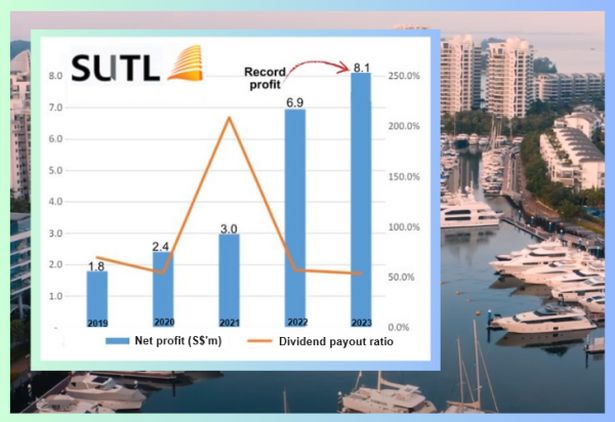

| • ONE°15 Marina Sentosa Cove, Singapore -- this iconic marina opened in 2007 and is owned by SUTL Enterprise, the only such listed business on the Singapore Exchange. • Post-pandemic business has been especially good: SUTL's revenue crossed S$40 million for the first time in FY23. Net profit too reached a record S$8.1 million (see chart) aided by a $1.9 million jump in "other income" which was mainly due to higher interest income. SUTL was sitting on net cash of S$57 million as at end-FY23.  SUTL paid 5 cent/share in dividends in FY22 and FY23. SUTL paid 5 cent/share in dividends in FY22 and FY23. • SUTL's revenue has been largely from the operations of the marina and its facilities in Sentosa, including restaurants. Recovering from a misadventure in Malaysia (S$6.5 million losses incurred on the Puteri Harbour project which was terminated in 2022), SUTL continues to pursue its overseas ambitions. That means consulting on the development of marinas and management of third-party marinas. • SUTL has a marina development project in Phuket which is expected to complete this year. And SUTL will manage soon-to be completed marinas owned by third parties but branded ONE°15 in Jakarta, Suzhou, and Zhongshan, China. SUTL has previously said that the management fee structure "usually includes a minimum flat fee and a variable component based on performance." • For more, read SAC Capital's recent report below ..... |

Excerpts from SAC Capital report

Analysts: June Yap & Matthias Chan

Sailing Towards Sustained Growth and Strategic Expansion

| Listed on the Singapore Exchange Mainboard in 2000, SUTL Enterprise Limited has evolved into a premier developer, operator, and consultant of integrated marinas. Headquartered in Singapore, it operates the iconic ONE°15 Marina Sentosa Cove and manages various marinas under the ONE°15 brand globally. Over the years, the Group has diversified its services to include luxury yacht chartering, consultancy, and management services, establishing a strong presence in the marina and yachting industry. Through strategic expansions and a commitment to sustainability, SUTL has cemented its position as a leader in creating luxurious waterfront experiences. |

In FY23, the Group achieved a milestone by surpassing S$40m (+5.2%, y/y) in operating revenue and EPS increased to 9.31 S cents, up from 8.74 S cents in FY22 (+6.5%, y/y).

This reflects the significant growth in marina, room, and banquet sales.

|

Stock price |

69 c |

|

52-week range |

50 – 73 c |

|

Market cap |

S$61 m |

|

PE (trailing) |

7.7 |

|

Dividend yield (trailing) |

7.25% |

|

1-year return |

34% |

|

Shares outstanding |

88.7 m |

|

Source: Yahoo! |

|

The Group's financial position also improved, with net cash (including liquid financial assets) rising to S$57.1m in FY23, up 16.1% y/y, which is close to its market cap of S$62.1m.

Expansion and upgrading of facilities at ONE°15 Marina Sentosa Cove, reflecting the growing demand enhancing the marina’s capacity to accommodate larger and more luxurious yachts.

The marina underwent a S$5 million upgrade, increasing the number of superyacht berths from 15 to 33.

This expansion reflects the growing demand for super yachts among the uber rich and the Group’s ability to cater to this high-end niche.

In Phuket, Thailand, the group is redeveloping an existing marina. This strategic initiative involves a soft loan of S$1.5 million to refurbish Phase 1, which will include 16 berths.

The marina, located in a prime spot and has easy access to popular islands. The redevelopment agreement includes a renewable five-year lease, with the potential to extend up to 30 years on government-owned land.

Additionally, the Group plans to secure up to 60% ownership stake in the marina, conditional upon Thai law which necessitates partnering with a local Thai business owner who will hold a 40% stake.

The expansion will eventually see the development of Phase 2, adding 77 more berths.

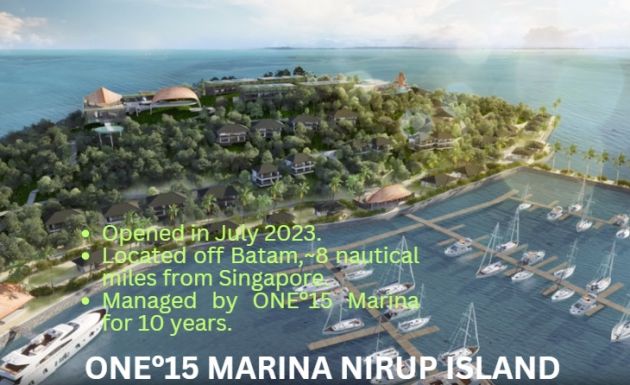

SUTL is strategically expanding its footprint across Asia, enhancing its global presence and market position. A hotel there will be completed in the later part of 2024 or early 2025. After the opening of the hotel, SUTL will actively promote Nirup to boaters.

A hotel there will be completed in the later part of 2024 or early 2025. After the opening of the hotel, SUTL will actively promote Nirup to boaters.

Recent developments include the opening of ONE°15 Marina Nirup Island in Indonesia in July 2023 and the upcoming ONE°15 Marina Panwa Phuket in Thailand in late 2024.

Additionally, SUTL will be managing the Indonesia Navy Club in Jakarta, Taihu International Marina in Suzhou and ONE°15 Marina Logan Cove in Zhongshan, China, once they are completed, catering to the growing demand for luxury yachting.

The Group demonstrates its commitment to sustainability through significant initiatives such as the Blue Water EduFest.

This annual event, held at ONE°15 Marina Sentosa Cove, brings together corporates, conservationists, volunteers, and academia to raise awareness about ocean and coastal conservation.

| In FY23, SUTL Enterprise Limited showcased its commitment to delivering shareholder value through its robust financial performance and dividend policy. The Group paid dividends amounting to S$4.4m, up from S$1.7m in FY22. This increase reflects the company's confidence in its financial stability and growth prospects. SUTL's dividend policy aims to provide consistent and sustainable returns to its shareholders, balancing the need for reinvestment in growth opportunities with the desire to reward shareholders for their continued support. Over the past five years, dividend yield, ranged from 3.5% to 10.4%, with a payout ratio of more than 0.5. |

Potential risks include

| i) regulatory and compliance challenges across different jurisdictions, ii) economic fluctuations affecting demand for luxury yachting and marina services, and iii) environmental risks such as climate change and extreme weather events impacting marina operations. |