AS ITS business recovered, Stamford Tyres shares have firmed up and are now hovering around 31 cents, up by 50% since the start of the year when they were at 20 cents.

The current level is at a discount to the Net Asset Value of 42.78 cents per share, and some way to go from the 40-60 cent range that the stock traded at between 2006 and 2008.

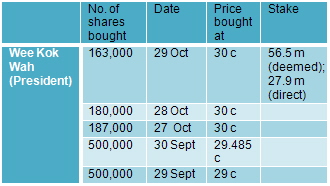

If anyone sees upside, it is Stamford Tyres President Wee Kok Wah, who has recently bought 1.53 million shares (see table).

He now has a deemed interest in 24.075% of the tyre distribution company and a 11.886% direct interest.

Then there is also Sumitomo Rubber Industries, the second largest tyre maker in Japan, which bought 4.3 million new shares (amounting to a 1.8% stake) in September.

The price was $0.35 cents per share, a premium to the volume weighted average price of $0.275 then.

Sumitomo is no ordinary stakeholder. Its Falken brand of tyres has been distributed by Stamford Tyres since 1975.

In 1Q2011, the sales from Falken tyres accounted for approximately 39% of Stamford Tyres’ revenue.

The group reported a 23% rise in net profit to S$1.1 million for the first quarter ended July.

Recent stories:

STAMFORD TYRES shares shoot up after Japan giant tyre maker takes stake

STAMFORD TYRES: Leading distributor opens new markets

Wife of CEO of Hongwei Technologies on buying spree

IN THE PAST six trading days, shares of Hongwei Technologies have spiked up 4 cents, or 18.7%, rising from 24 cents on Oct 27 to close at 28.5 cents on Nov 4.

On Nov 1 and 2, Madam Zhuang Xinxin, a non-executive director and the spouse of the chairman & CEO, bought a total of 2 m shares at S$0.26506 per share on average.

The purchases were made through Maxpro Global, which she owns 100% of.

Maxpro holds 64.8% of Hongwei, which manufactures and sells polyester differential fibers.

Strange as it seems, her husband, Lin Jimiao, does not own any shares directly.

Her buying came after a placement at a lower price in October when Hongwei sold 20 million new shares at 22 cents apiece to unidentified investors.

The business has shown strong growth in the 1H of this year, with revenue rising 30.7% to RMB157 million. Net profit jumped 33.1% to RMB36.4 million.

Annualising the half-time EPS would give about 6.7 Singapore cents, translating into a PE of 4.3X for the current year.

Recent story: HONGWEI: Profit up in 1Q, 2Q, chairman may cut stake to boost share turnover

Technics Oil & Gas makes S$1.1 m share buyback in one fell swoop

Technics Oil & Gas is not the type to nibble at its shares. Its share buyback has proven to be in significant quantities each time, and the latest one was no exception.

The company bought back 1.3 million shares on Oct 29, the day its stock went x-dividend.

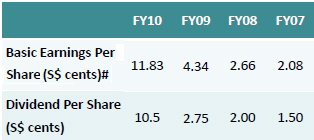

(The dividend, by the way, was 10.5 cents a share, continuing a trend whereby Technics pays out higher dividends on higher earnings.)

The purchase came up to $1.117 million.

With that, the company has bought back 13.309 million shares, or 9.31% of its issued share capital

.

It has since cancelled 13 million shares, a move that effectively raises the shareholding of existing shareholders. It’s the opposite of a dilutive effect that comes from moves such as a placement of new shares.

Technics, which is headed for a TDR listing in Taiwan, has just reported full-year (ended Sept) profit growth of 165% to S$16.38 million.

Recent stories:

YANGZIJIANG, TECHNICS OIL & GAS: What analysts say now.....

TECHNICS OIL & GAS shares at three-year high - nearly