|

After a series of unexpected developments -- negative ones, starting in 2H2023 -- the lacklustre (but not unexpected) 1H2024 results of AEM Holdings dealt a further blow to its stock price (1 year return: -62%). |

In last week's earnings call, Amy painted broad and assuring strokes of AEM's recent achievements and forward direction:

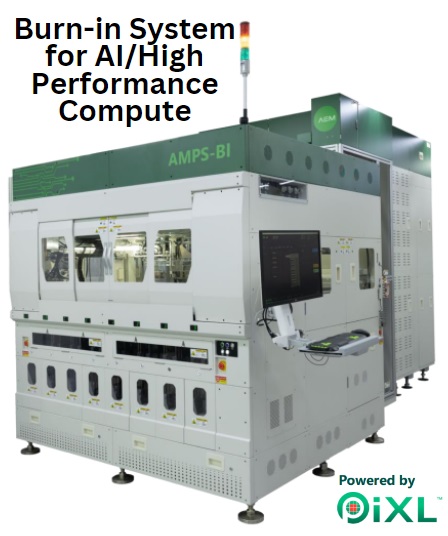

| Customer diversification, product innovation: Our diversification strategy to expand market segments and customers continue to gain momentum. AI and advanced packaging are the bright spots for us. Our significant R&D investment over the last few years have yielded differentiated test products for our AI customers. We have recently announced our burn-in system, AMPS-BI, and we have already received the first production orders of more than S$20 million for several systems. We believe this is the initial stage of a multi-year rollout to support our customers AI product ramp.  Additionally, we're also very encouraged by the rising demand for our thermal technology PiXLTM that can be deployed into multiple test insertions, including system level tests, burn-in, final tests providing us a common thermal pathway to drive our future growth. Additionally, we're also very encouraged by the rising demand for our thermal technology PiXLTM that can be deployed into multiple test insertions, including system level tests, burn-in, final tests providing us a common thermal pathway to drive our future growth. All of these opportunities for AEM came in at a time when our key customer is facing headwind and recently just announced a major business restructuring. In the near term, we expect continued soft demand from our key customer. Momentum from new customers: However, we anticipate strong momentum in new business growth as we move into later part of this year as a result of our diversification strategy. We expect positive quarter-on-quarter revenue growth in the fourth quarter driven by new customer business growth. For the second half of 2024, we're providing a guidance of revenue range of S$160 million to S$180 million. |

To a question "Is the triple-digit million dollar revenue forecast from new accounts -- does it still hold in 2025?", she replied:

| The short answer is yes, we are really seeing the first evidence in 2024. We're doubling our new customer business this year and we're on track for our previous projection for 2025. The S$20 million order that we have received is for the new product that we have just announced. It is called AMPS Burn-In and it's optimized for AI chips as part of the test flow. This is one growth vector of our several new customer engagements that we already have developed. We have several projects with five customers going on right now and the collection of those customers and those projects will fuel our triple digit million revenue (from new accounts) in 2025. |

Non-executive chairman Loke Wai San made several comments on new customer wins during the earnings call:

Non-executive chairman Loke Wai San. File photo"It takes many years to win and displace an incumbent in any one of these marquee clients that we have. The selection process is very rigorous, it is multi-year and we're seeing the fruits of that. Last year's initial revenues were where we shipped prototypes, paid prototypes into lab evaluations.

Non-executive chairman Loke Wai San. File photo"It takes many years to win and displace an incumbent in any one of these marquee clients that we have. The selection process is very rigorous, it is multi-year and we're seeing the fruits of that. Last year's initial revenues were where we shipped prototypes, paid prototypes into lab evaluations.

"What you'll be seeing in the second half especially in Q4 is that shift into production. We have received POs (purchase orders) for production. It means that we've crossed the chasm, if you will. There are still many that we expect to cross into multiple ramps."

| There was a question of R&D expenses impacting profit margins. R&D expenses amounted to S$11.5 million in 1H2024 (1H2023: S$15.2 million). Mr Loke commented: "I hope we continue to have customer engagements where we invest in R&D to win significant, you know, multi hundred million dollar type businesses over a period of years for each account. "If you layer those demand curves and opportunity curves, you have to invest in R&D to then win for multi-years. These are very sticky multi-year projects that we're winning and getting into production." |

For more, see AEM's press release here.