Excerpts from latest analyst reports…..

TAIWAN's Polaris Financial Group sets $1.28 target for Super

Analyst: Jeffrey Lau

Well-established in SE Asian markets, a pioneer in 3-in-1 coffee. According to Euromonitor, instant coffee consumption is expected to experience a 2009-11 CAGR of 6.6 and 10.9% in Malaysia and Thailand respectively.

Super Group (Super) is one of the leading brands in the instant coffee-mix market and is in the position to benefit from this growing trend in SE Asia. The company has also moved upstream and entered the ingredient market, which products are mainly sold to industrial customers in China and Taiwan.

• Ingredient – the sales growth driver. Super’s branded consumer segment (ie.coffee and cereal) provides steady recurring income, and we expect FY10 sales from this segment to reach S$246.8m, up 9% yoy.

Meanwhile, ingredient sales are expected to be the growth driver, with sales growth of 39% yoy to S$43m in FY10. Driven by robust demand, Super is doubling its productioncapacity in China by 2010.

• Undemanding valuations, potential upside of 38%. Super’s plan of a TDR issue will add some speculative appeal to the company. It is currently trading at core FY10 earnings of 9.5x, lowest among its peers.

We set our target valuation at FY10 core PER of 13.2x, which is close to the average valuation of its peers. This implies a target price of S$1.28/share, and a potential upside of 38.4% from the current price level.

Recent story: SUPER: Huge cash pile, divestment proceeds 'augur for special dividend'

DBS Vickers says ASIATRAVEL.COM has a double spanner in growth story

Analyst: Suvro Sarkar

• Thailand violence implies lower room bookings

• Universal Studios ramp up not fast enough, online package sales may be loss-making in FY10

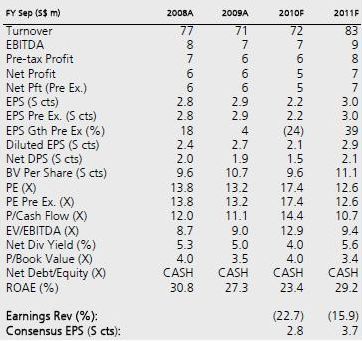

• Cut FY10/FY11 net profit estimates by 23%/16%

• Downgrade to HOLD, TP revised down to S$0.42

Thailand takes its toll. The Red-Shirt uprising in Thailand has dealt a severe blow to the country’s tourism industry, slashing tourist arrivals by almost one-third.

Nineteen countries including the US issued tourist advisories to avoid the troubled state. Thus, tourists are increasingly wary about the security situation in Bangkok, and believe the tense situation is prevalent across Thailand.

1H-CY10 tourist numbers will be hit very hard and 2H-CY10 may only see a gradual improvement.

With Thailand accounting for more than 20% of inbound hotel room bookings for Asiatravel, the impact on earnings in FY10 will be significant.

Universal Studios package sales not ramping up not fast enough. While we had initially assumed Asiatravel to sell about 500 Universal Studios Singapore tickets daily in FY10, it has not really taken off that fast, with some of Universal Studios’ biggest attractions – like the “Battlestar Galactica” duelling roller coaster rides – closed owing to teething technical problems.

Thus, Asiatravel.com has been able to sell only around 250-300 package tickets a day, which we believe is a loss making proposition for them. We estimate a breakeven load of around 500 people per day, given the significant operating expenses involved in running their coach fleet.

Downgrade to HOLD. Given the above concerns, we cut our FY10 and FY11 net profit estimates by 23% and 16%, respectively. Our DCF-based TP is revised to S$0.42 (higher WACC of 10%), which implies 14x FY11 earnings – a justifiable 15% discount to bigger peers.

CIMB-GK says ‘take profit on shipping counters’

(Report put out on Wednesday afternoon)

A surge in the Baltic Dry Index provides opportunity to take profit in shipping counters

• Yesterday the BDI, which measures the cost of transporting commodities, surged 6.2%. This effectively drove up prices of shipping stocks in Singapore this morning.

• Cosco Corp (COS SP; S$1.36) – Cosco which is a China-based shipbuilder that also operates bulk carriers climbed 4.6% to S$1.36. We currently have a target price of S$1.41and an Underperform rating.

• Neptune Orient Lines (NOL SP; S$1.82) – NOL which is South-East Asia’s largest container carrier soared 3.4% to S$1.82. We currently have a target price of S$2.50 and an Outperform rating.

• STX Pan Ocean (STX SP; S$12.76) – STX Pan Ocean which is Korean’s largest bulk carrier increased 1.3% to S$12.76. We currently have a target price of S$17.30 and an Outperform rating.

• SembCorp Marine (SMM SP; S$3.77) – SembCorp Marine, which is the world’s second largest oil rig builder, rose 3.3% to S$3.77. We currently have a target price of S$5.44and an Outperform rating.

• Though the longer term outlook for most of the abovementioned these stocks is positive, we feel there would be further selling pressure in the near term. As such we advise investors to take some profit off the table this afternoon.