Excerpts from Ernest Lim's blog

What's next for Sapphire if HKICIM becomes a substantial shareholder?

|

Two of Sapphire Corp's largest shareholders, namely Best Feast Limited and Ou Rui Limited, are swapping a combined 27.96% stake in the company with new shares to be issued by Hong Kong-listed Hong Kong International Construction Investment Management Group (“HKICIM”). According to an announcement by Sapphire, the above share swap represents Sapphire's share price of approximately S$0.51[1] per share. |

It is worth noting that

a) Sapphire’s successful transformation bears fruits

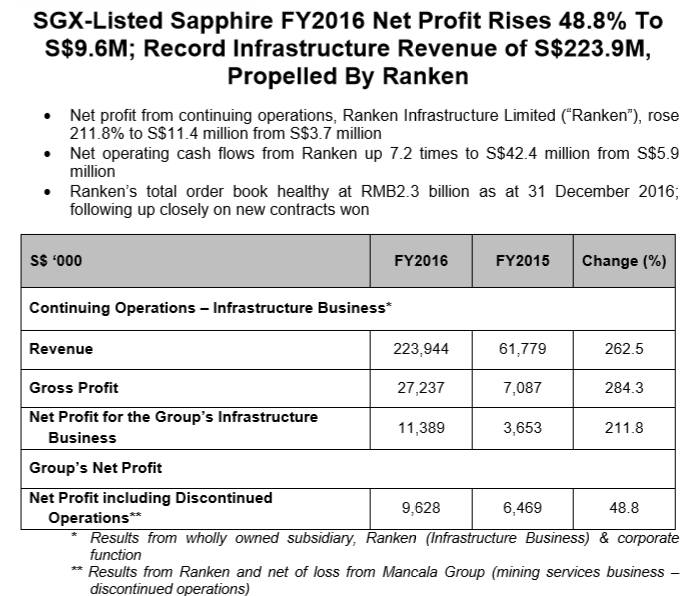

Under the stewardship of the Group CEO and Managing Director, Mr Teh, since his appointment in Oct 2013, Sapphire has divested its legacy steel business in 2014 and disposed of its 81% stake in its mining services in early 2017. Mr. Teh has successfully turned around the company from a loss-making position to a company which posted RMB 47.2m (converted from S$) and RMB20.5m net profit for FY2016 and 1HFY17 respectively.

Such transformation has not gone unnoticed as Sapphire announced on 28 Nov 2016 that it has received Hong Kong-based Capital Weekly (資本壹週) "Listed Enterprise Excellence Award 2016” - the first public listed company not quoted on the Hong Kong Stock Exchange to secure the prestigious accolade. This acknowledges the success of Sapphire’s corporate turnaround strategies under the leadership of Mr Teh. Readers can refer to my earlier write-up (click HERE) on the significance of this award.

b) Acquisition underscores the intrinsic value in Ranken’s licences and track records

Sapphire has always mentioned in their press release that their wholly-owned subsidiary Ranken is one of China’s largest privately-owned integrated rail transport infrastructure construction groups and the only privately-owned operator in China which has obtained the prestigious full AAA-certification for design, construction and project consultation in the rail sector. The acquisition by Sapphire underscores the intrinsic value of the licences held and track records achieved by Ranken.

c) Significant synergies may be reaped

It appears that HKICIM believes that Ranken's capability in rail and infrastructure engineering procurement and construction could complement that of HKICIM. Furthermore, this acquisition will facilitate HKICIM in taking advantage of the industrial development opportunities brought forth by the “One Belt, One Road” development strategy of the PRC.

|

My personal view on this transaction Looking at HKICIM's profile and its networks, it is likely to have a larger portfolio of projects which may bode well for Sapphire/Ranken over the medium to long term, further strengthening its existing good business fundamentals. Although Sapphire mentioned that it has not done any independent review of the financial target for the HKICIM deal, I find it encouraging that the financial target is around RMB64.75m for the 12 months ending 30 Jun 2018. To put this into perspective, 1HFY17 net profit ended 30 Jun 2017 was only RMB20.5m. I am making a wild guess here, if HKICIM and Sapphire/Ranken can work well together with significant synergies, HKICIM could further up its stake in future – as the current interest of about 28% under the deal is very close to trigger the 30% threshold for a general takeover offer. |

If I were to play devil's advocate…

With (almost) all announcements of this nature, we can view them positively or negatively. Some readers may have the following questions which I have put in my personal views:

Are the substantial shareholders Ou Rui and Best Feast cashing out of Sapphire?

After this transaction, Best Feast will still have 17.33% of Sapphire, thus it still has a significant stake in Sapphire.

Ou Rui which is 100% owned by Mr Li Xiaobo, a private and sophisticated investor, thus it is natural for him to exit if he deems fit. However, HKICIM will replace him as a substantial and, more importantly, a strategic shareholder.

Overall, I would think this is still a positive outcome.

Controversy around HKICIM

Although there may be some controversial news surrounding HKICIM and its related companies, I am focusing more on the potential significant synergies which Sapphire/Ranken could gain given HKICIM’s profile and its networks.

|

Sapphire’s existing business remains very promising |

Conclusion

In a nutshell, with the emergence of HKICIM as a potential substantial shareholder, coupled with record order book and strong order momentum for the Sapphire Group, Sapphire seems to have completed its turnaround story from a loss-making firm to an up-and-coming infrastructure player of significant scale. Let’s look out for its 3QFY17F result scheduled for release around mid Nov.

P.S: As with all investments (most investments carry at least some degree of risk), readers should carefully evaluate each investment decision with care. Readers who wish to know more about Sapphire can refer to their informative website HERE.

Disclaimer

Please refer to the disclaimer here

[1] Sapphire’s implied share swap price without any premium to HKICIM share price is around $0.39-0.40.