|

|

Photo: ijeab / Freepik |

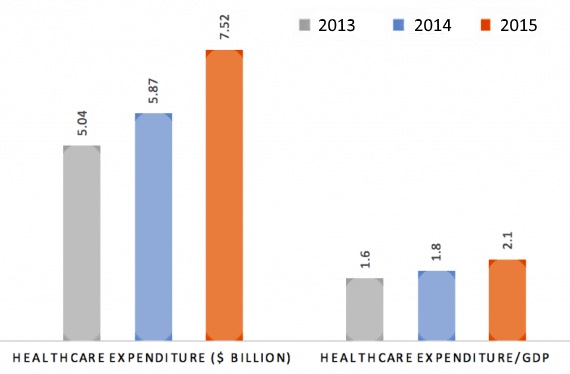

It was reported in December 2017 that the government’s expenditure on healthcare is expected to “rise quite sharply” in the next three to five years.

In fact, a quick look at the national Budget figures shows that healthcare expenditure has increased over the years.

Singapore Government Healthcare Expenditure:

Source: Ministry of Health

But what’s the reason for this?

Our Ageing Population

Similar to many developed countries, Singapore has an ageing population.

Back in 2006, Singapore had 6.9 citizens of working age for every one older adult (65 and above). In 2016, this declined to just 4.7 citizens per senior. By 2030, the number is expected to drop to just 2.3 citizens for every elderly Singaporean.

What this means is that in the coming years, we need to be prepared for a greater number of older adults who will be reliant on our country’s healthcare system.

Read Also: Singapore’s Ageing Population: The Financial Implications Of Our Country Growing Old

More People with Chronic Conditions

Medical innovation and health science technology continue to be a growing area. The investments in new medical procedures, devices, and drugs have allowed Singaporeans to enjoy a high quality of care with access to more diagnostic and treatment options. Medical innovation and health science technology continue to be a growing area. The investments in new medical procedures, devices, and drugs have allowed Singaporeans to enjoy a high quality of care with access to more diagnostic and treatment options. |

As we mature into a more developed society, it is natural that there will be more people, including more elderly, with chronic conditions such as cardiovascular diseases, cancers, and diabetes.

Unlike acute medical conditions, people with chronic conditions need long-term treatment and care, and such costs will add up over time.

To improve accessibility and to meet the increasing demand for healthcare services, the government has been increasing our healthcare capacity to ensure that everyone has access to healthcare services.

Five new hospitals have opened since 2010 and another three new general hospitals will be built by 2030 to help ease the bed crunch.

The government has also expanded the healthcare safety nets by increasing subsidies for home and community-based care, and in- and out-patient care to ensure that healthcare remains affordable, especially for lower- and middle-lower income Singaporeans.

Advancement in Medical Technology

Medical innovation and health science technology continue to be a growing area. The investments in new medical procedures, devices, and drugs have allowed Singaporeans to enjoy a high quality of care with access to more diagnostic and treatment options.

For these reasons, public healthcare spending will naturally continue to increase in the years ahead.

Read Also: Singapore’s Medical Inflation Rate Is At 15%: Why That Spells Disaster For Us

Who Will Pay For The Healthcare Bill?

Typically, this falls on just three groups: Individuals, corporations, government.

Healthcare benefits given to citizens such as the Pioneer Generation Package not only benefit the individuals who receive them but by extension, their families as well, since this benefit means transferring some of the healthcare cost from the individual or the family to the government. Healthcare benefits given to citizens such as the Pioneer Generation Package not only benefit the individuals who receive them but by extension, their families as well, since this benefit means transferring some of the healthcare cost from the individual or the family to the government. |

(1) Individuals, Or Their Families

As individuals, we are largely responsible for our own healthcare costs. If we are sick and require hospitalisation, treatments or medicines, it’s reasonable to expect that we would have to pay for it.

There is a common misconception that medical insurers can cover all the expenses. This isn’t really true. That’s because at the end of the day, private insurers are simply helping us with risk-pooling. What an insurer does is that it pools together your premiums, along with thousands of other individuals, and helps administer the claim payouts.

If more people start making more frequent and larger claims for their medical bills, premiums could increase over time in order to cover the higher costs. In turn, we all bear the costs of higher premiums.

Meanwhile, healthcare benefits given to citizens such as the Pioneer Generation Package not only benefit the individuals who receive them but by extension, their families as well, since this benefit means transferring some of the healthcare cost from the individual or the family to the government.

(2) Companies

Companies that provide healthcare benefits for their employees are indirectly helping to cover part of the overall healthcare cost in Singapore. Count yourself fortunate if you’re covered by a comprehensive corporate package.

(3) Government

Last, but certainly not the least, the government bears a large part of the overall healthcare bill, to the tune of close to $10 billion a year in 2017. This amount is spent on areas such as building up our healthcare technology and facilities, subsidies for MediShield Life premiums, patient subsidies, and social transfer to public healthcare institutions.

How Can We Avoid The Problems Other Countries Face With Healthcare Inflation

There are a few things that we can do, both individually and collectively as a nation, to keep healthcare costs sustainable.

Live Healthily

First, prevention is always better than cure. It’s definitely cheaper (and better) to invest in our health today, than to make poor health choices which may lead to chronic illnesses such as diabetes and other diseases.

Eating right, exercising regularly and getting enough sleep are all important factors when it comes to taking care of our health in the long term.

Avoid The Moral Hazard Issue

One of the dangers of having healthcare insurance is the moral hazard problem. This is when individuals, knowing that they are already insured, make poor health choices or over-consume healthcare services, thinking that their insurance will cover the cost.

Total healthcare cost will quickly spiral to unsustainable levels should everyone think the same. Eventually, insurers will have to increase insurance premiums and pass on costs on the consumers.

Making Good Healthcare Choices Benefits Everyone

One of the most overlooked aspects of taking care of our health is that it does not just benefit us individually, but also our loved ones.

When we are blessed with good health and continue to make the effort to live healthily, we are able to not only reduce our own healthcare cost, but also be able to support our families more effectively. This way, we also get to spend more quality time with them.

By making sustainable healthcare choices, and by avoiding over-consumption of healthcare services, society will also benefit as a whole as insurance premiums for healthcare would be kept at an affordable rate.

Only by tackling issues relating to healthcare today can we ensure that we continue to keep healthcare costs in Singapore sustainable for ourselves, and for future generations.

This article is republished with permission from Dollars and Sense.