|

YCL contributed this article to NextInsight, which builds on an earlier piece: CHINA NEW TOWN: Awaits bids for its land parcel (reserve price RMB2.6 b) China New Town Development (CNTD) voluntarily delisted from Singapore in Feb 2017 and made HK its primary place of listing. It has a number of Singapore-based shareholders, including YCL. |

Q: How do you value China New Town Development? Should it be valued like a property company? Or should it be valued like a specialist asset/fund manager with a portfolio of both operating and income generating assets?

Q: How do you value China New Town Development? Should it be valued like a property company? Or should it be valued like a specialist asset/fund manager with a portfolio of both operating and income generating assets?

The valuation for the assets is quite straight forward except for item 3) in the table.

However, we should be able to have a sense of its value once the auction result for the H-02 land parcel is announced by the end of this month.

|

Total Assets (as at 30 Jun 2017) |

RMB 7,461,449,000 |

|

Major assets: |

|

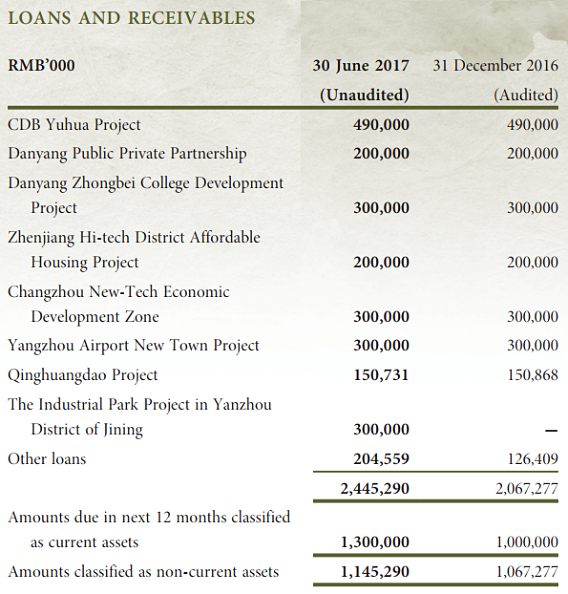

| 1) Loans & Receivables (Fixed Income Portfolio, estimated 12% gross yield) |

RMB 2,445,290,000 |

| 2) Financial Assets at fair value through profit or loss (mainly short-term wealth management product, estimated yield 4%) |

RMB 825,365,000 |

| 3) Land Development for Sale (mainly Luodian) |

RMB 1,514,096,000 |

| 4) Other Receivables |

RMB 1,178,038,000 |

| 5) Cash & Bank Balance (estimated yield 3%-3.5%) |

RMB 1,293,121,000 |

|

Total: |

RMB 7,255,910,000 |

Based on the reserve price (or the floor price), H-02 land parcel’s expected net proceeds is RMB 749,000,000 or about 49.5% of “Land Development for Sale” book value.

Accordingly, the estimated net proceeds valuation for the 281,000 sqm construction area of residential and commercial land in Luodian Eastern Project is RMB 2,364,500,000.

Potential revaluation gain for item 3) will be RMB 850,400,000.

To calculate the RNAV, consider that the outstanding shares = 9,756,214,750 and the NAV per share = RMB 0.409 = HKD 0.480 (based on

|

|

|

|

Based on reserve price: |

|

| Revaluation gain for item 3) per share |

RMB 0.087 (HKD 0.102) |

| RNAV per share |

RMB 0.496 (HKD 0.582) |

| P/RNAV (based on HKD 0.39 share price) |

0.67x |

However, based on past auction conducted in 2013, the successful bid was 40% higher.

It is not unrealistic to expect a scenario with successful bid at 30% higher. The corresponding results would be:

|

|

|

|

Net proceeds for H-02 Land |

RMB 973,700,000 |

|

Net proceeds for Eastern Project |

RMB 3,073,800,000 |

|

Potential Revaluation Gain |

RMB 1,559,700,000 |

|

|

|

|

Based on 30% higher successful bid: |

|

| Revaluation gain for item 3) per share |

RMB 0.16 (HKD 0.188) |

| RNAV per share |

RMB 0.569 (HKD 0.668) |

| P/RNAV (based on HKD 0.39 share price) |

0.58x |

The monetization of the Luodian Eastern Project which is expected to be sold over 3 years should progressively provide the company extra liquidity to deploy capital in the sectors that the company is focusing on, ideally generating return similar to or better than the fixed income portfolio.

Given that 97.2% of total assets are predominantly Level 1 & Level 2 type assets with more than 60% of total assets yielding 3% -12% gross return, should the company be trading at a discount to NAV/RNAV like a typical property company? Does the company deserve a higher valuation than today’s 0.67x P/RNAV to 0.58x P/RNAV under the 2 scenario?

Or should the company be valued like a specialist asset/fund manager with portfolio of both operating and income generating assets?

As at 30 June 2017, the Company owns & manages a portfolio of RMB2.445 billion fixed income investments in aggregate, securing a total contractually guaranteed annual return before tax of approximately RMB290 million, representing an average annualized pre-tax return of approximately 12%.

It is also involved in land development projects such as Beijing Mentougou Junzhuang Project which is a JV with Vanke. The Company has also implemented collaboration projects in the downstream industry, setting “Education, Tourism, Industrial Parks” as the key strategic direction. Other strategic cooperation partners include the sole manager of the National IC Industry Fund and Shenzhen Capital Group.

In all these projects and collaboration, the company will be playing the role of asset manager as well as having its skin in the projects with the objective of generating decent ROE for all stakeholders.

| As an example, Value Partners Group (806:HK), a HK listed asset management company with AUM of USD15.5bio for the period ended 30 Jun 2017, achieved a profit attributable to owners of the Company of HKD 219.5mio. Its equity attributable to owners for the same period was at HKD 3.723 bio. Its share is valued at 3.69x P/Book. |

In view of the above, is it absurd to value the company as a specialist asset/fund manager? What valuation metrics should be used then?

In the interim results, CNTD achieved a profit attributable to owners of the Company of RMB 116.7 mio (HKD 137.0mio). Its equity attributable to owners for the same period was at RMB 3.990 bio (HKD 4.683 bio). This is definitely not an apple to apple comparison given Value Partners Group’s outsized AUM versus CNTD and the different nature of their revenue flow.

Is it fair to ascribe Value Partners P/B multiple for the company at this stage?

Does the company deserve a higher valuation than today’s 0.67x P/RNAV to 0.58x P/RNAV under the 2 scenario? We shall leave you to be the judge.

|

Q: What has changed since China Development Bank Capital Corporation (“CDB Capital”) became the controlling shareholder of the Company in Mar 2014?

|