*ComfortDelGro (9M2023 profit: S$128 million) full-year profit/dividend forecast by Maybank KE. • Maybank Kim Eng has just put out a report that is essentially about its top picks for 2024. *ComfortDelGro (9M2023 profit: S$128 million) full-year profit/dividend forecast by Maybank KE. • Maybank Kim Eng has just put out a report that is essentially about its top picks for 2024.• These picks emerged from its discussion on the major themes that will benefit the stocks in the medium term. "Key amongst these is the accelerated adoption of GenAI, coupled with rising demand for 5G and IoT," it said. • And China’s economic re-opening, though below expectations, has spillover benefits. Not left out, of course, is tech manufacturing. • "New production capacity coming on-stream regionally and new product launches are set to drive upside to margins and volumes for technology manufacturing." • Transport may be old economy but it will benefit as domestic and international travel pick up pace. ComfortDelGro (market cap: S$2.8 billion) is Maybank KE's preferred pick in this sector given its, among other things, strong net cash of S$500 million. Read on ..... |

Excerpts from Maybank KE report

| ComfortDelGro -- Retain BUY for its continuing attraction as a recovery play, supported by solid balance sheet and yield of 5% |

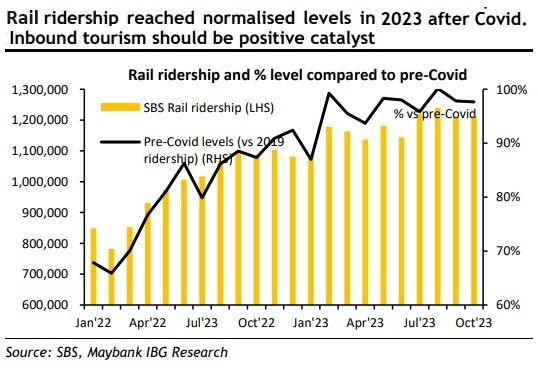

For land transport operator CD, its rail ridership has improved over the past year and mostly returned to pre-pandemic level.

CD is actively investing in transport-related green energy businesses. Its 49%-owned JV, CDG ENGIE, has secured tenders to install 5,000 EV charging points in Singapore. The group has also entered into a strategic partnership with Guangzhou Public Transport Group to construct EV charging and battery swapping stations, with the initial project catering to the needs of municipal buses and cars in Guangzhou. |

||||

| CD remains our preferred pick |

We prefer CD (SGD1.33, BUY, TP: SGD1.55) for its sustained earnings growth and solid balance sheet with net cash of SGD500m.

Supported by its relatively asset-light operator model and strong operating cash flow, we believe the group is able to maintain its dividend payout ratio of at least 70% of underlying net profits.

Full report here