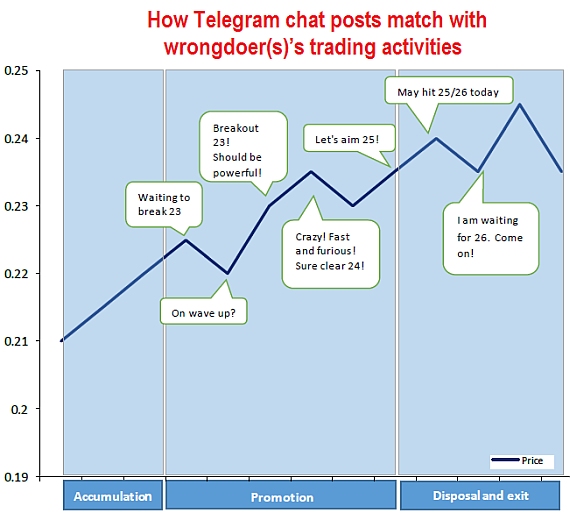

| Singapore Exchange Regulation (SGX RegCo), in a statement today, alerted the public to possible market misconduct activities that exploit Telegram chat groups and other channels where investment strategy is discussed. It said that while such platforms may be useful for investors to share knowledge and information, it is, however, aware of instances where wrongdoers may misuse these channels. "The wrongdoers do so by engaging in “pump and dump” schemes where they would promote interest in a particular security(s) for their own benefit." |

The modus operandi typically involves the wrongdoers, either working alone or in groups, using channels such as Telegram chats to encourage other members in the chat group to trade a particular security.

When more members of the chat group are incited to trade, the momentum of the security will be ignited, said SGX RegCo.

The wrongdoers would then sell shares of that security that they had accumulated earlier, at a higher price.

An illustration of such a scheme was given by SGX RegCo.

|

Step |

Action |

|

1 |

Wrongdoer(s) accumulate shares typically in a low-volume, low-price security. |

|

2 |

Wrongdoer(s) may enter orders to sell the shares at a higher price. |

|

3 |

Wrongdoer(s) will post messages in the Telegram chat indicating they are about to enter that security and that interest in the security is building up. |

|

4 |

Most posts with encouraging messages are made by the wrongdoer(s) in relation to that security and their purported target price for exit. This purported target price is usually higher than the prices at which the wrongdoer(s) has actually queued to sell or intend to sell at. |

|

5 |

Wrongdoer(s) make small purchases at higher prices and announce in the chat that interest in the security is building up and price is gaining momentum. |

|

6 |

Wrongdoer(s) may use other aliases to post messages to indicate support for the original posts. |

|

7 |

Price reaches the level at which they are queuing to sell or intend to sell and wrongdoer(s) will close the position with a profit and may move on to pump and dump another counter. |

Source: SGX RegCo

Source: SGX RegCo

Information on investments and trades shared on social media, in particular by anonymous individuals, may not be credible.

Wrongdoers may hide behind the veil of anonymity to instigate interest in a security for their own benefit.

Investors should always conduct their own due diligence and research on any potential investments.

This should never be substituted with information obtained on social media.

| "SGX RegCo will refer potential wrongdoer(s) to the statutory authorities for investigation of breaches of the laws." |