|

At 26 cents, the recent stock price of Geo Energy Resources is up about 18% from a year ago (when it traded at 22 cents).

But the Singapore-listed miner continued to be profitable: In 1H2024, its cash profit per tonne averaged USD11.94 (1H2023: USD15.69). For the near term, coal futures look stable which could enable 2H2024 earnings to surge if Geo Energy successfully increases its production sharply (more on that below). |

What's perhaps alluring about the company to longer-term investors is a transformative plan it is executing.

It will result in, from late 2025 or early 2026, its scale of operations and profitability being in an entirely different league from where it is now.

To recap some key steps:

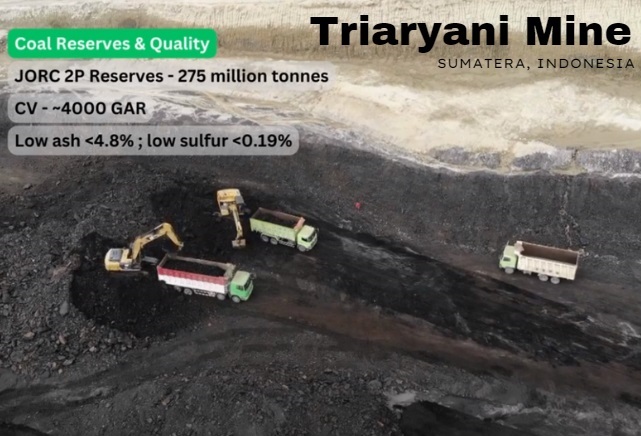

- Acquisition and Expansion: Geo Energy acquired a 73.11% stake in PT Golden Eagle Energy Tbk, listed on IDX, and it owns 85% of TRA mine. This acquisition is a key component in boosting Geo Energy's production capacity.

- Infrastructure Development: Geo Energy is developing a world-class hauling road and coal terminal port at Lalan River, with a targeted capacity of up to 40 million tonnes per year.

Of this, 25 million tonnes are reserved for coal from the TRA mine, ensuring efficient logistics and transportation to both domestic and international markets.

- Offtake Agreements: Geo Energy has entered into a life-of-mine offtake agreement with EP Resources, committing to supply up to 12 million tonnes per year.

This agreement secures a substantial portion of TRA's production, providing financial assurance.

Recognising the potential creation of great value, a Swiss fund, Resources Invest, became a substantial shareholder of Geo Energy with close to 82 million shares of Geo, or a 5.8% stake, according to a stock exchange filing earlier this year.

The total consideration was approximately S$30 million.

It paid 45 SG cents/share for 14.9 m treasury shares of the company and an assumed 35 SG cents/share average for the remaining 67.1 m open market shares.

It will not stop there.

As agreed and announced previously, Resources Invest intends to buy another tranche of treasury shares in March 2025 for US$5 million (at 50 SG cents per share).

The obvious optimism of Resources Invest may be grounded in a few key factors:

| • Assuming the coal price remains at the current levels, Geo Energy says it would generate an estimated USD400-USD500 million EBITDA per annum when its TRA mine achieves 25 million tonnes of coal a year. It's a gradual ramp-up. • In addition: Assuming Geo Energy is able to get third party miners using its new haul road to transport their own coal amounting to 10 million tonnes, the revenue is US$100 million a year assuming US$10 per tonne. And obviously the need for the road could well extend to over 10 years, if not more. (Workings: Road will have capacity for hauling 40 million tonnes a year, of which up to 25 million tonnes will be reserved for Geo Energy's TRA coal. Geo Energy has said there's a potential up to US$10 per tonne cost savings in logistics for TRA mine which, by extension, could apply to other mines in the vicinity). |

So that's the kind of very approximate profit scenarios that Geo Energy may start to see 1.5-2 years from now.

As for the immediate future .....

1H2024 was lacklustre in terms of operating profit owing to wet weather affecting coal production.

But 2H2024 might be much brighter because of a large production ramp in more conducive dry weather.

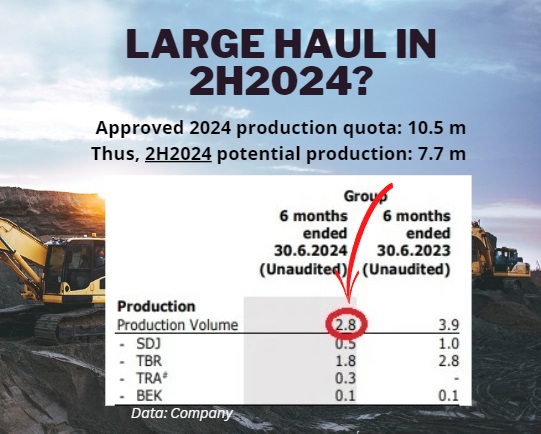

As the graphic below illustrates, given that Geo Energy produced 2.8 million tonnes in 1H2024, it is potentially able to mine up to 7.7 million tonnes in 2H2024, which is within the 10.5 million quota approved by the authorities.

Reflecting the upcoming ramp, an update embedded in the 1H results release by Chairman Charles Melati sounds promising.

Charles Melati, Executive Chairman & CEO of Geo Energy“In anticipation of seasonal heavier rainfall in the first half of the year, we recalibrated our mining plan in SDJ and TBR coal mines, to open more pits and ramp up our coal production in 2H2024. Charles Melati, Executive Chairman & CEO of Geo Energy“In anticipation of seasonal heavier rainfall in the first half of the year, we recalibrated our mining plan in SDJ and TBR coal mines, to open more pits and ramp up our coal production in 2H2024."For 1H2024, the Group posted total sales of 3.2 million tonnes. "Starting from July 2024, coal sales have increased as planned with the country going into its drier climate. As at the last week of July 2024, our production averaged 35,000 tonnes per day, which translates to over a million tonnes per month, just from SDJ and TBR coal mines." |

Longer-term challenges & risks

The construction of the 92-km haul road may face challenges related to local communities. The road's extensive 92-kilometer stretch crosses numerous villages and affects many families.

To mitigate these challenges, Geo Energy is focusing on corporate social responsibility activities.

In its business, coal prices which Geo Energy has no influence over, are a real and direct influence on its profitability.

Prices are in turn a function of global supply -- which hit a historic high last year -- and global demand, which surprisingly also hit a historic high despite the rise of renewable energy generation.

The shift towards renewable energy is expected to gain further momentum especially in developed countries but coal, the cheapest form of energy, is seen as a key source in Asian countries such as China and India.