|

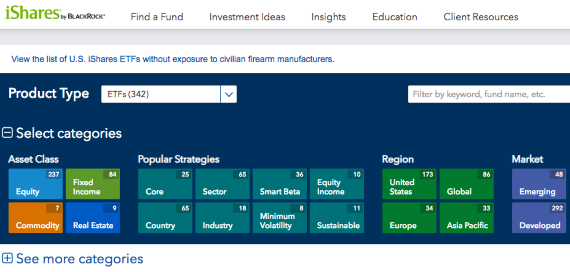

From menu items to dating partners to investment options, we think that the more choices we have the better. The truth is, too many choices often leads to decision paralysis. Asset manager giant Blackrock, for example, offers 342 U.S. listed ETFs alone. They have 92 U.S. equity-focused ETFs slicing and dicing the market in every which way. A more obscure one we found on the list: iShares North American Tech-Multimedia Networking ETF. |

ETFs have become synonymous with passive index funds, but this is a great misconception.

Adding to the permutation of possibilities, there are many financial services firms now offering portfolios of ETFs they have selected, then actively trading those portfolios, creating a whole new can of worms.

Selection, strategy and portfolio construction aside, how do we answer the initial question: ETF or mutual fund (aka unit trust)?

Both ETFs and mutual funds pool investors’ money, which becomes part of a fund that invests in different assets. Both can be great tools to help you build a diversified portfolio with just a single investment, but there are important differences between them that you should understand before you decide which investment is right for you.

Do you want to trade frequently?

ETFs are priced and traded on stock exchanges throughout the day, just like stocks. You can set price limits or market orders when you trade ETFs. Depending on the liquidity of the ETF, the bid/ask spread can be narrow or very wide. In contrast, units of mutual funds are invested or redeemed directly with the fund management company via a bank or broker. The price (or more commonly referred to as NAV) is set once a day, and everyone who puts in their order before a set time each day will have the same day-end NAV.

For a long-term investor, the intraday liquidity of ETFs is of little importance. Trading at NAV versus unsuccessfully trying to time the market and potentially paying more than what the underlying assets of the ETF are worth is comforting.

|

|

You should want to pay less in fees.

People look at ETFs and think “cheap!”, but this is not always the case.

You pay a brokerage fee to trade ETFs. Depending on your broker, this could range from a few dollars to over 0.50% on your investment amount.

For mutual funds, depending on your distribution channel, fees can vary widely. The lack of transparency has given mutual funds a deservedly bad reputation. You need to read the fine print and ask your broker exactly what fees are involved: There is an upfront sales fee, and potentially wrap fees, brokerage fees, switch fees, and redemption fees. Worst of the lot is hidden trailer fees embedded into the fund, which are essentially sales commissions paid on a recurring basis by the fund manager to the distributor. These fees can take a massive bite out of your returns so you should not blindly accept them.

We at endowus are greatly opposed to these complicated layers of fees and misaligned incentives, which is why we charge a transparent and low all-in access fee (no additional sales fee, brokerage fee, rebalancing, or wrap fees) and we never take kickbacks from fund managers or anyone else for that matter.

Though the expense ratios of ETFs are generally lower than mutual funds, this isn’t always the case. There are mutual funds (such as those offered by Dimensional Fund Advisors) that provide additional value such as efficient implementation, and therefore generate returns at costs comparable to ETFs.

For example, let’s look at 2 UCITS funds, which are more tax-efficient for the non-U.S. person. Dimensional’s World Equity mutual fund invests in almost the entire world with over 10,000 securities and has a fee of 0.50% p.a. Blackrock’s iShares All Country World ETF, on the other hand, has under 1300 securities and a fee of 0.60% p.a. Furthermore, Dimensional’s fund has a share-class denominated in SGD, which means that you would avoid unnecessary foreign-exchange related costs that you might have to incur if you are a SGD-denominated investor trying to invest in foreign-listed ETFs.

|

This is your hard-earned money. Do the work and look hard. There are solutions out there that suit your needs.

|

This article is republished with permission from Dollars and Sense.

Photo: Unsplash

Photo: Unsplash