|

What was the heyday like for Nordic Group's marine business?

The relevance of this question will be evident later in this article. |

||||||||||||||||

At the 1H2024 results briefing on 20 Aug, Nordic's executive chairman, Chang Yeh Hong, provided some colour on the past peak and subsequent deep trough -- and what looks like the start of an upcyle now:

"We were generating something like $8 million of profit and order books amounted to about $70 million. After that, it just came down. "We were generating something like $8 million of profit and order books amounted to about $70 million. After that, it just came down. "For the next 12 years, it just went barren. The orders came as one vessel, two vessels, three vessels. You'd be lucky to get four, and even more lucky to get six. "The trend now, you'll notice, is we have gotten 20 vessels, 25 vessels. The uptrend is coming back, there's an upcycle, and that's why it's very exciting for Dorcas (who heads the marine business within Nordic) and I think it it would be a catalyst for her business to outperform." |

One more key piece of the past: As the marine segment headed down in the past decade or so, Nordic successfully diversified its business offerings via acquisitions of synergistic businesses (table below):

|

Nordic Group’s M&A history |

||||||

|

2011 |

2015 |

2017 |

2019 |

2022 |

2022 |

2023 |

|

$29 m |

$26 m |

$17 m |

$14.8 m |

$59.1 m |

$10 m |

$5 m |

|

All are 100% acquisitions paid for in cash. |

||||||

While Nordic grew as a group, thanks to the acquisitions, its marine segment faded from investor interest but the segment stayed afloat on its recurring MRO (maintenance, repair and overhaul) business for the 1,000+ vessels it had installed systems into over the years.

The Resurgence

Dorcas Teo: Executive Director and CEO, Nordic Flow ControlThe current resurgence in vessel building, especially in China, Japan and Korea, is driven by, among other things, oil & gas exploration, offshore wind turbine construction, and eco-friendly regulations.

Dorcas Teo: Executive Director and CEO, Nordic Flow ControlThe current resurgence in vessel building, especially in China, Japan and Korea, is driven by, among other things, oil & gas exploration, offshore wind turbine construction, and eco-friendly regulations.

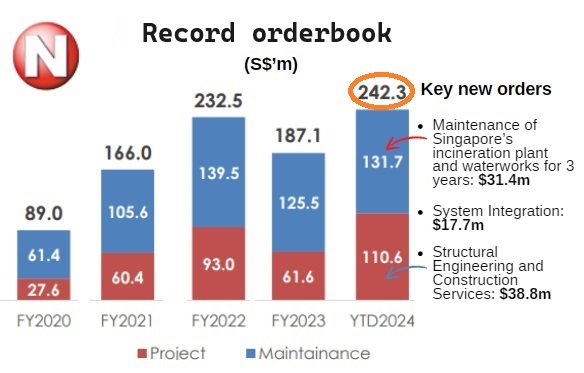

Going forward, Nordic's maritime segment -- which won S$17.7 million orders in 1H2024 -- is expected to play a bigger part in raising Nordic's orderbook.

While S$17.7 million doesn't look amazing, Nordic management has signalled their raised expectations for the marine segment, and shone the spotlight on it for the first time in years. Just look at the 1H2024 PowerPoint deck.

Nordic's total orderbook stood at a record S$242 million as at end-1H2024. Above shows outstanding orderbook at the end of each financial period.

Above shows outstanding orderbook at the end of each financial period.

• Orderbook is broad-based in terms of industries.

• Majority of orderbook comprises recurring maintenance services.

Key projects highlighted in Nordic's 1H2024 PowerPoint deck include:

• Manufacture of valves and actuators for 2 FPSOs, and manufacture of valves, actuators and controls systems for 61 vessels (bulk carriers, car carriers and chemical tankers) to be constructed by shipyards in China.

• Construction services for training facilities for security agencies (by subsidiary Starburst) and fuel dispensing systems for aircraft (by subsidiary Avon).

Challenges

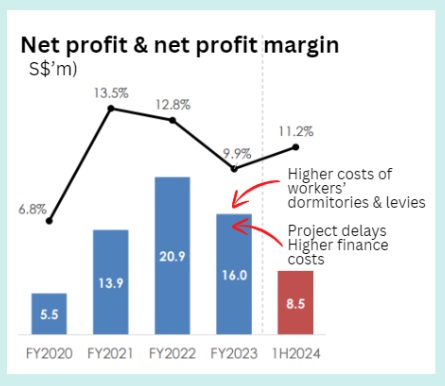

While its outlook is more positive than last year, Nordic Group, whose 1H2024 net profit came in at $8.5 million (-16% y-o-y), continues to face several challenges:

- Cost Pressures: Rising costs, including accommodation expenses which have soared from about $230 per person a month to about $500 over the past few years, and may creep up a bit more in the near term.

Foreign worker levies imposed by the Ministry of Manpower have also moved up.

Nordic is addressing these pressures by adjusting its pricing strategies for new contracts, and sending its workers for higher skills training which will lead to lower worker levies. - Competitive Landscape: The maritime industry is highly competitive, with both international and local players vying for market share.

Overall, after a challenging 2H2023 Nordic is on a recovery trajectory with a record orderbook from diverse industries on hand and, notably, a potentially exciting upcycle for the maritime segment.

See also: Nordic's PowerPoint deck and 1H2024 announcement.