Photo: Dollars and Sense Photo: Dollars and Sense

Are you looking to achieve financial freedom? Or perhaps trying to build your nest egg for retirement? “24% returns at virtually no risk to your capital; all you need to do is invest!” Coupling these with glib salesmen touting stories of success – think posh offices, fancy cars and bespoke suits – many investors have ended up handing over their money unwittingly to invest in schemes which were nothing more than lies. |

To protect yourself from falling prey to investment scams, remember the following red flags.

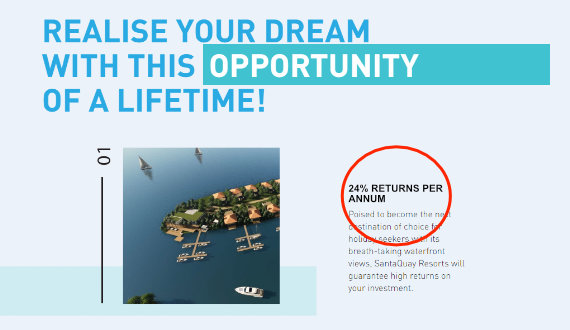

#1 Are They Promising You High Returns At Low or No Risk?

Source: Santa Quay Resort

Source: Santa Quay Resort

Investment scam artists appeal to the basic human nature of greed by emphasising the high returns only. When you ask about the investment risks, scam artists will be quick to assure you that it is 100% safe, or claim that the risks are “negligible” without elaborating. Essentially, they will say exactly what you want to hear.

When you encounter such a situation, you should ASK as many questions as you need to find out how the company is able to generate the high returns with low or no risk. If the company claims that there is no risk despite the high returns, or is unable or unwilling to explain the downsides, tread carefully.

Always remember there will always be a risk/return trade-off when it comes to investing – a higher expected return usually comes hand-in-hand with higher risks.

#2 Guaranteed Capital

Most of us are risk-averse and hate losing money.

See if you can relate to this example.

If you drop a $10 note on your way to the office, it sticks in your mind for way longer than it should, and you will feel gloomy for the rest of the day.

On the flipside, if you pick up a $10 note on our way to the office, you might feel a short thrill, but that would quickly fizzle out as we go on with our day.

In economic theory, this is called loss aversion – where we feel the pain of loss more than we feel the pleasure of gain.

Scam artists take advantage of this psyche by assuring you that your capital is “guaranteed”. This is to give you peace of mind that you will not lose money if you invest into the scheme they offer you.

#3 Commissions for Referrals

One of the most effective ways of marketing is through “word-of mouth”.

Investment scam artists often lure new investors by encouraging existing investors (who are still unaware they are in a scam) to refer their family members and friends to the investment schemes. Sometimes, this is in exchange for lucrative commissions.

Source: Brilliant Ingots

Source: Brilliant Ingots

As we trust our family and friends, we tend to let our guard down. We may invest quickly without doing our homework, especially if we are told that the family member or friend had already invested into the scheme.

It may not always be easy but we should remind ourselves to be cautious even if a trusted family member or friend refers an investment opportunity to us.

#4 Strong Track Record

Investment scams are often run by companies that appear to be well established and legitimate. For instance, they may tell you they have famous investors on their books. Or they may claim that they are regulated by the authorities.

Source: Santa Quay Resorts

Source: Santa Quay Resorts

Uncovering this facade is easy. You can do your own research and CHECK on the company. For example, a quick search on the Internet could throw up feedback and comments about the company and the investment opportunities it is offering. Although you should always take online feedback with a pinch of salt, these could provide some useful food for thought.

The Monetary Authority of Singapore (MAS) also maintains a Financial Institutions Directory that you can use to CONFIRM if a company is indeed licensed to provide financial services in Singapore. If the company you are dealing with is not listed on the directory, it means that the MAS does not regulate them.

Dealing with unregulated entities for financial services would mean forgoing the protection afforded under the laws administered by MAS.

#5 Pressure Tactics

To prevent you from doing your own due diligence checks on the company and the investment opportunities it is offering, investment scam artists will pressure you into signing up on the spot. Typical pressure tactics include claiming that that the investment is on a limited-time discounted price offer, there are limited opportunities, or there are incentives for on-the-spot sign-ups.

If you encounter such pressure tactics, you can immediately recognise what they are doing and avoid falling into the trap, by asking yourself these questions:

- Why is the company not giving you the time to think about the investment, do your own checks, and discuss this investment opportunity with your family or friends who are more knowledgeable? What are they afraid of?

- Is it worth risking your entire capital by not checking on the investment, just for the sake of the “additional incentives”? What if it turns out to be a scam?

It is important to fully understand what an investment is about before putting in your money. Always be prepared to walk away when you are unsure. There will be other investment opportunities.

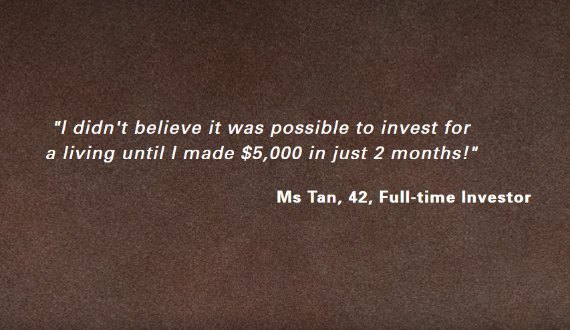

#6 Testimonials

Source: Brilliant Ingots

Source: Brilliant Ingots

It’s easy for investment scam artists to seed unsubstantiated success stories among a few selected individuals, or even create fake ones entirely. Unless you know these individuals personally (you likely don’t) and can verify their stories, you should always take these testimonials with a (big) pinch of salt. In fact, it is better to assume they are not true at all.

# 7 If It’s Too Good To Be True, It Probably Is

Investment scams are usually just that – deals that are seemingly too good to pass up. The investment opportunity seemingly checks off all the right boxes – short term investment, high returns, capital guaranteed, and solid track record. The salesperson may make you feel like you are missing out a lot if you give up the chance. He tells you that other people you know are smart to have put in their money quickly. He may even try to convince you he had invested a significant amount of money himself to “prove” to you he has skin in the game.

Do not be too quick to believe everything you’re told.

Remember, there is no such thing as a free lunch.

As the saying goes, if something sounds too good to be true, it probably is, and if you come across such “deals”, you should walk away quickly.

| Stay updated about investment scams by following these websites |

|

Apart from recognising the tell-tale signs of investment scams, you can protect yourself and your loved ones by keeping updated about news related to investment scams. |

This article is republished with permission from Dollars and Sense.