HONG KONG’S Hang Seng Index is about to get bigger.

On December 5, the benchmark index will grow to 48 constituents with two food giants attaining blue chip status – rice cracker and snack food king Want Want China China Holdings Ltd (HK: 151) as well as instant noodle and beverage behemoth Tingyi Cayman Islands Holding Group (HK: 322).

A Chinese-language piece in Sinafinance says that news of the new entrants could help bring some 1.2 bln hkd in new fund inflows into the Hong Kong market.

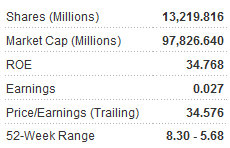

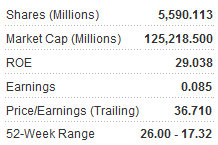

Following their promotion to blue-chip status, Want Want will comprise 0.89% of the Hang Seng Index in terms of market capitalization, and Tingyi 0.72%.

The move will help further diversity the benchmark index which is heavily represented by property developers, insurers and resource conglomerates, the report added.

First, a bit about the two well-known food plays.

Want Want specializes in the production and trade of rice crackers, snack foods, beverages and packing materials, while also engaging in upstream manufacturing of many of the raw materials like wheat and flour found in its ubiquitous downstream products.

The bulk of its manufacturing facilities are located in Taiwan and Mainland China, and Want Want is China’s biggest producer of rice cakes.

The other blue-chip-to-be, Tingyi, is owner of the highly recognizable Master Kong brand, which it uses to market its instant noodles, ready-to-drink teas and baked goods across the region.

Tingyi, China's top packaged food maker, has been making headlines recently with its decision to become PepsiCo’s bottler in the PRC.

For the privilege, Tingyi agreed to provide PepsiCo a 5% stake in Tingyi-Asahi Beverages Holding, with the option to boost the stake to as high as 20% in four years if PepsiCo so wishes.

In addition to PepsiCo’s eponymous carbonated colas, Tingyi will also make, sell and distribute the US firm’s Gatorade drinks.

As part of the deal, Tingyi will also co-brand PepsiCo's Tropicana-branded juice products.

And just this week, media reports had Tingyi actively seeking out Deutsche Bank to help the foodmaker secure a 150 mln usd loan.

Sinafinance said that analysts expect Want Want to attract some 91.6 mln usd in index-traded funds once it gets onto the benchmark Hang Seng, which would be equivalent to around 100 mln of its shares at current valuations.

On Monday, Want Want surged 6.1% on the news, its biggest daily gain in nearly one-and-a-half years.

Meanwhile, Tingyi added 4.3% to begin the trading week, and another 2.8% on Tuesday.

The report added that market watchers from HSBC recommend investors keep a close eye on these two “up and coming” newcomers to the Hang Seng Index.

See also:

Food Firms WANT WANT, YURUN, TINGYI: Buy Or Sell Them?

BAOFENG: Aiming To Crystallize New Orders With Swarovski