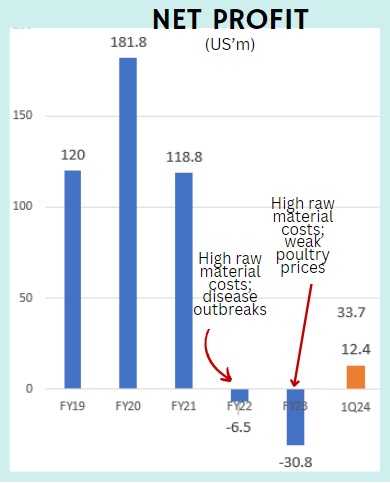

Olagud-branded chicken from Japfa for sale in Singapore. Olagud-branded chicken from Japfa for sale in Singapore.• Since mid-2023, Japfa has been shipping live chickens from its farm in Bintan to Singapore, adding to the country's chicken imports from a long-time traditional source, Malaysia. Headquartered in Singapore, Japfa is one of the largest poultry producers in Indonesia and in the region. (Japfa also has a smaller swine business, mainly in Vietnam). • Japfa controls the entire work flow: from producing the feed that feeds the chickens, to breeding and raising the chickens, and finally processing and selling the chicken meat and eggs. • Japfa's stock has surged 45% since the start of 2024, from 22 cents to 32 cents recently. A key trigger for the run was a Bloomberg report in early March on a possible privatisation of the company. See: Top Asia Poultry Firm Japfa Owners Said to Mull Go Private Deal. Japfa's response is here (which didn't outright say it wasn't in the works). • The privatisation possibility aside, after 2 years of losses, Japfa is giving investors reason to anticipate a profit recovery with its just-released 1Q2024 announcement of a net profit of US$12.4 million. EBITDA was US$99 million.  Read CGS-CIMB'S take on the 1Q2024 results -- highlights include higher selling prices and lower feed ingredient costs .... |

Excerpts from CGS-CIMB report

Analyst: TAY Wee Kuang

Japfa Ltd: Starting FY24F with better ASPs

■ JAP reported core net profit of US$13.4m in 1Q24, above expectations at 102.4% of our FY24F estimate on better ASPs and lower raw material prices.

■ We increase our FY24F-26F EPS by 30.8-94.9% on sustained profitability across quarters. Reiterate Add with higher TP of S$0.37. |

||||

Return to profitability with better ASPs

JAP’s 1Q24 core net profit of US$13.4m was a reversal of losses in 1Q23 and 4Q23.

Its Indonesian operations through PT Japfa Comfeed (JPFA IJ, Add, TP: Rp1,600) reported 1Q24 core net profit of US$21.7m, supported by increasing broiler and day-old chick (DOC) prices leading up to Lebaran.

On the other hand, JAP’s Animal Protein – Other (APO) segment reported core net loss of US$2.4m for 1Q24 due to streamlining of operations in Vietnam, alongside weak poultry prices across India, Bangladesh and Myanmar, although losses were narrower against 1Q23 and 4Q23 due to better swine prices in Vietnam, likely as a result of Tet festivity, in our opinion.

Management also shared that JAP recorded US$6.1m as recognition of doubtful debt as well as inventory obsolescence in 1Q24 as part of US$7.3m in “other losses” for the quarter.

Decline in raw material prices favourable for margins Japfa is, partly, into poultry breeding and farming in Indonesia. Photo: CompanyApart from improving ASPs, we observe that prices of key feed ingredients, such as soybean meal (SBM) and corn, eased globally in 1Q24 to their lowest levels since Jan 2022 (Fig 4 and 5).

Japfa is, partly, into poultry breeding and farming in Indonesia. Photo: CompanyApart from improving ASPs, we observe that prices of key feed ingredients, such as soybean meal (SBM) and corn, eased globally in 1Q24 to their lowest levels since Jan 2022 (Fig 4 and 5).

Even in Indonesia, where feed millers have to source supply of corn locally, domestic corn prices decreased to Rp4,500/kg as of 26 Apr 24 (Fig 6).

As such, we believe that JAP’s margin profile could improve in subsequent quarters, even though ASPs could weaken following Lebaran.

Looking out for APO turnaround in 2H24F

Management recalibrated its growth plans for Vietnam in FY23 due to the weak consumer sentiment there.

With more sustainable ASPs observed in 1Q24, we think swine fattening volumes could grow further in 2H24F given the lead time to build swine fattening volumes of c.6 months, supporting a turnaround in the APO segment.

Market dynamics to start to improve; reiterate Add Tay Wee Kuang, analyst.We increase our TP to S$0.37, now pegged at 0.7x FY25F P/BV (0.5 s.d. above 10-year mean), from S$0.26, based on 0.5x FY25F P/BV (0.5 s.d. below 10-year mean) previously, as we view the improvement in ASPs and lower raw material prices supporting sustainable profitability in the upcoming quarters that should re-rate the stock. Tay Wee Kuang, analyst.We increase our TP to S$0.37, now pegged at 0.7x FY25F P/BV (0.5 s.d. above 10-year mean), from S$0.26, based on 0.5x FY25F P/BV (0.5 s.d. below 10-year mean) previously, as we view the improvement in ASPs and lower raw material prices supporting sustainable profitability in the upcoming quarters that should re-rate the stock. Consequently, we increase our FY24F/25F/26F EPS estimates by 94.9%/34.3%/30.8% to reflect consecutive quarters of profitability vs. our earlier forecasts for losses. Re-rating catalysts: faster-than-expected turnaround in APO segment; downside risks: rising raw material prices, weaker ASPs and biosecurity mishaps resulting in culling of livestock. |

Full report here