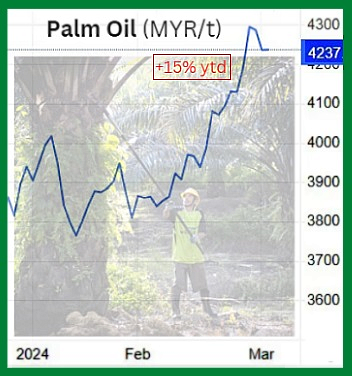

Chart: TradingEconomics.com• Palm oil prices are on the upward march. So, after its stock has slid to 3-year lows, is Wilmar International going to turn around? Chart: TradingEconomics.com• Palm oil prices are on the upward march. So, after its stock has slid to 3-year lows, is Wilmar International going to turn around?• While it has a diversified agribusiness, Singapore-listed Wilmar has a high degree of dependence on palm oil prices as it is one of the world's largest oil palm plantation owners. The majority of its palm oil acreage is in Indonsia, followed by East Malaysia. • In 1H2022, Wilmar reported record net profit of US$1.16 billion, benefiting from higher palm oil prices. 1H2023 showed much lower profit for its palm plantation business due to lower palm oil prices. • Its 2022 annual report states that the Plantation and Sugar Milling segment's profit of US$569.3 million was largely driven by palm oil prices, which weakened towards the end of the year. • Wilmar's 3Q2023 profit slumped on lower palm oil prices. For the full year, segment profit decreased by 12% to US$500.1 million, mainly due to lower profit from lower palm oil prices. • 2021 was a good year as was 2022. In 2021, the Plantation and Sugar Milling segment more than doubled its pre-tax profit in the second half, benefiting from higher palm oil prices. Given the above results, it is clear that the profitability of Wilmar's core Plantation and Sugar Milling business is heavily dependent on the fluctuations in global palm oil prices. Read more on where palm oil prices are headed below ..... |

Excerpts from UOB Kay Hian report

Analysts: Leow Huey Chuen & Jacqueline Yow

• CPO prices are getting ‘HOT” again with the highest open interest recorded for total palm oil future contracts traded at Bursa Malaysia Derivative (BMD). This surge signifies a bullish market sentiment with new positions being established. We attribute this phenomenon to several factors: a) Recognition of palm oil supply tightness. Market players and traders are adjusting their outlook, leaning towards a more bearish stance on palm oil supply. This shift follows the realisation of the impact from El Niño and recent reports such as those from the Malaysia Palm Oil Board (MPOB), indicating a 10% m-o-m drop in CPO production in Feb 24 due to lower harvesting days. Insights shared at the recent Palm Oil Conference in early-Mar 24 further affirmed concerns regarding palm oil availability despite widespread complaints about the high prices of CPO. b) Panic buying from India. Purchases from India surpassed expectations, driven by fears of dwindling near-term supplies and favourable import margins. c) Positive news from biofuel/biodiesel industry where the Indonesian government is looking at B40 biodiesel implementation and the Brazil government is also looking to increase its biodiesel mandate to B15 in 2025 and B20 in 2030 (currently: B14). d) US Department of Agriculture (USDA) revised down the soybean oil inventory level in Mar 24 mainly due to lower soybean oil production from Brazil. |

See also: WILMAR : After 3 years of punishing decline, is it time to pick up this stock? |