Translated by Andrew Vanburen from 希慎興業潛在價值被低估 (中文翻譯, 請看下面)

IN THE HONG KONG stock market, to find a pure rental unit with strong growth potential is a tall order.

But Hysan Development Company Ltd (HK: 14), with a strong presence in Causeway Bay South – both commercial and retail rental real estate -- is one such property counter.

But understanding this Hong Kong listco’s intrinsic value requires more than a casual glance at its P&L sheets, but instead demands the potential investor carefully poring over some of the reports being issued on Hysan lest opportunities to buy into this counter slip away.

Hysan’s business model is disarmingly simple, focusing primarily on The Lee Gardens in Causeway Bay South with its upscale commercial and retail rental units on hand.

It also has half-owned rental housing units along with joint venture integrated property partner Grand Gateway.

Hysan is also perched atop a nestegg of some 1.9 bln hkd, 1.5 bln of which is in shares and assured capital, as well as a current investment property land bank approaching 3.8 mln square feet.

Hysan recently announced its FY2010 earnings performance in which only single digit earnings and turnover growth were recorded during the period, with both higher by around 5%.

On the surface, it appears that Hysan should be haphazardly bunched together with the bulk of slow-growth stocks.

But a more careful inspection of their earnings statement and balance sheet reveals a more nuanced property counter with unappreciated potential.

More obvious growth in 2010

To date, Hysan’s newly reconstructed flagship property – Hysan Square, all 710,000 square feet of it – was not fully reflected in the most recent earnings statement, but the land and construction costs of course made their way into the financials, thus skewing the results to the downside.

Floor area can only be fully tallied into a company’s total after the completion of a project, and Hysan Center, upon completion, will be bigger than the original Hennessy Center located at the same venue.

So far, Hysan has managed to find leased tenants for 25% of Hysan Center’s shops, all of which will be opening in this current quarter (2Q).

The entire layout of the project lends itself very comprehensively to a flagship property for Hysan, with a distinctive feel within, quite distinct from the neighboring properties, and upon completion will substantially enhance Hysan’s overall land bank.

Logistically, it offers underground connections to the MTR as well as the Sogo Department Store in Causeway Bay and several major destinations across Hong Kong.

It is quite likely that with new partners and investors coming on board, Hysan can raise its net asset total to as high as 50 bln hkd.

If things move in this likely direction, Hysan can shrink its debt-to-equity ratio down from the 6.4% seen in 2010.

Following completion of Hysan Square, the complex is expected to contribute an additional 200-300 mln hkd in annual rental income.

Bullish on retail sector

Hysan Square will have retail rental units from the ground floor all the way up to the seventeenth storey.

Eventually, it is expected that revenue from Hysan Square will overtake that of The Lee Gardens in Causeway Bay South.

For the reasons outlined above, Hysan Development is certainly a property play worth paying attention to.

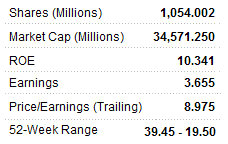

Many investment banks give Hysan a target price of between 36.7 hkd to 45.91 hkd, and these can be used as valuable reference points.

About the company: Causeway Bay, Hong Kong-based Hysan Development Company Ltd, together with its subsidiaries, engages in the investment, development, and management of properties in Hong Kong. It leases office, retail, and residential properties. The company also engages in treasury operations, leasing administration, residential club management and capital market investment, as well as in the provision of security services. As of September 7, 2010, it had investment property portfolio of approximately four mln sq ft of office, retail and residential space; and owned and managed approximately 1,200 carparks.

See also: SOHO CHINA: What Analysts Now Say...

希慎興業潛在價值被低估

文: 估你唔知 (筆名)

在香港股票市場上,要尋找純收租股而又要具增長潛力的,數目相當有限。

當中在銅鑼灣南部利園山一帶持有貴重商業及零售收租物業的希慎興業 (HK: 14),不能夠單以現有的盈虧狀況及資產負債表去衡量價值,在細閱大行報告時,亦需要小心處理,否則很容易忽略了潛在價值。

希慎興業的業務架構很簡單,主要是在銅鑼灣利園山一帶持有貴重的商業及零售收租物業。

另在半出擁有出租的住宅單位,及透過聯營公司,沾手上海港匯廣場綜合物業。

同時亦坐擁逾19億元(港元、下同)現金,以至為數逾15億元的股票及保本投資。以手上的投資物業樓面面積計,多達380萬平方呎。

在希慎剛公布的2010年全年底止年度業績,期內營業額及基本盈利均只有單位數字增長,分別為5%及3%,只有17.64億元及11.48億元而已。

來自估值增加方面的盈利則有25.94億元。從表面上來看,該公司只屬低增長股,然而讀者若能夠細心留意,便發現一些微妙的變化。

增長動力今年顯現

首先希慎旗下原興利中心的重建而成的希慎廣場,坐擁71萬平方呎的樓面面積,並未在其財務報表內全面反映,暫時只計算地皮及建築成本而已。有關項目重建後的樓面面積,比原有的興利中心為多。有關項目至今已租出約25%商鋪,並且將於第二季開幕,屆時將會為希慎新增一項擁有環保元素的旗艦地標物業。其面積比以前更大的地庫物業,與地底的港鐵銅鑼灣站及崇光百貨取得更佳連接。

有關物業加入其投資物業組合中,不單為該公司的整體估值提高製造條件,推高資產淨值至500億元並無難度。若依此方向推論,希慎的淨負債與股東權益比率會比2010年度的6.4% 還要進一步壓低。另因為希慎廣場以旗艦物業新面貌示人,就算按現租值計算,估計每年多增加最少2億至3億元左右租值,亦嫌保守。

零售元素繼續加強

況且該集團會在希慎廣場新添更多零售元素在其中,涉及樓層多達17層,比寫字樓的樓層樓目更多。按旗下現有的零售物業在2010年度的分部溢利達6.19億元,差不多追貼寫字樓帶來的分部溢利6.51億元,連同希慎廣場的零售物業部份計算在內,零售物業佔其整體盈利比重超過一半,只是時間問題而已。長遠筆老更不能夠排除,此項新物業會帶動該集團在利園山的其他商業及零售物業租值進一步提高。

前述因素,還未計算現有物業出租率於2010年提高後,將在2011年度全面反映,甚至年內續租物業提升租值等因素在內。

更重要的意義在於,完成希慎廣場項目 之後,希慎興業將可以更強的資產負債表、經營現金流及更佳的業績表現,為未來包括重建項目等新發展計劃營造條件。

自希慎興業上星期公布去年度全年業績後,股價便持續調整,正好為投資者製造低吸的良機。多家投資銀行預期該公司的目標價由36.7至45.91元不等,均可以作為參考。