Photo: Dollars and Sense Photo: Dollars and Sense

Much of the buzz generated by the fintech wave revolves around disruptions and innovations that could potentially change the way we earn, spend, and invest. |

#1 Remittance Services

We’re so used to the convenience of doing everything through the internet and transferring money overseas is no different. By doing so, we incur costs in the form of high foreign exchange rates set by banks. Not only that, we unwittingly chalk up charges for overseas bank transactions. These include, but are not limited to, cable or telegraphic (telex) charges, commission, agent bank charges. Agent bank charges are from intermediary or recipient banks handling the fund transfer.

Remittance services involve the transfer of funds to people residing outside of Singapore. We usually see migrant workers and foreign domestic helpers using remittance services. To remit money, you can go to a bank or a licensed remittance agent.

Here is a table comparing POSB’s charges for remittance and overseas bank transfers (out of Singapore) to the UK:

|

|

|

Regular Overseas Fund Transfer |

|

Cable/telex charges |

S$0 |

S$20 |

|

Handling commission |

S$0 |

S$5 for amounts up to S$5,000 |

|

Agent Bank charges |

S$0 |

Where applicable |

|

Cancellation/ |

S$35 per transaction |

|

|

Amendment fee |

S$30 per transaction |

|

Parents transferring money to their children studying overseas, or people sending money back home to Singapore, tend to take the internet banking way to be the most convenient option, without realising they could save up to $55 per transaction by choosing to remit money instead of doing an overseas fund transfer.

With remittance services, you can save on extra services charges and benefit from an arguably better exchange rate than the ones banks generally offer.

#2 Multi-Currency Accounts (MCA)

Travellers often exchange the foreign currency they need before going overseas. To be on the “safe” side, they tend to change more money than what they expect to spend.

If over-budgeted for, travellers may end up over-spending or bringing home leftover foreign currency. On the other hand, if they under-budgeted, they have the hassle of changing more money in the foreign country, or have to use their credit cards, which is very costly. For frequent travellers, foreign exchange fees can really add up.

|

“With remittance services, you can save on extra services charges and benefit from an arguably better exchange rate than the ones banks generally offer.” |

This practice also necessitates carry around large amounts of cash overseas, which could be risky.

A multi-currency account allows you to hold foreign currencies in addition to the SGD. You can make overseas transactions in foreign currencies without incurring miscellaneous charges and fees, which are very common amongst credit cards enabled for overseas use.

You can buy your desired currencies online when you see favourable exchange rates, and access them by linking your card to the MCA. You can withdraw money directly from your MCA at ATMs overseas, without incurring the costs of foreign exchange fees, enabling you to save more when travelling.

#3 Finance Management Apps

The proliferation of personal finance apps has been very helpful in making life benter for people who wish to track their expenses. With expenses management apps such as Seedly, Mint and Toshl Finance, you can better manage your cash flow and savings.

Seedly is a locally designed app that integrates, to a certain extent, with Singapore’s local banks, enabling you to import your bank transactions from multiple accounts. It makes it seamless for you to manage your daily expenses, credit and debit card use on a single platform.

Gone are the days where you have to manually note down your spending in your phone, before transferring it onto an Excel spreadsheet. By tracking and categorising your spending and savings with apps, you can also get more insights on the way you spend and be more efficient with saving money.

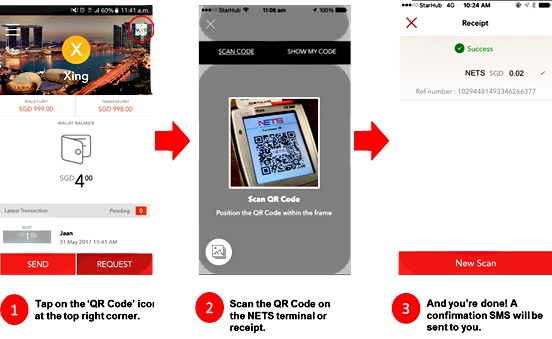

#4 PayNow, PayLah!, Pay Anyone  The DBS PayLah mobile app enables retail consumers to make cashless payments to thousands of participating merchants with NETS terminals. (Graphic: DBS Bank)

The DBS PayLah mobile app enables retail consumers to make cashless payments to thousands of participating merchants with NETS terminals. (Graphic: DBS Bank)

Saving hassle and time is worth it, because we all know, time is money. Mobile payment apps have vastly improved and streamlined the transfer of funds among people.

With digital P2P transfer services from individual banks such as DBS’s PayLah! And OCBC’s Pay Anyone, sending and receiving money amongst peers can be done virtually instantly just with a mobile number. With the advent of PayNow, which integrates existing e-payment apps and methods across multiple banks, processing mobile P2P payments will be even more convenient and seamless for us.

With QR code capabilities, DBS PayLah! and OCBC Pay Anyone allow customers who are registered PayNow customers to create a personalised QR code that specified the desired amount to be paid. The code can be sent to someone on an instant messenger like WhatsApp, a social network like Facebook or an e-commerce platform like Carousell, aNFL the other party can just scan to pay.

This article is republished with permission from Dollars and Sense.