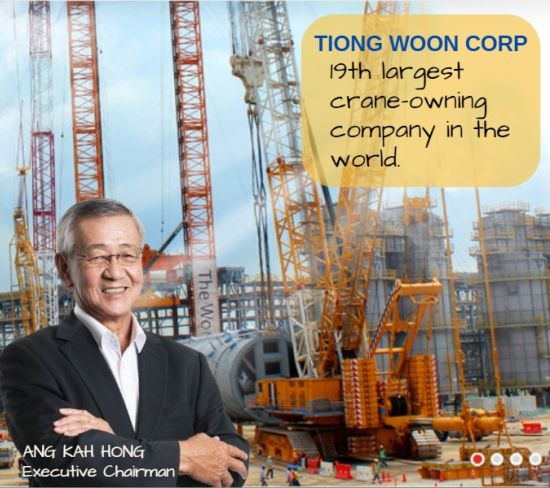

• Tiong Woon Corp 's cranes -- typically in bright orange -- are not an uncommon sight in Singapore. After all, the company has been around a long time -- several decades. • This year (2024) will be the 25th anniversary of its listing on the Singapore Exchange, a rare longevity for any Singapore listco, let alone a construction-related business. • It is not entirely dependent on the construction industry as it also serves oil & gas and petrochemical clients. Post-pandemic, these industries have been doing well, benefitting Tiong Woon. But it's not entirely well appreciated (as a 12 Feb Straits Times article recently noted).  • Below is Lim & Tan Securities' take on Tiong Woon's just-released 1HFY2024 performance. |

| Tiong Woon Corporation / TWC ($0.50, unchanged) recorded revenue of $75.3 million for the six months ended 31 December 2023 (“1HFY2024”), an 14% improvement from the corresponding period a year ago. This was mainly attributable to the increase in contributions from Heavy Lift and Haulage segment. GP was $32.9 million in 1HFY2024, an increase of $4.5 million or 16% from $28.4 million in 1HFY2023 and GP margin was higher at 43.7%. The Group’s net profit attributable to equity holders increased by $3.6 million, or 49%, from $7.2 million in 1HFY2023 to $10.8 million in 1HFY2024. |

• Heavy Lift and Haulage segment external revenue increased by 15% to $73.6 million as Tiong Woon undertook more heavy lift and installation projects in Singapore, Thailand, Middle East and India during 1HFY2024.

PBT for this segment increased from $9.0 million in 1HFY2023 to $13.8 million in 1HFY2024 mainly due to higher revenue and gain on disposal of property, plant and equipment.

• Marine Transportation segment external revenue was lower at $1.2 million in 1HFY2024 as there were fewer chartering jobs for external parties.

PBT for this segment decreased from $0.6 million in 1HFY2023 to $0.3 million in 1HFY2024 with lower revenue and share of loss of associated companies in 1HFY2024.

• Revenue from Trading segment remained stable at $0.5 million for both 1HFY2024 and 1HFY2023.

With lower currency exchange loss, this segment recorded a profit before income tax of $0.03 million in 1HFY2024, as compared to a loss of $0.08 million in 1HFY2023.

Outlook: The business environment continues to be uncertain, amid the confluence of ongoing geopolitical tensions, military conflicts, ensuing supply chain disruptions, a busy political calendar, challenges in the Chinese economy, still-high interest rates, as well as persistent cost pressures.

Notwithstanding the above-mentioned, the Group maintains its positive outlook, that customer demand for its Heavy Lift and Haulage solutions should remain resilient in Singapore, particularly in the petrochemical and construction sectors, as well as in key regional markets such as India, Saudi Arabia, and Thailand.

|

TWC’s market cap stands at S$115.9mln. |