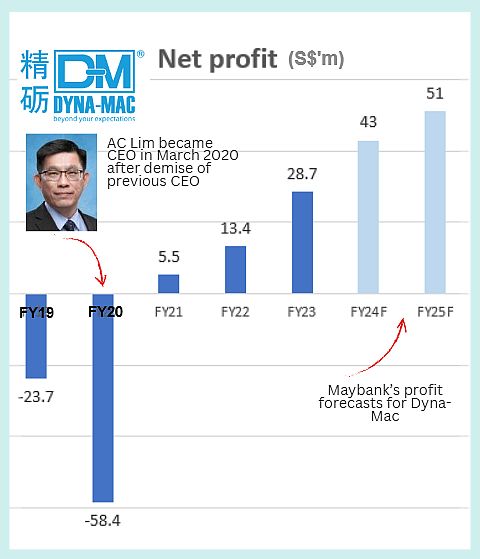

Dyna-Mac produces top modules that are destined to sit atop specialised vessels that extract oil offshore. Dyna-Mac produces top modules that are destined to sit atop specialised vessels that extract oil offshore. • The oil & gas industry is alive and well. Aside from offshore support vessels being in high demand (and short supply), there's also the FPSO market whose flag bearer in Singapore is Dyna-Mac Holdings which is doing really fine. FPSO (Floating Production Storage and Offloading) vessels are involved in the production, processing, storage, and offloading of hydrocarbons. As the chart below shows, Dyna-Mac's profit has bounced back from the pandemic lows.  • Dyna-Mac's key business is fabricating topside modules -- critical components that house the equipment and systems necessary for processing hydrocarbons extracted from underwater wells -- for FPSO vessels. Asia’s FPSO market is growing as new exploration activities surge to all-time highs, often in deeper waters requiring sophisticated technology. • Analysts are calling for an industry "supercycle". And Dyna-Mac is expected to enjoy more contract wins, margin expansion and profits. • Its orderbook, as of April 2024, was close to S$900 million. And South Korea's Hanwha Ocean and Hanwha Aerospace bought an aggregate 23.91% stake in Dyna-Mac from Keppel for S$100 million in May 2024. The transacted price was 40 cents/share. • Read more from Maybank's latest report below.... |

Excerpts from Maybank KE's report

Analyst: Jarick Seet

Dyna-Mac (DMHL SP)

Robust FPSO market spurs growth

| Maintain BUY with a higher TP of SGD0.52 |

| We expect Dyna-mac’s 50% capacity expansion, high operating leverage and doubling of its orderbook to SGD896m should enable it to reap better net margins as FPSO builders and operators continue to enjoy high prices and rates. We lift our FY24E PATMI by 24.7% and FY25E by 26.9% and raise our TP to SGD0.52, based on a 15x FY24E P/E, from SGD0.46. We believe Dyna-Mac is a key beneficiary of this multi-year FPSO upcycle and it remains one of our Top Picks in the SMID (small & mid-caps) space. |

| Capacity increase = higher revenue + margins |

|

Stock price |

40 c |

|

52-week range |

23.5 – 44.5 cts |

|

Market cap |

S$418 m |

|

PE (trailing) |

15 |

|

Dividend yield (trailing) |

2.2% |

|

1-year return |

2.7% |

|

Shares outstanding |

1.05 b |

|

Source: Yahoo! |

|

With its orderbook doubling to SGD896m within 12 months as well as its new land expansion of 50%, we expect Dyna-mac to execute its orderbook at a faster pace.

From our channel checks, we also discovered that FPSO builders are enjoying better pricing for each FPSO new-build and we believe that this should flow-down to players like Dyna-mac which would grant them better margins for the new orders won.

With better gross margins on new projects and better operating leverage with more efficient use of labour and space, we believe Dyna-mac could perform much better than we initially expected.

| New substantial shareholder – an interesting angle |

Hanwha Aerospace & Ocean bought over Keppel’s stake of 24.1% in May 2024 but purchased another 2.95% before this.

| "With better gross margins on new projects and better operating leverage with more efficient use of labour and space, we believe Dyna-mac could perform much better than we initially expected." |

We believe Hanwha Ocean may be on a global expansion drive, as it looks to expand its footprint in marine energy solutions and shipbuilding.

It also launched a bid for Australian shipbuilder Austal back in Apr 2024 for USD662m.

We believe Hanwha Aerospace & Ocean should be a positive addition for Dyna-Mac.

| One of our Top SMID Picks |

Jarick Seet, analystWe believe Dyna-Mac will continue to benefit from the current strong demand for FPSO and it should further re-rate as it executes its larger-size contracts and achieves higher profitability.

Jarick Seet, analystWe believe Dyna-Mac will continue to benefit from the current strong demand for FPSO and it should further re-rate as it executes its larger-size contracts and achieves higher profitability.

Maintain BUY.

Full report here.