|

RESOURCES PRIMA GROUP (“RPG”) has been on the restricted “online list” of a few brokerages such as CIMB Securities, OCBC Securities and UOB Kayhian (i.e. clients are not able to trade online but have to call their broker to execute trades for this stock). This restriction is typically for more speculative stocks. So what attracted me to take a closer look and do a writeup? |

First glance - What attracts me…

1. Chart formation seems positive

I have pointed out in my article dated 23 Mar 2015 “Selective stocks may have some small near term technical rebound” that RPG seemed to be building a base. RPG closed at $0.083 on 20 Mar, Fri and was trading around $0.082 – 0.084 on 23 Mar, Mon. It closed at $0.082 on 23 Mar.

Since 23 Mar, RPG has jumped 23% to close at $0.101 on volume expansion. Based on Chart 1 below, RPG surged 11% & 10% with 10.7m & 14.6m shares traded on 26 Mar & 27 Mar respectively. The volumes transacted were significantly above its 30D & 100D average volume of 3.6m & 12.8m shares.

Based on my personal observation, RPG’s has completed its base formation and it seems to be on the verge of a new uptrend. 21D exponential moving average (“EMA”) has turned up. Indicators such as RSI and MACD have formed bullish divergences and they seem to be strengthening. Although the RSI was a 15 month high (RSI closed at 57.7 last Fri), it is not overbought yet. Near term supports and resistances are at $0.097 / 0.094 / $0.090 and $0.109 – 0.111 / 0.122 / 0.136. The “bullish feel” of this chart will be negated if RPG falls below $0.090 on a sustained basis.

Resources Prima (11.4 cents) is loss-making and has a market cap of S$207 million.

Resources Prima (11.4 cents) is loss-making and has a market cap of S$207 million.

Chart: Yahoo!

2. Negatives seem to have been largely priced in

Firstly, the price for thermal coal has slipped to a six-year low. According to a Bloomberg article dated 24 Mar 2015, prices for a coal-supply deal between Glencore Plc and Japanese utilities may be set at a six-year low. The low coal prices have already prompted Glencore to plan to reduce its Australian output by 15m tons in 2015, equivalent to about one fifth of its production from Australia. Glencore also plans to trim output by shutting some mines in South Africa.

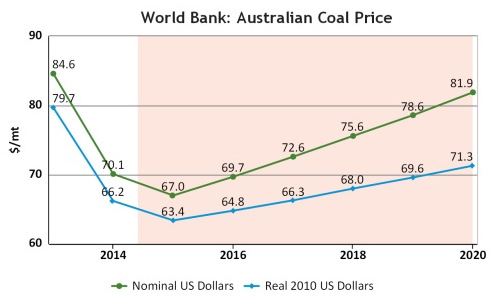

Notwithstanding the fallen coal prices, the World Bank forecasts that coal prices are likely to hit bottom in 2015 and rebound thereafter (See Chart 2). Other institutions such as the IMF and Economist Intelligence Unit also predict that 2015 is likely to be the bottom for coal prices.

Secondly, the massive 70% RPG’s share price drop from an intraday high of $0.265 on 4 Dec 2014 to $0.079 on 18 Mar 2015, coupled with a three week long base formation should have exhausted the selling.

Coupled with the online trading curbs by brokerages and the current bearish news on coal, it should be quite safe to assume that most sellers have already exited. It is likely to be an “under owned” stock for both retailers and institutions / funds. UOB Kayhian is the only house which is covering RPG, and it has a target price of $0.295.

Thirdly, RPG has incurred a few one-off expenses in 9MFY15 results such as:

a) Professional fees of US$1m under Admin Fees in 3QFY15 incurred in relation to completion of the reverse takeover;

b) The immediate recognition of the entire historical depreciation costs of US$11m which should otherwise have been amortised over a few years;

c) Arranger fee of US$15.7m & goodwill of US$45.9m written off in 3QFY15F in relation to the reverse takeover;

According to management, the above are not expected to be incurred in future. In other words, going forward, ceteris paribas, RPG’s financials are likely to be better without the above non-recurring expenses.

Company description

RPG (formerly known as Sky One Holdings Limited) was listed on SGX Catalist Board on 14 November 2014 via a reverse takeover. RPG is a mine owner and primarily engages in the business of coal mining and coal exploration operations in East Kalimantan, Indonesia. RPG also owns and provides coal mining facilities such as coal hauling road, coal stockpiles, coal crushers, coal conveyor system, jetty and barge loading facilities to third party mine owners. RPG is 54.67% controlled by Madrone Enterprises Limited, a company which is 100% owned by the family of Executive Chairman and CEO Mr Agus Sugiono.

Company developments to watch out for

Major catalyst – Potential award of the 2nd IPPKH permit

RPG currently has a “borrow-use” permit to mine 309 ha out of its total mining concession area of 1,933ha. In a 19 Jan 2015 press release, RPG said it has submitted an application to secure the “borrow-use” permit to mine the remaining 1,624 ha of total mining concession area. This, if approved, should have a positive impact on its reserves and future earnings. UOB Kayhian estimates that the award may be given to RPG by June 2015.

Cost reduction measures

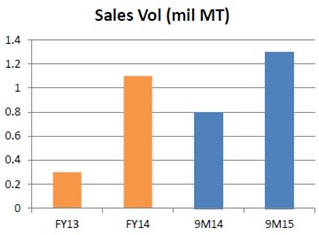

In its 3QFY15 press release, RPG mentioned that it has commenced a cost reduction programme covering areas such as waste mining rates; heavy equipment requirements and fuel supply arrangements. In my opinion, as the rates with their waste mining operator, PT Cipta Kridatama (“CK”) were last adjusted and reduced in July 2013 (i.e. almost approaching two years), there is scope for reduction in 2015. It is noteworthy that waste mining costs comprised approximately 45% of the cost of goods sold. Source: Company (Year ends in Mar)Sales volume ramp up

Source: Company (Year ends in Mar)Sales volume ramp up

With reference to Chart 3 on the right, sales volume surged 59% from 0.82MT in 9MFY14 to 1.30MT in 9MFY15. It is likely that the company will further ramp up its sales volume in FY16F, albeit at a slower pace (on a percentage basis).

Contracts from coal logistics kicking in FY16F

According to the company, RPG leases its excess capacity in its coal logistics facilities, such as crushers, conveyors, stockpile, jetty etc to nearby concession owners. This business segment is lucrative and likely enjoys good margins.

RPG has signed contracts with five concession owners. RPG priced such contracts on a “use per basis” and by distance and tonnage. One concession owner already started to lease RPG’s logistics facilities which contributed to RPG’s 9MFY15 facility usage revenue of around US$1.7m. Barring unforeseen circumstances, it is likely that three other concession owners may start to lease RPG’s logistics facilities in FY16F.

Possibility of M&A

Besides organic growth, the company is also looking to accelerate growth through acquisitions, joint ventures and/or strategic alliances. Acquisitions are particularly interesting as the current depressed prices offer an opportunity to buy at attractive prices. The company is interested in projects that are located near their existing mine in order to achieve synergies and also for ease of management.

As of 9MFY15, RPG only has US$1.9m of debt. Thus, there seems to be scope for the company to take on more debt to finance inorganic growth.

*Some noteworthy points

Concentration risk

RPG has concentration risk in a couple of aspects. Firstly, it only has one mine, thus any problems in the mine will have an adverse impact on RPG. Secondly, due to its current small sales volume, it only has one customer, namely PT Anugerah Bara Kemilau (“ABK”). It is noteworthy that RPG signed the offtake agreement with ABK in Jun 2013 and this agreement will expire on Jun 2015. According to RPG, ABK has offered a 2 year extension at RPG’s option.

Notwithstanding the above, management is cognizant of the customer concentration risk and plans to diversify its customer base when they further ramp up their production.

Dependent on coal price

Any drop in coal price due to an increase in supply or a drop in demand may have an adverse impact on RPG’s operations.

Regulatory risks in Indonesia

RPG’s Rinjani mine is in Indonesia. Any adverse change in regulations may affect the approval for the “borrow-use” permit for the remaining 1,624 ha of mining concession area and their existing business.

*For the full range of risks, readers should download Skyone’s circular to its shareholders (available on SGX) and the UOB Kayhian analyst reports.

Conclusion

This is just a brief introduction on RPG. Readers should be cognizant of RPG’s volatile share price, concentration risk and its dependence on coal price. However, the bullish chart formation, and my view that most negatives have been priced into the share price, coupled with the aforementioned company developments, should make it an interesting stock to keep on the watchlist.

P.S. Readers should refer to the company website http://resourcesprima.com.sg/ for more information and email me at