• AI has been relentlessly discussed in the news in recent times. And AI is coming to your PCs, revolutionising the landscape of personal computing. These next-generation devices integrate AI capabilities directly into their hardware. • These PCs are equipped with specialized processors, such as Neural Processing Units, which enhance their ability to perform complex AI tasks locally without relying on cloud services. • Users can expect faster processing speeds, enhanced security features, and more intuitive user interfaces tailored to individual preferences. • AI PCs are projected by Boston Consulting to comprise an astounding 80% of the world's PC market by 2028. Morgan Stanley had a figure of 65% in its report (not publicly available) titled "AI PCs To Usher In The Next Leg Of PC Market Growth". This is a big business opportunity for not just PC makers but the likes of chip producer Intel that makes the majority of chips in PCs. And, if Intel does well, so will Singapore-listed AEM Holdings for whom Intel is its key customer for semiconductor backend testing. • See what DBS Research says about the smartphone and PC vendors and component suppliers which will benefit. |

Excerpts from DBS Research report

Analyst: Jim Au

| We expect hardware downstream vendors with growing AI exposure to benefit from the uptrend in AI device adoption. Component suppliers are poised to capitalise on rising endmarket demand for AI smartphones and AI PCs. |

| Smartphone and PC vendors |

Lenovo (BUY, TP: HKD13.6)

Lenovo is the market leader in PCs with aggressive AI PC development, and is well-positioned for the inflection point in AI PC adoption that is expected in 2025.

The company has a strong pipeline for expanding its AI PC offerings through 2024 and 2025, including the latest generations of ThinkPad and ThinkBook by the end of 2024, as well as Yoga-series and IdeaPad-series models from late 2024 to early 2025.

We forecast Lenovo’s AI PC shipments to surge by 125.9% and 153.8% in FY3/25F and FY3/26F, respectively, representing 20% and 47% of total PC shipments.

We raised our earnings forecasts by 5.3% for FY3/24F and 9.5% for FY3/25F, reflecting stronger AI PC shipments and a favourable product mix shift towards higher-premium PCs.

We maintain our BUY rating on the stock with an increased TP of HKD 13.60, based on 13x forward P/E, in line with historical averages.

Xiaomi (BUY, TP: HKD31.0)

The company is launching the most competitive AI flagship smartphone among Android peers, marking the first smartphone powered by Snapdragon’s next-gen AI optimized SoC.

This positions the company to effectively capitalise on the growing trend of AI smartphone adoption in FY25.

We anticipate that higher-than-expected XM15 shipments will further increase Xiaomi's premium phone mix to 20.1% in FY24F and 22.9% in FY25F, up from 17.4% in FY23F. Xiaomi SU7, the first EV car launched this year by the phone maker.

Xiaomi SU7, the first EV car launched this year by the phone maker.

Reflecting this stronger-than-expected XM15 shipment and a boost in gross margins within the hardware business, we raised our earnings forecasts by 0.8% for FY24F and 4.6% for FY25F.

We maintain our BUY rating on the stock with a higher target price of HKD 31.0, based on an unchanged valuation of 27x forward P/E, consistent with historical averages.

| Component suppliers |

| BYDE (BUY, TP: HKD 45.0) The anticipated AI smartphone adoption is expected to increase demand for more complex chassis and structural components, designed to improve heat management and accommodate larger batteries for extensive edge AI computing. BYDE has expanded its exposure to iPhone components, now covering approximately 40% of iPhone Pro and Pro Max shipments following its acquisition of Jabil’s mobile business. As a key supplier of upgraded chassis components for iPhone 16 and other major Android brands, BYDE is well-positioned to benefit from specification upgrades in chassis design, which should boost the ASP and gross margin of its smartphone component business. We maintain our BUY rating on the stock, with an unchanged target price of HKD 45.0. |

| AAC Tech (BUY, TP: HKD 43.0) The adoption of AI is expected to shift smartphone controls from touch-focused to voice-focused interactions, driven by the increasing use of AI assistants. As a result, demand for microphones with improved signal-to-noise ratio (SNR) in smartphones is expected to rise. AAC Tech, a key acoustic supplier for Apple and other Android brands, is well positioned to benefit from upgrades in both the number of microphones per device and enhanced SNR as AI smartphone adoption grows. We anticipate gross margin expansion driven by higher ASPs and an improved product mix in microphone components, leading to earnings growth of 183% and 23.4% in FY24F and FY25F, respectively. We maintain our BUY rating on the stock with an unchanged target price of HKD 43.0. |

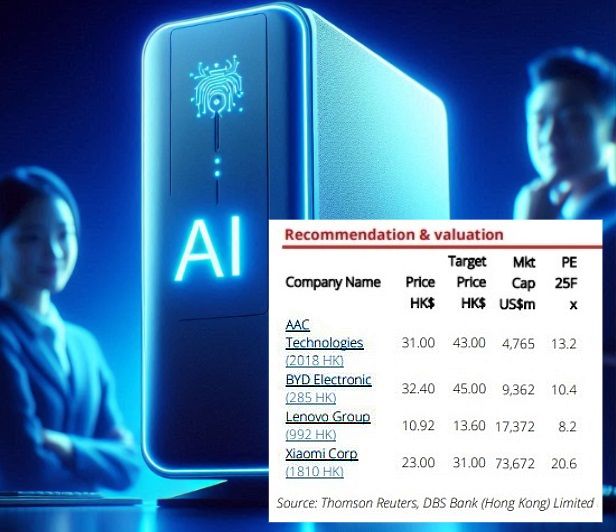

Most downstream players display accelerating growth, driven by AI device adoption. Our picks, AAC Tech, BYDE, Lenovo, and Xiaomi, are trading at attractive PEG ratios compared to peers. AAC Tech’s 0.28 and BYDE’s 0.35 are below the component supplier average of 0.57, while Lenovo’s 0.28 and Xiaomi’s 0.95 are well below the vendor average of 2.63. All are trading below the downstream players' average PEG ratio of around 1.52. |

Full report here.