• So, there’s this popular café chain in Johor and in various parts of Malaysia called Oriental Kopi. Not exactly as delicious as their food, but hey, it’s fair. And it turns the spotlight on a Singapore F&B company (more on that later) |

Excerpts from CGS International report

Analyst: William Tng, CFA

■ We resume coverage of Food Empire Holdings (FEH). Our last report on FEH was issued on 15 May 2024. ■ We resume coverage of Food Empire Holdings (FEH). Our last report on FEH was issued on 15 May 2024. ■ In our view, FEH is pivoting its business to the Asian region, with its planned US$80m freeze-dried soluble coffee manufacturing facility in Vietnam. ■ We update our forecasts (lifting operating costs on higher marketing spend in Vietnam and interest expenses for its REN), leading to a lower S$1.43 TP. |

Further capacity expansion to grow its business

|

Food Empire |

|

|

Share price: |

Target: |

FEH plans to invest US$30m to build a new coffee-mix production facility in Kazakhstan.

The facility will occupy half of a 10-hectare plot, leaving room for future expansion.

FEH targets to have the plant ready for production by end-FY25F.

FEH will also invest US$80m in Binh Dinh province, Central Vietnam, for the construction of its second freeze-dried soluble coffee manufacturing facility.

Partnership with Ikhlas Capital

FEH completed its strategic partnership with Ikhlas Capital (Ikhlas; private equity fund) on 1 Nov 2024 to expand its Southeast Asia/South Asia businesses.

FEH completed its strategic partnership with Ikhlas Capital (Ikhlas; private equity fund) on 1 Nov 2024 to expand its Southeast Asia/South Asia businesses.

FEH has issued US$40m, 5-year redeemable exchangeable notes (REN) at 5.5% annual interest.

Together with Ikhlas, FEH aims to create value for its shareholders by tapping into Ikhlas’ vast network to open doors for partnerships and business opportunities in the region, the company said in its 20 Aug 2024 press release.

The REN can be converted into FEH shares at S$1.09 apiece after 1 Nov 2026.

9M24 revenue grew 12.8% yoy

For 9M24, FEH’s revenue grew 12.8% yoy to US$344.3m. Southeast Asia/South Asia were the fastest growing segments at 30.6% yoy/28.3% yoy, respectively.

The strong growth in Southeast Asia was due to Vietnam, FEH’s current fastest growth market, while the growth in South Asia was due to higher sales volumes of snacks and non-dairy creamer.

Southeast Asia’s revenue reached US$94.8m in 9M24 and, in our view, is likely to exceed that of Russia (FEH’s biggest segment; 9M24 revenue of US$102.5m) over FY25-26F.

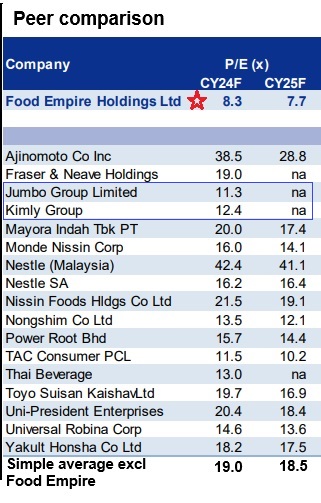

| Reiterate Add We raise our operating expense assumptions as FEH further increases marketing spend in its growing Vietnam market, and we factor in US$2.2m in additional interest expenses from the REN, leading to 4.67-17.24% reductions in our FY24-26F EPS forecasts.  William Tng, CFA William Tng, CFAGiven the FY25F EPS cut, our TP falls to S$1.43 (from S$1.73). Our valuation basis is unchanged at 11.2x FY25F P/E, 1.0 s.d. above its 5-year mean (2019-23). We reiterate Add due to: a) its potential to grow its operations in Vietnam into a new major revenue contributor, and b) its potential to grow its food ingredients business. |

Key re-rating catalysts:

a) improving operating margins on stabilising market demand,

b) sustained market share in its key market, Russia, and

c) a resolution to the Russia-Ukraine conflict.

Key downside risks:

1) an escalation in the Russia-Ukraine conflict affecting its Russian operations, and

2) depreciation of the Russian ruble against US$, leading to lower revenue in US$ terms.

Full report here.