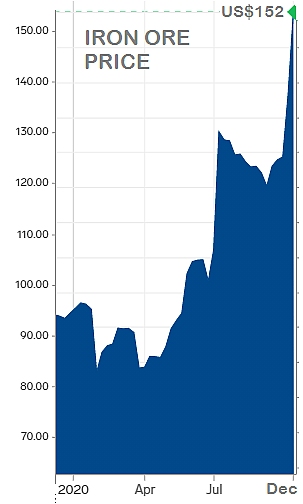

Chart: Business InsiderIron ore prices have soared and soared this year (+65% year-to-date). That has benefitted the only 2 iron ore producers listed on the Singapore Exchange -- Fortress Minerals and Southern Alliance Mining. Chart: Business InsiderIron ore prices have soared and soared this year (+65% year-to-date). That has benefitted the only 2 iron ore producers listed on the Singapore Exchange -- Fortress Minerals and Southern Alliance Mining. Phillip Securities today initiated coverage of Fortress Minerals. (See also: SOUTHERN ALLIANCE MINING: Where the upside is) |

Excerpts from Phillip Securities report

Analyst: Vivian Ye

Growing demand from steel mills in Malaysia to spur higher sales volumes. We project 54% volume growth from FY20 to FY22e.

Initiate coverage with BUY and TP of S$0.28. Valued at 11x FY21e PE, in-line with industry average. Fortress is smaller in size but is growing faster and enjoy higher returns than industry. |

||||

Company Background

Fortress Minerals (FML) is an iron ore concentrate producer in Malaysia. As FY2019 was the Group’s maiden year of commercial production, profitability margins were partly crimped by initial ramp-up costs and gestation.

Its mining concession is located in Bukit Besi, Terangganu, Malaysia, with 7.18MT of reserves and 13 years of concession life.

FML explores, mines, produces and sells magnetite iron-ore concentrate.

Steel is the world’s most commonly used metal and iron ore is a key ingredient in steel-making.

FML sells primarily to steel mills in Malaysia and China.

Investment Merits

1. Healthy volume growth of 40% expected in FY21e to meet construction demand. 1HFY21 production volume surged 57% YoY to 231,007 WMT.

Demand was driven by new offtake agreements with steel mills in Malaysia.

We expect FML to increase production by 54% from FY20 to FY22e.

Malaysia’s 9M2020 production of iron and steel bars and rods grew 5.5% YoY.

On the basis of projected GDP growth of 6.5%-7.5% and construction-sector growth of 13.9% in 2021, demand for steel and iron ores is expected to increase.

2. High profitability due to low-cost structure and proximity to customers. Unit cost of US$28.8/WMT against ASPs of US$95.9/DMT yielded gross profit margins of 66.7% of (industry average of about 50%) in FY20.

Another advantage FML has is the close proximity of its Bukit Besi mine – of about 100km – to domestic steel-mill customers.

The quality of its iron ores (TFe grade of 65.0%), consistent supply and short delivery time are expected to ensure captive buyers from steel mills in Malaysia.

Iron ores from Australia require a delivery time of about 10-20 days vs. daily trucking services in Malaysia.

3. Considerable exploration upside potential with 5% of concession area explored. FML completed its plant expansion in late FY2020.

Of its concession area of 526.2 ha at Bukit Besi, less than 5% has been explored.

There is thus substantial potential for mining as larger tracts are explored.

FML’s mining rights will only expire in early 2033.

We initiate coverage with a BUY rating and TP of S$0.28. Our TP is based on 11x FY21e PE, in-line with industry average.

| Iron-ore prices may fall from current peak levels |

| Iron-ore prices affect the company’s revenue directly. Iron ore prices have reached seven-year high, aided by fast-recovering steel markets and stimulus measures in China. A shortage of supply caused by Covid-19 measures which disrupted shipments of iron-ore concentrates to China and global supply chains also contributed to increased prices. In the medium term, supply is expected to recover. Though a demand recovery could be slow as most countries are still trying to contain the virus, demand for steel from China is expected to remain strong. This should keep prices above US$110/DMT. |

Full report here.