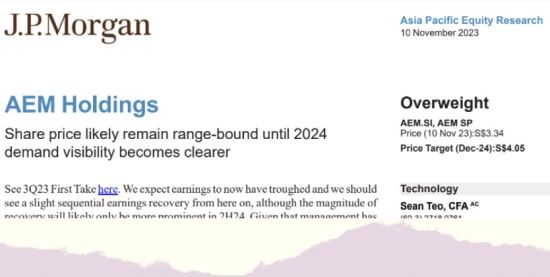

JP Morgan has the highest target price of $4.05 for AEM Holdings following its 3Q results release. The stock closed today at $3.26.

JP Morgan said its target price is based on 10.5x P/E, which is the 5-year mean P/E of the stock. This is down from 11x previously, considering the following:

|

Here's our compilation of broker reports:

|

Research house |

Call |

Target |

Net profit forecast |

|

|

2023 |

2024 |

|||

|

CGS-CIMB |

Add |

3.76 |

8.6 |

65.4 |

|

Maybank KE |

Buy |

3.76 |

10 |

74 |

|

JP Morgan |

Overweight |

4.05 |

13 |

83 |

|

UOB KH |

Buy |

3.63 |

14 |

76 |

|

DBS |

Hold |

3.00 |

13.6 |

73.8 |

|

Citi |

Buy |

3.78 |

||

|

Average |

3.66 |

11.8 |

74.4 |

|

DBS Research has the lowest target price of $3.00 based on a higher P/E multiple of 12.5 compared to JP Morgan's 10.5.

DBS, which expects a lower 2024 profit than JP Morgan, has positives about AEM's fundamentals to highlight:

| • Reiterating its long-term positive view on AEM, it noted AEM's technological superiority in the systems-level test segment and unique Test 2.0 approach. AEM has also been awarded three new patents in 3Q for its thermal capabilities, reinforcing its competitive advantage. • The niche that AEM plays in has long-term secular drivers such as artificial intelligence, Internet of Things, and 5G. |

See our post-3Q2023 report: AEM: 3Q was bad, FY23 will be bad. It's still a $1 billion company because ....