• At last Friday's (23 April 2021) AGM of Avarga Ltd, CEO Ian Tong responded to pre-submitted questions from shareholders.  Ian Tong, CEO of Avarga• From a transcript, we excerpt the section dealing with Avarga's key contributor, its 71.9%-owned Taiga Building Products which is listed in Toronto. For the full 5-page Q&A, which covers other business aspects of Avarga, click here. Ian Tong, CEO of Avarga• From a transcript, we excerpt the section dealing with Avarga's key contributor, its 71.9%-owned Taiga Building Products which is listed in Toronto. For the full 5-page Q&A, which covers other business aspects of Avarga, click here.• Avarga, an investment holding company listed on the Singapore Exchange, has also made available on the SGX website a deck of PowerPoint slides which make for an in-depth and interesting insight into its business. That's 38 slides! Click here. Investors could not have asked for better communication. |

| Questions from shareholders Following Taiga’s special dividend this year, please comment on the company’s gearing level, debt headroom, and ability to pursue growth opportunities. How does management provide effective leadership and guidance to Taiga given the border restrictions related to Covid-19? Please elaborate on the scope of Taiga’s internal audit function. Did internal audit evaluate Exterior Wood during the acquisition in 2018? Is 3D building construction technology disruptive to the building construction industry, and what is the potential impact on Taiga? |

Management's response

.... the primary driver of our performance was Taiga, as we reaped the rewards from the years of effort acquiring the company, expanding its network, and optimizing its capital structure and business operations. Given its tremendous results, Taiga was able to declare its first special dividend amounting to Canadian dollar $30 million.  Datuk Tong is also the owner of the Edge Media Group in Malaysia which publishes, among others, The Edge Malaysia and The Edge Singapore.Lumber prices continue to hover around historical highs as we speak, crossing US$1,300 on Monday before retreating slightly this week. For comparison’s sake, lumber closed at end 2019 around US$400.

Datuk Tong is also the owner of the Edge Media Group in Malaysia which publishes, among others, The Edge Malaysia and The Edge Singapore.Lumber prices continue to hover around historical highs as we speak, crossing US$1,300 on Monday before retreating slightly this week. For comparison’s sake, lumber closed at end 2019 around US$400.

Much of this has been driven by a strong US housing market and the demand shift from multi-family to single-family homes.

We were able to capitalize on this environment given Taiga’s strong market positioning, balance sheet, and expansion in the US market.

Pre-tax profit increased by almost threefold to C$95 million, led by our US operations, which has been an area of focus for us over the years. in 2012, US sales were C$64 million, C$137 million in 2017, C$254 million in 2019, and up to C$357 million last year. The last two years, of course, being partly due to the acquisition of Exterior Wood. Taiga is Canada's largest wholesaler of home-building material products, with a fast-growing presence in the USA.

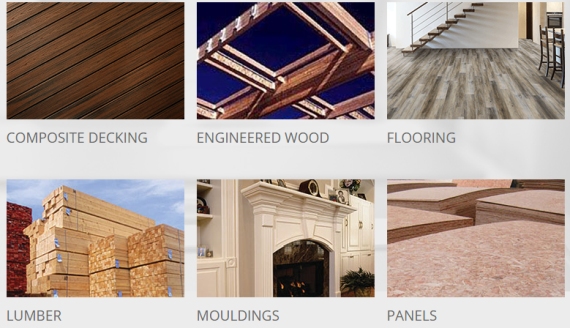

Taiga is Canada's largest wholesaler of home-building material products, with a fast-growing presence in the USA.

Excluding lease liabilities, which is a fancy accounting term for rental expenses, Taiga had total debt of C$29 million, including the subordinated notes of C$12.5 million, at end-2020. With equity of C$205 million, this represents an extremely conservative gearing ratio of 14.3%, especially for a wholesale trading business.

Taiga’s revolving credit facility of C$250 million only had C$9 million drawn at end-2020. Therefore, even with the special dividend of C$30 million, we are comfortable that the company’s balance sheet is strong and flexible with regards to pursuing future opportunities.

Taiga has its own board and management team that manage day-to-day operations. Avarga representatives on Taiga’s board communicate regularly with the management team, which has not been an issue given existing communications technology. Taiga employs a full-time internal auditor with full access to senior management and its entire operations.

The IA’s scope is very wide –credit controls, inventory management, employee claims, site safety, et cetera. He reports directly to Taiga’s Audit Committee. Due diligence for the acquisition of Exterior was conducted by external professionals, not the internal auditor.

With regards to technological disruption in the building industry, Taiga’s role in the supply chain is being an efficient wholesale distributor. Management continually monitors changing industry trends and responds accordingly.

If builders change their methods, the products change, hence translating to different orders to us, and we then source those products. On that note, we have also built an e-commerce platform called Taiga Digital to account for changing consumer behaviour as well.

Sustainability

So, what happens if lumber prices start to fall drastically back to its historical averages? It is certainly likely that Taiga’s sales and profit decrease from its record highs. That said, the company’s strength is its sustainability, and we would still expect it to churn out an appropriate return on our investment. Taiga has weathered through volatilities in housing cycles and commodity prices over its 40-plus year history.

This is primarily due to its diversification, as it has a wide product offering, caters to both new home and renovation activity, and is spread out across North America. Furthermore, continued strength in the US housing market, particularly single-family homes, would drive earnings growth.

Taiga has also had success in growing its margins organically by increasing the sales ratio of allied or manufacturing products to lumber or commodity products.

Over the last decade, allied products as a percentage share of sales have increased from 30% to 50%. This is important because allied products have a higher gross margin than commodity products and reduces the dependence on lumber.

| It is also unlikely for Taiga to recognize huge inventory losses on lumber if the price starts falling because it has very high inventory turns of 2 times per week. That risk is more relevant for the treated wood business, as Taiga accumulates lumber in the winter, treats it, then sells it in the spring. However, we are now past that stage. |