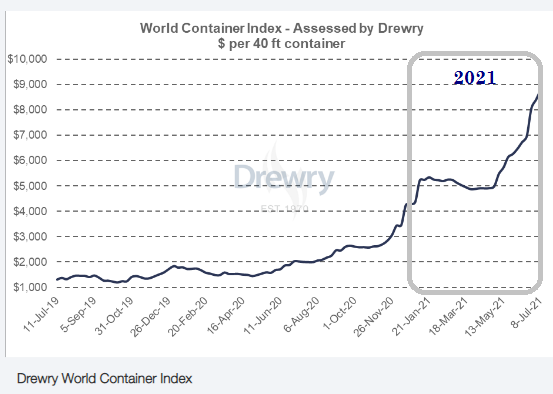

| Shipping companies have never had it so good. Shipping rates for containers and dry bulk are at sky-high levels, although these costs will eventually filter down to consumers. As the chart below shows, the container index has doubled since the start of 2021 and, astonishingly, is about 5X higher than pre-covid levels. And the index has yet to show signs of plateauing.  Samudera Shipping is a rare play on the Singapore Exchange with exposure to the container market. Samudera's stock price has gained 56% year-to-date (from 26 cents to 40.5 cents). But last Friday (9 July 2021), KGI Research's note to investors sounded an alert that Samudera's upcoming half-year results could "provide another booster shot" to the share price. |

KGI report:

Samudera Shipping (SAMU SP): Higher prices are coming for you

- BUY Entry – 0.38 Target –0.43 Stop Loss – 0.36

- Samudera Shipping Line is primarily engaged in container shipping transportation of cargo in the Asia region. The company’s vessels and services currently ply trade routes connecting various ports in Southeast Asia, the Indian Subcontinent, the Far East and the Middle East

- As of end-2020, Samudera’s operating fleet, which comprises vessels owned by the group as well as those on leases, currently stands at 30. This consists of 27 container vessels, 2 chemical tankers and 1 gas tanker.

- Fast and furious on the high seas. The WCI Composite Container Freight Benchmark rate, which tracks eight major trade routes, surged to US$8,796, a 333% increase from the same period last year. Drewry expects rates to increase further in the coming week. (See the chart above).

- Upcoming semi-annual results is a key catalyst. The company is likely due to report its first half results in the last week of July. A better-than-expected performance may provide another booster shot to its share price.