out to 500K tonnes x RMB 300 = RMB 150 million in revenue, or RMB60 million in gross profit a year.

Compare that with the Group's RMB24.2 million in gross profit in FY2011 or RMB8.1 million in 1H2012.

On that basis, it appears that shareholders can look forward to, assuming shareholders approve of the acquisitions, enhanced profitability from Sapphire from the fourth quarter of this year.

Recent stories:

SAPPHIRE: Impact of repaying S$91.3 m loan to Credit Suisse

SAPPHIRE: 'My 10 takeaways from investor meeting'

I think china vtm is a very well managed company. The current depressed share price of china vtm is due to power supply issue which should not happen again and their current PE is around 3.....

It would be akin to your kopitiam operator versus Asia Pacific Brewery. Ok, I exaggerate but I hope you get it.

Sapphire already own some % in china vtm.

I believe china vtm should be a better company than the two mention above.