| • As its problems of 2023 (which were pretty much one-offs) fade away, AEM Holdings is being seen as an important player in the fast-evolving Artificial Intellingence (AI) era. Semiconductor chips for AI are all the rage -- and AEM has cutting-edge solutions that do the required back-end tests of the chips before they are deployed in devices.  Text: annual report 2023• Outside of AI, chips have already become increasingly complex, as AEM notes below. It references "heterogenous integrated packages" -- also known as chiplets. Think: Lego blocks. Text: annual report 2023• Outside of AI, chips have already become increasingly complex, as AEM notes below. It references "heterogenous integrated packages" -- also known as chiplets. Think: Lego blocks.• There are Lego blocks for specific purposes - some for making walls, others are perfect for windows or doors. They are combined to create all sorts of structures. Chiplets are like "Lego blocks" for computer chips. Instead of one giant, complex chip that does everything, chiplets allow for smaller, specialized chips to be put together. For example, you have one chiplet that's really good at processing graphics, another that specializes in artificial intelligence computations, etc. • The growing use of chiplets has made testing chips more difficult and time-consuming, driving up costs. Below, you get an idea of how AEM's Test 2.0 solution helps customers overcome higher costs. • The Securities Investors Association of Singapore (SIAS) and shareholders put in questions to AEM ahead of its AGM this week, and the company's response was posted on the Singapore Exchange website. Excerpts: |

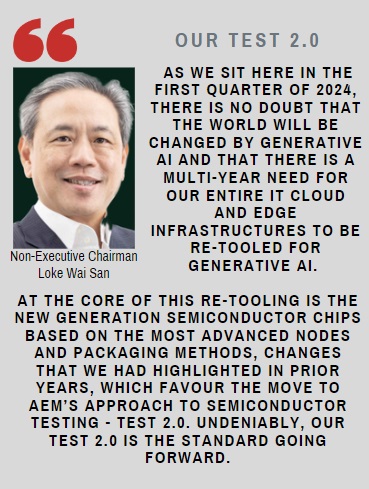

SIAS: As noted in the chairman’s message to shareholders, despite the challenges and errors in FY2023, the big picture looks positive with generative AI driving multi-year need for the entire IT cloud and edge infrastructures to be re-tooled. New-generation semiconductor chips for AI are based on the most advanced nodes and packaging methods, a trend that the chairman sees as favouring the group’s approach to semiconductor testing, Test 2.0.

(i) Can the management explain, using layman’s terms, why the chairman has such high confidence that the company’s Test 2.0 is “undeniably” the standard going forward?

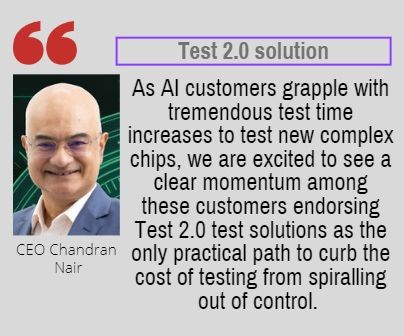

The adoption of heterogenous integrated packages (chiplets) has created significant challenges in the testing of the latest advanced logic devices. These challenges are directly correlated with an increase in test time, which results in a higher cost-of-test.

A key way for a semiconductor manufacturer to overcome this increase in cost-of-test is via innovation in test flows and methodologies.

Our Test 2.0 solution set features leading thermal capabilities, advanced automation with massively parallel solutions and Factory 4.0, and finally application optimized test instrumentation which enables elements of the current dominant Final Test insertion to shift test content into the Burn-In and/or System Level Test insertions.

These capabilities combine to offer an attractive solution for the next generation advanced logic devices under development. Text: annual report 2023(ii) Currently, what percentage of the industry is using the group’s Test 2.0?

Text: annual report 2023(ii) Currently, what percentage of the industry is using the group’s Test 2.0?

Our Test 2.0 solutions are applicable to Logic and Logic enabled chips. In terms of this particular segment, we estimate that we have about 30% of the installed test systems base.

Additionally, this is applicable for High Bandwidth Memory that is increasingly used in conjunction with Logic enabled chips.

(iii) Besides the group’s current key customer, how many of the top 10 AI chip players such as NVIDIA (Hopper H100/Blackwell B200) and AMD (Instinct MI300X) are utilising Test 2.0? Does management perceive greater potential with hyperscalers who are designing their in-house AI chip solutions?

We have announced initial wins at various test stages (burn-in, functional, system level) at 2 other customers for their AI chip programs.

One of the new customers is in the top five AI chip players and the other we estimate to be in the top 20. We do see excellent potential with hyperscalers and are actively engaged with several.

SIAS: The group has been successful in its diversification journey with the onboarding of “several new customers”. Of the five new customers, two are in the xPU segment, two in “Systems & Hyperscalers” segment and one in the Memory segment. Nevertheless, the key customer still contributed $238.8 million in revenue, with the Test Cell Solutions segment registering $271.5 million in revenue for FY2023.

(i) What insights has the group gained from acquiring these five new customers that will inform its approach to future customer acquisition?

(1) Receptivity of AEM’s technology solutions: The acquisition of these five new customers has confirmed that our technology strategy and roadmap are aligned with the market’s needs. Our thermal technology is highly differentiated due to its scalability and flexibility, which makes it very desirable.

(2) Timing of revenue ramp: The migration from lab evaluations to production volumes takes between 9 months to 3 years depending on the intercept for new chips to be launched and the trials’ assessment of platform stability, yield management and financial Return-on-Investment. No customer changes over to new test platforms mid-stream in a production ramp.

(3) R&D investment by AEM is relatively high at the qualification stage as customer feedback is integrated into the equipment modifications with support from our engineering teams.

(4) Getting to a production Plan-of-Record at a customer takes time but is valuable as it requires customer buy-in at many levels and usually lasts through many new product cycles.

(ii) The group has not declared a dividend as it is prioritising investments in “new customer programs”. What are the costs related to customer acquisition?

AEM: See answer above.

(iii) What can the group do to shorten the gestation period that includes “engineering validation” and “production intercept” before the group reaches the ramp up stage?

We believe a natural outcome of the development and refinement work we have done on our platforms and the customer acquisitions to date will be a shorter gestation period from initial engagement to initial high volume manufacturing orders.

It is important to remember that the ramp rate is dictated entirely by the customer and the demand for the device families being run through our test equipment.

| Shareholder: What is the status of the investigation into the shortfall in inventories? AEM: For details on the shortfall in inventories, please refer to the group’s FY2023 earnings press release dated 28 February 2024, titled “AEM reports FY2023 revenue of S$481.3M and profit before tax, excluding exceptional items, of S$38.3M.”

The investigation was run by the Audit & Risk Management Committee, with the Chairwoman acting as chair of the investigation. The investigation concluded that there was no evidence of fraudulent activities. Additionally, the investigation determined that the issue was limited to FY2023. Shareholder: How have the Management been held accountable for the shortfall in inventories? Through the investigation, the Management and staff responsible for the failures that led to the shortfall in inventories have had their employment terminated or are no longer with the group, and the senior leadership has volunteered to forgo all discretionary bonuses. This decision is supported by the board. |

The full Q&A is here.