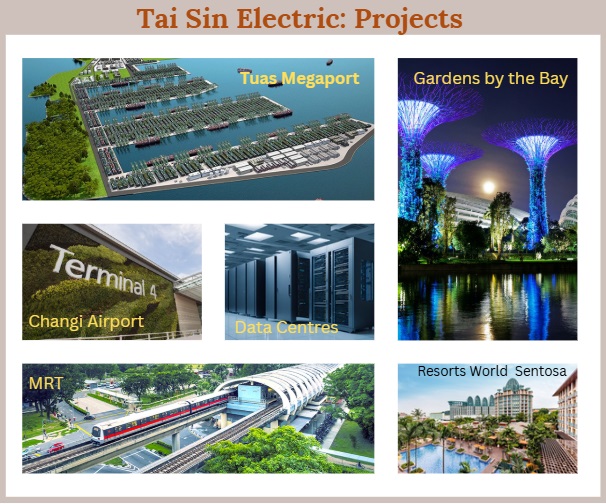

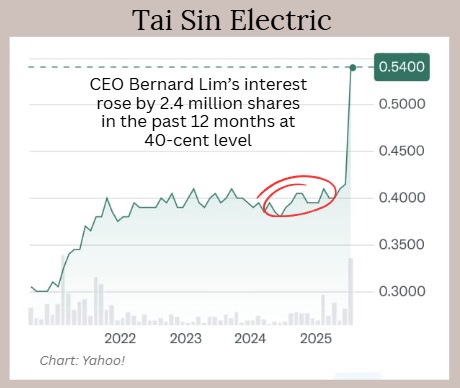

| When it comes to Singapore’s construction and infrastructure sector, Tai Sin Electric is an established name as it has been listed on SGX for the past 27 years. It supplies the cables, wires, and electrical materials that power everything from public housing to MRT line to massive data centers. Tai Sin is a beneficiary of the current construction boom in Singapore and Malaysia, and a wave of new mega-projects on the horizon. Tai Sin has been involved in big-name projects, some of which are highlighted on its website:  In 1HFY25 (ended Dec 2024), the company’s earnings soared 129% y-o-y, reaching S$15.9 million (aided in part by a $2.2 million gain on disposal of a Cambodian subsidiary). Revenue jumped 20% to S$235 million, which the company attributed to "strong demand from major public sector projects and the rapid growth of data centers." Full year FY25 results are expected in August. Despite the positive busines outlook, a key risk in Tai Sin's business is fluctuating prices of copper, the main input material for making electrical cables, which could erode margins where pricing of Tai Sin's products is fixed or negotiated in advance. |

Riding the Construction Wave

The Cable & Wire division accounted for nearly three-quarters of Tai Sin’s total revenue.

This segment brought in S$168.6 million.

Beyond cables, Tai Sin also supplies switchboards and control panels — all vital for the reliable and safe distribution of electricity.

Another 21% of revenue came from distributing such electrical materials, much of it also tied to building and infrastructure projects.

In short, over 90% of Tai Sin’s business is either directly or indirectly linked to construction, especially in Singapore.

The company also serves the electronics and semiconductor industries, which were in a downturn in 2023-2024 and are making a recovery, contributing to the 1HFY2025 (ended Dec 2024) results of Tai Sin Electric.

Mega Projects on the HorizonThe future looks bright for Tai Sin, with several major projects set to drive demand for its products:

These projects aren’t just headlines—they represent real, ongoing demand for Tai Sin’s core products. |

Malaysia: The New Frontier

While Singapore remains Tai Sin’s biggest market, Malaysia is becoming increasingly important.

In FY2024, Tai Sin’s revenue from Malaysia hit S$80 million, up from S$68 million the year before.

The driver is likely the data center boom fueled by global tech giants like Microsoft, ByteDance, and Nvidia.

As Singapore limits new data centers, many companies are building across the border, which likely took supplies from Tai Sin.

Tai Sin's manufacturing site in Malaysia has also seen rising exports to the Phillipines but the company did not disclose the client industries. (Tai Sin also has been exporting more from its Vietnam facility to Cambodia).

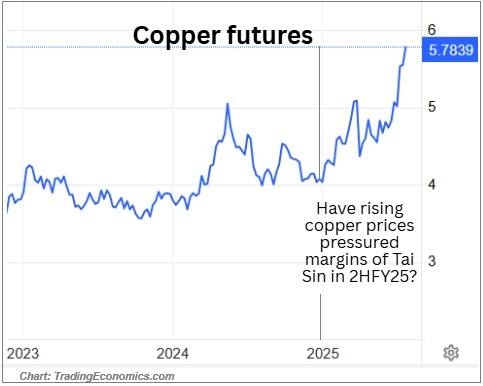

Managing Risks: What About Copper Prices?

Copper is a key raw material for cables. When copper prices rise, Tai Sin’s costs go up.

The company manages this by using financial hedges, managing inventory, and carefully structuring contracts.

While these steps help cushion the impact, sharp or sustained increases in copper prices can still squeeze profit margins, especially on long-term, fixed-price contracts.

In 1HFY25, Tai Sin made a reversal of provision for onerous contracts of $2.322 million (31 December 2023: $3.702 million) based on the prevailing copper price.

Year-to-date, copper prices have been volatile, starting around US$4 per pound and reaching above US$5.80 by late July.

Dividends: Consistent but Will Go Higher?

|

FY |

Interim (ct) |

Final (ct) |

Total Dividend (ct) |

|

2021 |

0.75 |

1.5 |

2.25 |

|

2022 |

0.75 |

1.6 |

2.35 |

|

2023 |

0.75 |

1.6 |

2.35 |

|

2024 |

0.75 |

1.6 |

2.35 |

|

2025 |

0.75 |

N/A* |

N/A* |

|

*to be announced |

|||

For income-focused investors, Tai Sin is attractive because of its consistent dividends supported by free cash flow.

The company has paid dividends twice a year for many years (see table).

The payout ratio ranged from 50% to 74% of earnings in recent years, well above the market average.

The final dividend for FY25 will be revealed with the full-year results in Aug.

| The Bottom Line

Tai Sin Electric looks like a solid play on the region’s construction and data center boom. |