ALONG WITH several Singapore analysts, I first visited Combine Will’s operations in Dongguan, China in 3Q of 2008 as the global financial crisis broke out.

I wondered how much of a hit the company would suffer. It was an OEM/ODM supplying premiums (collectibles) for customers such as a global fast food chain whom I figured were receiving body blows to their business.

As it turned out in 2009, Combine Will’s net profit fell 38% to HK$45.2 million while revenue fell 21% to HK$1.1 billion.

Since then, Combine Will (market cap: S$77 million, dividend yield 4.3%) has made a sharp recovery: It recently announced 1H2010 net profit growth of 246% to HK$50.7 million.

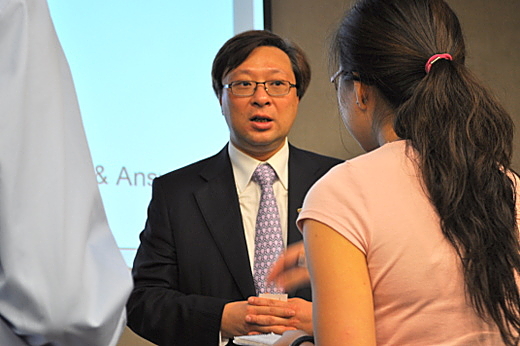

This week I met up with Combine Will’s executive director Simon Chiu and CFO Alan Tsang when they travelled to Singapore to speak with investors and analysts.

Were they were brimming with confidence on growth in the current 2H and for next year!

The 1H revenue and profit was boosted significantly by Combine Will starting manufacturing of a household product that took 2.5 years of Combine Will’s co-development of it with a global healthcare company.

The product is an auto liquid soap dispenser whose annual production is tens of millions of units. The product dispenses liquid soap when its sensor detects hand motion under the nozzle.

Typically, such a product has a life cycle of 3 to 5 years.

For its production, Combine Will has added 2,000 - 3,000 workers, and spent HK$40-50 million in capex. Because of client confidentiality requirements, Combine Will cannot reveal how much the product contributed to its revenue.

But certainly it has made a significant impact in the 1H, which sets the stage for the company’s expected good growth this year – and gives the stock an attractive valuation.

Assuming an annualized earnings per share of 30.92 HK cents (5.4 Singapore cents), the stock at 23.5 cents trades at a current-year PE of 4.3X.

This valuation could improve in the coming months as Combine Will stays on track for a dual-listing in South Korea where the PE for such manufacturing companies is roughly 10X, said Combine Will’s Mr Tsang.

Assuming Combine Will’s valuation on the Korean exchange is at the 10X PE level, the shares in Singapore are likely to trade up to that level too, in order to close the arbitrage gap.

Unlike dual listings via TDRs in Taiwan, a listing in Korea will enable shares on both exchanges to be transferable.

Mr Tsang said the dual listing is likely to take place by the end of this year.

Next year: More high-volume production

Over the years, Combine Will – which began life in 1992 as a small toy manufacturer - has developed capabilities to add electronics and sophisticated mechanical movement to its toys.

These capabilities have positioned it now for a new phase of supercharged growth. It is preparing for a ramp-up in production of high-value toys for a customer which has placed a significant order for delivery from early next year, said Mr Chiu.

“We have been discussing with this customer for about a year already. We showed them our capabilities in automation, R&D, product design, engineering support, and they have designated us as one of their core factories,” added Mr Chiu.

While revenue growth is a given, the profitability level will be challenged by rising operating costs in China. Mr Chiu said that the price of the key raw material – plastics – has been gradually rising.

To mitigate cost increases, Combine Will is turning to semi-automation, raw materials of different specifications, and changes in product specifications such as size.

Recent story: COMBINE WILL: Ramping up production of innovative consumer product