|

My thoughts on Sing Medical Group possible share transaction

|

Why am I interested in SMG?

My personal view is that at $0.315, given a potential share transaction scenario, the risk reward seems favourable. Please refer to my basis and the risks as highlighted below:

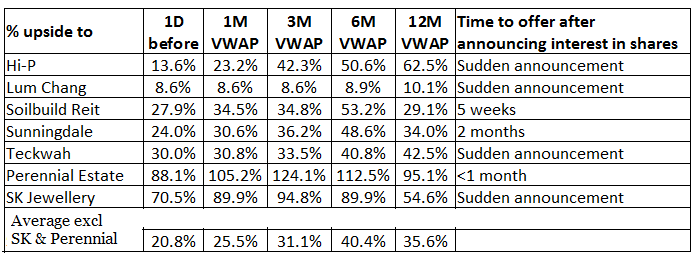

1) Past recent trend – average premium to 3M, 6M VWAP are around 31% and 40% respectively

Based on Table 1 below, and with prudence, if I exclude Perennial and SK Jewellery which have incredibly large premiums, the average premium to 3M, 6M VWAP are around 31% and 40% respectively. This translates to a potential take-over price of around $0.360- 0.380.

It is also noteworthy that based on a recent trend, it takes anytime less than a month to approximately two months from announcing a potential transaction to an offer.

Table 1: Average premium to VWAP

Source: Ernest’s manual compilations

2) Free float is quite huge

Based on SMG’s 2019 annual report, as of 23 March 2020, approximately 53% of the issued ordinary shares of the Company was held in the hands of the public. Thus, it is likely that the offer price (if any), may not be too low. Otherwise, the shareholders may not accept the offer.

3) Management previously sold shares at $0.605

In Feb 2019, CHA bought 83m shares at $0.605 from five existing shareholders via a sale and purchase agreement. Separately, SMG issued a S$10m convertible bond to CHA at a conversion price of $0.423 / share. If a low ball offer is issued to the minorities, the offer may not be successful.

4) SMG trades at around 10.9x FY21F PE, compared to peers trading at an average 20x FY21F PE

Based on analyst estimates, SMG trades at approximately 10.9x FY21F PE vis-a-vis peers which are trading at an average of around 20x FY21F PE.

As its peers are trading a much higher PE, it is likely that should an offer price be given, it is likely to take into account the sharp disconnect between SMG’s low valuation vis-à-vis its peers'.

5) Average analyst target $0.355

The average analyst target is around $0.355 if I take the latest two analyst reports from KGI and UOB Kayhian. (RHB report is dated 26 May 20 and its a bit far to be accurate). However, it is noteworthy that the reports from KGI and UOB Kayhian were also dated in Aug 2020.

It is likely that there may be re-rating in the healthcare stocks as vaccines are rolled out.

Already, Raffles Medical has had two latest analyst reports dated 30 Sep 2020 and 11 Dec 2020 as analysts believe that healthcare sector may be on the cusp of a recovery post Covid. In other words, amid other numerous factors, an offer price for SMG may also take into account the average analyst target price.

6) Previous acquisitions by SMG issue SMG shares at $0.330; $0.540 & $0.620

Based on my manual checks on the announcements from SGX spanning to 2016, I noted that SMG has done a few acquisitions from 2016 to 2017 and they have financed at least part of the acquisitions via issuance of new shares at $0.330; $0.540 and $0.620 to their acquisition targets.

Notwithstanding the rights issue offer 1 for 20 at $0.480 on 12 Jun 2018 and I do not know whether these targets have sold their shares, I think the offer price (if any) may need to take into account (to some extent) of such stake holders too.

7) Previous takeover in the healthcare sector fetches good valuations

The previous takeover of HMI via a scheme of arrangement values HMI at S$611m. According to UOB Kayhian, this has an implied FY20F PE of around 29x. It is noteworthy that SMG trades at approximately 10.9x FY21F PE only.

Given the basis above, it is likely that the offer price may not be too low.

|

Risks I have outlined some risks below pertaining specifically to the potential share transaction. This is by no means exhaustive. |

- No offer on the table

This is always possible. As I am not the management, I am unable to quantify this risk. If there is no offer, SMG may plunge. Oftentimes, share price may move ahead before news is out. Hence, the share price may drop quite a bit before any announcement on “no offer” is out. Thus, this may lead to difficulty in gauging risk and exit level.

- Extreme low ball offer (e.g. <=$0.31)

There is always the possibility that a low ball offer may be dished out to the minority shareholders. Given the above basis (e.g. large free float, low valuations against peers; management sold out shares at way higher price), an extreme low offer (e.g. <=$0.310) may not be likely.

- Opportunity cost as the discussions may drag on and on

There is also the possibility that discussions on a potential share transaction may drag on and on, resulting in opportunity costs.

Based on a recent trend, it probably takes anytime less than a month to approximately two months from announcing a potential transaction to an offer.

Furthermore, as travel restrictions are lifted over time (assuming a successful and effective vaccine rollout), it is likely that SMG's business may recover over time.

Against the backdrop of a recovering business, it will get less likely for a low-ball offer to be successful.

Thus, my gut feel is that should there be an offer, it is in the interest of the offeror to get it done sooner rather than later.

|

Conclusion

P.S: I have highlighted SMG to my clients on Christmas' eve for them to consider to take a closer look. I am vested. |

Disclaimer

Please refer to the disclaimer HERE

This article was originally published on Ernest Lim's blog.