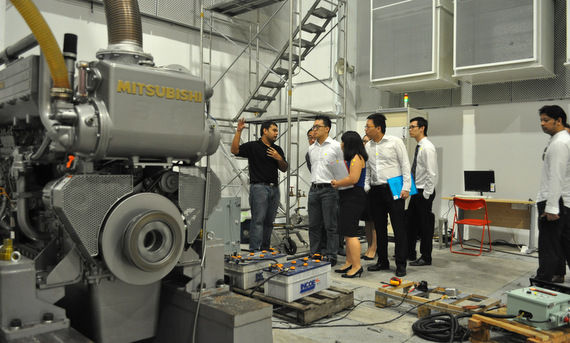

XMH’s new facility in Tuas houses all its business segments and brings functions such as the testing of engine propulsion system in-house. (NextInsight file photo) XMH’s new facility in Tuas houses all its business segments and brings functions such as the testing of engine propulsion system in-house. (NextInsight file photo)

COMPANIES exposed to the oil & gas sector are making use of the slowdown to consolidate operations and strengthen relationships with customers.

One example is XMH Holdings, a diesel engine, propulsion and power generating solutions provider in the marine and industrial sectors. |

The Group has a new CFO, Mr Tan Leong Kim, who was Tat Hong Holdings’ former CFO. He was appointed as XMH’s CFO on 11 July 2016 and replaces Ms Jessie Koh, the former Finance Director who resigned.

“We are exploring new revenue streams and trying to secure new customers in emerging markets,” said the new CFO, who was also present at the briefing.

“With all our business segments housed together in one building, we are able to have greater collaboration when pushing out our products.

“We save on rental, centralized purchases, as well as the management of treasury and other finance functions,” he added.

Below is an excerpt of the questions raised at the briefing and the replies provided by the Chairman and by the new CFO.

Q: How is the progress for the sales of your former Sungei Kadut office building?

| Stock price | 35c |

| 52-week range | 33c-62.4c |

| Market cap | S$38.9 m |

| PE | 5.3x |

| Dividend yield | 5.7% |

| Net gearing | 0.77x |

| Source: Bloomberg | |

JTC has already approved the transaction. We are selling our Sungei Kadut premises for S$2 million.

Q: What is the leasing status of your current office premise?

We have 3 tenants and third party rental income of more than S$100,000 per year. JTC allows us to lease no more than 30% of our gross floor area.

Q: How is the Indonesian shipping market?

Charter rates are still low and many vessels are still idle. Indonesian banks are unwilling to extend loans to vessel owners for capital expenditure as charter rates are not high enough to support loan instalment payments for buying new equipment.

The only business we see comes from a small volume of activity from state-owned oil majors such as Pertamina.

Q: How is the progress of your marinisation programme (conversion of industrial engines for marine vessel use)?

Marinised engines are attractive to the customer as they will be more cost effective than brand new ones. We have been talking for the past 6 months to prospective customers from another market segment so as not to cannibalise our existing market.

It takes time to build up a customer base for a new business segment.