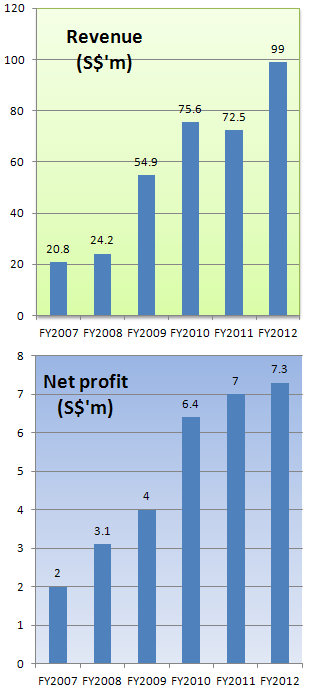

CHASEN HOLDINGS has again demonstrated its ability to grow. With the latest financial year's result, its revenue has shot up about 5X from just S$20.8 million in 2007.

Net profit has similarly risen, from S$2.0 million to $7.3 million.

The key service of Chasen, a Catalist-listed company whose financial year ends on March 31, is the relocation of sensitive high-tech equipment used in industries such as wafer fabrication, TFT display panel production and chip testing & assembly.

Its two other business segments are complementary: third-party logistics services and technical & engineering services. These form a complete supply chain.

Eddie Siah, executive director.The relocation business had a bumper year, contributing $44.5 million to the Group's record revenue of $99 million.

Eddie Siah, executive director.The relocation business had a bumper year, contributing $44.5 million to the Group's record revenue of $99 million.

Sharing insights into the business, Chasen’s lead independent director, Eric Ng, told analysts at a briefing on Monday that there was pent-up demand from MNCs which had deferred the relocation of their operations during the 2008/2009 global financial crisis.

Bumper year in China

Revenue from China, in particular, shot up to about $20 million out of the Group's $44.5 million in relocation business revenue in FY12.

Chasen's big relocation projects were completed in 3Q of FY12, so there was minimal contribution in the 4Q.

Going forward, Chasen is expecting delays in clients' relocation moves to China due to the euro crisis. In one case, a client decided to switch its destination from China to Vietnam where the cost of operating is seen as more attractive.

Intra-China relocation business is still there for Chasen, which is also looking to, specifically, South Korean manufacturers of TFT display panels relocating to China this year and next year to enjoy tax incentives before these expire.

All in all, Chasen is hopeful that its relocation business will be able to maintain the revenue level it achieved last year.

The strategic direction for Chasen is increasingly to develop its capabilities to offer turnkey solutions to customers -- build their plant, put in facilities, move the manufacturing equipment over, etc.

Chasen, which has yet to propose a final dividend, intends to do so in due course before the FY12 annual report is published, said MD Justin Low. Given the FY12 profitability, some investors expect 0.6 cent a share in dividend, unchanged from FY2011. That would be about 1.9% yield, based on the recent 32 cents stock price.

For more information on Chasen's FY12 results, read its press release here.

Recent story: CHASEN a top growing company, KEPPEL LAND's fair value is $3.65 or $2.40?

Excerpts from CIMB report:

Last week, we held our Singapore Corporate Day at the InterContinental Singapore. Centred on the theme of Asia's Up-And-Coming Names, we showcased companies that were riding the region‟s consumption boom.

High conviction >>

Our high conviction call is CSE Global (CSE SP, Outperform, TP S$0.89).

CSE started 2012 on a surer footing. A buoyant Australia, onshore US gas-development projects and the consolidation of TransTel should spur its earnings recovery, Below-crisis valuations and a 6% dividend yield should set it up for stock outperformance.

Outperforms >>

Ezion Holdings (EZI SP, Outperform, TP S$1.12). YTD, Ezion has secured over US$437.5m of contracts. Although it offers the best earnings-growth and ROE prospects, Ezion is the cheapest in P/E and P/BV valuations among peers.

Frasers Commercial Trust (FCOT SP, Outperform, TP S$1.14). With expected full-year accretion of 15% and FY13 yield of 13%, we reckon the market has yet to realise the full potential of the sale of KeyPoint.

Midas Holdings (MIDAS SP, Outperform, TP S$0.41) is facing headwinds in the form of rising receivables and higher operating and interest expense. However, the company has been diversifying its industry exposure. A potential contract win in 2H12 could be a share price catalyst.

Raffles Medical Group (RFMD SP, Outperform, TP S$2.69). Already in pole position in the local healthcare industry, RFMD continues to improve its productivity, pricing and patient mix.

United Engineers (UEM SP, Outperform, TP S$2.83). New hospitality assets and business parks should crown 2012 for UE. The completion of UE Bizhub East lifts its quality investment assets to 67% of GAV, boosting recurring income. We see catalysts from potential asset divestments.

Sheng Siong Group (SSG SP, Outperform, TPS$0.49) is a highly efficient supermarket operator. With no urgent need for funds, its 90% dividend payout ratio will likely continue beyond FY13.

Related story: HIAP HOE; Bear market strategy by DBS VICKERS, MAYBANK-KE