Excerpts from Maybank KE report (unrated)

Analyst: Eric Ong

Cheap Energy Champion

Its SDJ and TBR mines, which are adjacent to each other, benefit from favourable geological conditions, as well as a developed infrastructure that is in relatively close proximity. These allow for efficient and low-cost mining and undisrupted transportation of coal to its customers.  |

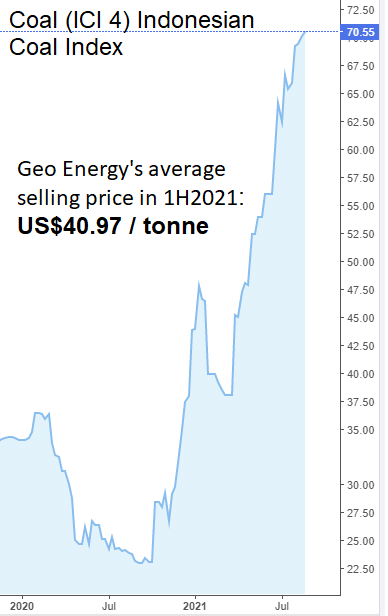

Direct beneficiary of rising coal price  In Aug 2021, coal prices (ICI4 index) have traded above US$70 / tonne. Source: Investing.comCoal price has been trending upwards amid concerns on supply availability due to COVID-19 related disruptions in other mines.

In Aug 2021, coal prices (ICI4 index) have traded above US$70 / tonne. Source: Investing.comCoal price has been trending upwards amid concerns on supply availability due to COVID-19 related disruptions in other mines.

This, coupled with strong demand from China because of the continued ban on Australian coal, further pushed the average Indonesian Coal Index price for 4,200 GAR coal (ICI4) to USD47.8/tonne in 1H21 versus USD30.6/tonne last year.

In fact, ICI4 coal price hit USD71.5 as at 18 Aug 2021 or over 49% up from the average ICI4 in 1H21.

1H21 core earnings firmly back in the black

The Group recently posted 1H21 net profit of USD48.5m, which is a complete turnaround from a net loss of USD8.7m last year (excluding the gains from repurchases of Senior Note).

Revenue rose 37% to USD220.3m, driven mainly by the increase in sales volume and higher ASP. Backed by its net cash position, it has declared a second interim DPS of SGD0.005, which translates to a 26% payout ratio on its 2Q21 earnings.

This will enable it to enhance its profits during this commodity upcycle. On valuations, the stock is trading at less than 3x FY21E P/E, based on 1H21 annualised earnings, compared to its closest SGX-listed peer, Golden Energy of c.7x. |

Full report here.