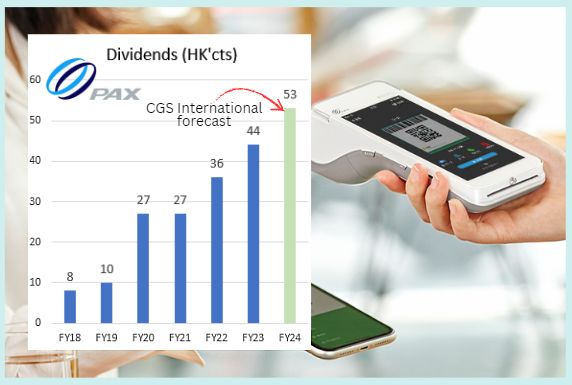

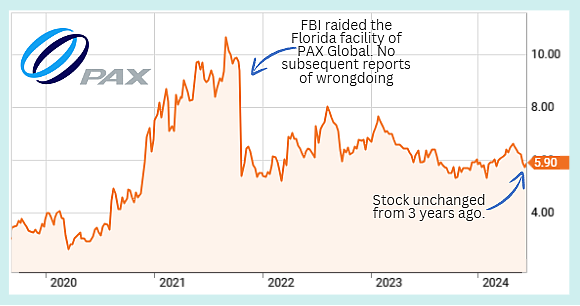

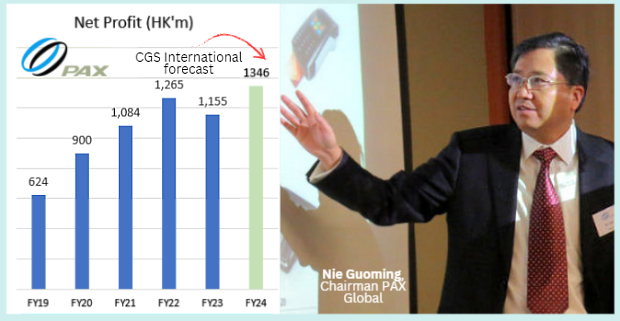

| • There's a global business whose stock trades at PE of 5X, its net cash makes up almost 50% of its market cap, and its trailing dividend is 7.5%. Pretty attractive metrics. And the dividend payout's expected to go up further (see chart below). And why not when the company has lots of cash and zero debt?  Payout ratio for FY23 was 41%. It was 31% the year before and 27% in 2021. At end-2023, PAX Global had HK$2,864 million cash and zero debt. Payout ratio for FY23 was 41%. It was 31% the year before and 27% in 2021. At end-2023, PAX Global had HK$2,864 million cash and zero debt.• HK-listed PAX Global derives most of its revenue from selling its e-payment terminals, which are wireless handheld devices that enable users to pay through the swipe or insert of a credit or debit card. The business is not akin to manufacturing a commodity: It's instead an innovation-centric business, which is why the gross margin is 45%. UOB Kay Hian issued a report last week on this enviable business. • But why has its stock languished in the last 3 years? The recent stock price is identical to that 3 years ago!  • The likely reason is (unjustified) continued investor uncertainty arising from an Oct 2021 incident -- the FBI raided the US office of PAX and there were unsubstantiated media reports of security issues around PAX products. The company addressed these in an Oct 2021 filing to the HK Exchange. A further filing in Dec 2021 gave results of an independent investigation, clearing the company of any wrongdoing. • To catch up on the latest developments, read excerpts of UOB KH's report below .... |

Excerpts from UOB KH report

Analysts: Paci Wu & Kate Luang

Pax Global Technology (327 HK)

| Leading E-payment Terminal Provider Expanding Into Emerging Markets Pax Global is a leading e-payment terminal provider with a 10-15% global market share and over 80m cumulative shipments in more than 120 countries as of 2023. It focuses on emerging markets expansion and enhancing customer stickiness through hardware innovation and software development. The company is guiding a 10% revenue growth in 2024 and targets to maintain a 40% dividend payout in the future on the back of a strong net cash position. |

WHAT’S NEW

• Leading e-payment terminal provider with global footprint. Pax Global Technology (Pax Global) is a leading supplier of secure e-payment terminal with a 10-15% global market share and established footprint in over 120 countries.

Latin America is its largest market, followed by Europe, Asia and the US that contributed to 35%/33%/16%/16% of its 2023 revenue respectively.

About 95% of Pax Global’s revenue is driven by hardware sales while services such as maintenance, installation and industry applications account for 5% of its revenue. CGS report is here.

CGS report is here.

• Stringent security certification remains the key entry barrier. E-payment terminal providers need to invest in R&D and obtain payment security certifications, which have an expiry period of 3-5 years.

Therefore, obtaining payment security certifications remains an entry barrier for new entrants while creating replacement demand for existing players every 3-5 years.

Pax Global targets to maintain its market leadership through diversified portfolio of products and services as well as its growing global network.

• Extensive product portfolio and integrated solutions enhance customer stickiness. Pax Global focuses on hardware innovation, software development and payment security certifications.

It offers a wide range of products with over 30 terminal models, including smart, traditional and mobile point-of-sale (POS) terminals that cater to its customers’ demand and preferences.

In addition, it launched Maxstore, a software service management platform that enhances inventory management, customer relationship management and data analysis for merchants such as convenient stores and gasoline stations.

Its products and integrated solutions enable smooth product adaptation, and enhance switching cost and customer stickiness.

• Robust cash reserve. Pax Global’s revenue increased eightfold since its listing in 2010, driven by overseas expansion and continuous product innovation.

|

Stock price |

HK$5.90 |

|

52-week range |

HK5.21 – 6.94 |

|

Market cap |

HK$6.3 b |

|

PE (trailing) |

5.6 |

|

Dividend yield (trailing) |

7.5% |

|

1-year return |

-0.8% |

|

Shares outstanding |

1.07 b |

|

Source: Yahoo! |

|

Meanwhile, it also improved its gross margin from 37% in 2018 to 45% in 2023, thanks to effective cost control and improving sales mix.

The company has a strong free cash flow generating capability and a strong net cash position, with a 53%/45%/38% net cash to equity ratio in 2021-23 respectively.

• Continued emerging markets expansion. Pax Global recorded notable sales in Latin America, Middle East and Africa, and will continue to pursue new opportunities in new markets such as Saudi Arabia and Egypt, thanks to:

a) the irreversible trend of cashless payment,

b) continuous product innovation and software development that enhance product adaptation and customer stickiness, and

c) replacement demand.

| • 2024 guidance. Pax Global guides for a 10% revenue growth in 2024, as it believes the destocking cycle in 2023 has come to an end (which resulted in a 16.8% yoy revenue decline in 2023). Pax Global has been raising its dividend payout ratio from 18% in 2019 to 41% in 2023 and targets to maintain a 40% dividend payout going forward. The trailing 12-month dividend yield was about 7.5%. |

Full report here.