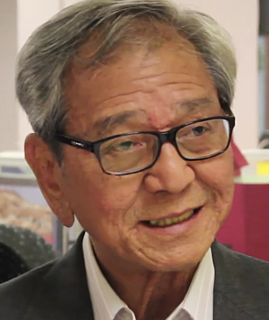

Koon Yew Yin, 85, is hardly known in the Singapore investment community but in Malaysia, where he lives, he is well-recognised as an investor and philanthropist. In his younger days, Mr Koon founded three Bursa Malaysia-listed construction firms: Gamuda, Mudajaya Group and IJM Corporation. Since retiring in 1983, he has been writing about public issues affecting Malaysia. He has also been investing heavily – and successfully, usually – in Malaysian stocks. Jaks Resources was a painful exception as this article, originally posted on his blog, says.

|

I have been looking at the price chart of Jaks Resources and when I saw the price began to move upwards in January 2017, I started buying at about Rm 1.10 per share. I was so excited when I read the following announcements by Jaks: ♦ On 22 March 2018 placed out 50.7 million shares at Rm 1.39 per share and on 16 March 2017, 43.9 million shares at about Rm 1.40 per share. ♦ On 13 June 2018 Ang Lam Poah, the CEO bought 50,000 shares, on 12 June 2018 bought 200,000 shares and on 8 June 2018 bought 550,000 shares from the open market at about Rm 1.40 per share. |

Malaysian investor Koon Yew Yin, 85: "This is the most expensive lesson in my life." The main objective for buying so many shares by the CEO Mr Ang Lam Poah and all the institutional buyers of the placement shares must be Jaks’ JV with the Chinese companies to construct the 1,200 MW power plant to sell electricity to the Vietnamese Government.

Malaysian investor Koon Yew Yin, 85: "This is the most expensive lesson in my life." The main objective for buying so many shares by the CEO Mr Ang Lam Poah and all the institutional buyers of the placement shares must be Jaks’ JV with the Chinese companies to construct the 1,200 MW power plant to sell electricity to the Vietnamese Government.

The 3 Chinese National Banks must have studied the power purchase agreement before they were prepared to finance Rm 7.76 billion for the project.

During the construction, the Chinese pay Rm 454 million to Jaks and this sum of money is to be used as capital for owning 30% of the Joint venture. Moreover, the Chinese would undertake the construction of the power plant.

It is like the Chinese Banks is giving a profit guarantee to all the Jaks shareholders every year for 25 years when the JV sell electricity to the Vietnamese Government.

Based on the above, the share price should go above the share placement price of Rm 1.40 when the 1,200 MW power plant is completed in 2020.

My wife started to accumulate more shares and we finally bought a total of about 160 million shares with margin financing. We bought too many shares with margin finance. Our average price should be about Rm 1.20 per share.

If you look at the price chart, you can see the price went up to Rm 1.85 in Feb 2018 and when I saw it started to drop, we started selling. I should have sold more to avoid force selling. It was my greed that I did not sell more shares.

In fact, forced selling was a blessing in disguise for us.

We had to sell to meet margin calls. The more we sold the more the price would drop. Forced selling is a vicious cycle.

We were fortunate introspectively to have sold a huge amount of our holdings at higher prices in comparation with the current price of 50 sen per share. We have completely sold all our holdings.

Based on our average selling price of 80 sen, our average purchase price of Rm 1.20 per share and our total holdings of 160 million shares, we have lost Rm 64 million. Coincidently this is the 64 million $ question many people have asked me.

This is the most expensive lesson in my life.

I believe I can make back some money using my golden rule for selecting shares- the company must report increasing profit for 2 consecutive quarters.

Sad to say that Jaks does not comply with my golden rule anymore because it has too much borrowings to finance its properties during the current depressed market. Jaks will continue to report losses in the next 2 or 3 years until the completion of the power plant.

Life has many challenges, don’t give up because life also has many solutions.

The sun is a daily reminder that we too can rise again from the darkness.