Main photo: Justin Low, MD, Chasen.

CHASEN HOLDINGS yesterday initiated a share buyback program as its stock fell, buying 200,000 shares at between 18.8 cents and 19.2 cents.

Chasen is a SGX Catalist-listed diversified investment holding company specializing in relocation solutions for sophisticated machinery and equipment with complementary logistics, technical and engineering service capabilities.

It has been recognized as one of the World’s Top 1000 Fastest Growing Public Companies in 2011, according to its press release yesterday.

This inaugural list was collated and compiled by the International Business Times (IBT).

Chasen is ranked 133rd on the list of the World’s Fastest Growing Public Companies, as announced on 18th January on IBT’s online portal.

Notably, the Group is also ranked 4th Fastest Growing Singapore Company and 1st in the Road & Rail category worldwide.

IBT takes into consideration all public companies with minimum revenue of US$2 million in 2011 and ranks them using 3-year revenue compound annual growth rate with each year’s revenue calculated on the basis of last twelve months.

Chasen's press release on SGX website can be accessed here.

Recent story: CHASEN HOLDINGS: "Business remains sound, ops continues to be healthy"

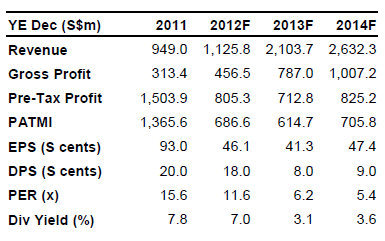

AmFraser Research, noting that Keppel Land is paying S$0.20 dividend per share for a yield of 7.8%, has revised upwards its RNAV estimate by 9% to S$3.65/share.

With fair value at parity to the RNAV estimate, AmFraser maintains its 'buy' rating on the stock and $3.65 fair value.

AmFraser analyst Lau Wei Chong said Marina Bay Financial Centre (MBFC) Phase 2 could present another opportunity for Keppel Land to recycle capital, as it has done with the Ocean Financial Centre last year and which has given Keppel Land an opportunity to pay 20 cent dividend.

The MBFC is expected to be completed in FY12F.

Currently, 66% of MBFC Phase 2 is pre‐leased. Using OFC as a guide, AmFraser thinks that Keppel Land may need to pre‐lease 80% of MBFC Phase 2 before injecting it into a REIT.

The headwinds are softening office rental rates, and AmFraser is forecasting a S$358mil surplus for MBFC Phase 2 based on a valuation of S$2,450 psf.

It is also on par with valuation of MBFC Phase 1 which was divested in October 2010.

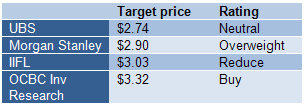

AmFraser's fair value is the highest in the market (see other houses' targets in table on the right).

The lowest is from CIMB, which reckoned that the 20-c dividend should catalyse its near-term share price but then 2012 sales outlook is anaemic with capital redeployment plans unlikely to excite.

"We advocate selling into strength. 4Q11 core EPS forms 29% of our FY11 forecast. FY11 forms 94% of our full year.

"We believe this is below consensus. We introduce FY14 estimates and cut FY12-13 estimates by 18-33% on slower residential sales.

"Maintain Underperform and TP of S$2.40 (still at 40% disc to RNAV)," said CIMB.

Recent story: KEPPEL LAND: Will it propose a special dividend today?