The writer is a 28-year-old Singaporean who started his investing journey in 2011 amid the euro crisis. He believes in investing in businesses even amateur folks understand, such as restaurants. The content below was recently published on primaryschoolinvestor's website, and is republished with permission.

THIS POST IS dedicated to one of the largest mistakes I have made in my investing journey. I feel like giving myself a good slap.

As you can see from my portfolio, I have successfully divested my holdings in Old Chang Kee and Chip Eng Seng.

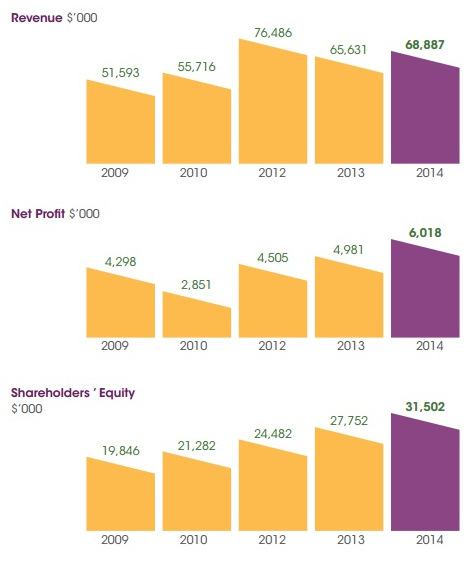

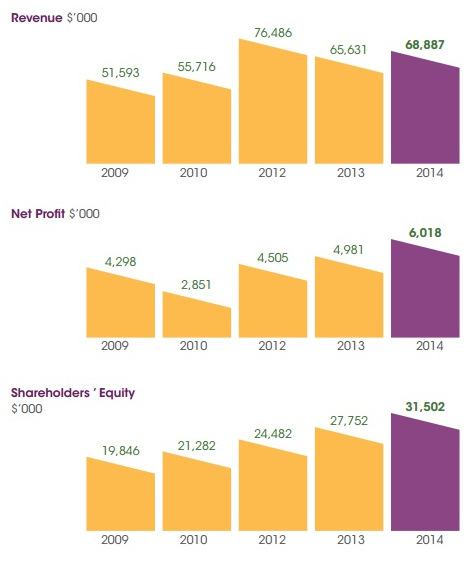

You can see from the charts that both counters have enjoyed a significant run up since my purchase. (You all must be wondering, WAH so shiok, sold them at their peak for a 4-bagger and a 3-bagger respectively.)

Old Chang Kee and Chip Eng Seng charts by Yahoo!

Old Chang Kee and Chip Eng Seng charts by Yahoo!

But unfortunately, that was not the case :(:(:(

I had fallen into the trap of “Pulling out the flowers, watering the weeds.”

I sold my holdings for a mere 14% increase for Old Chang Kee and 10% increase for Chip Eng Seng.

Why? All because of me buying into other people’s stories.

“You shouldn’t hold on to illiquid shares. You don’t get any profit out of them.”

“Property market is too hot at the moment. It is going to go down any time soon”

All these got into my head and convinced me to liquidate my shares in a hurry.

I’m still enjoying my curry puff from OCK. In fact, EVERYONE is still enjoying the good o’ curry puff!

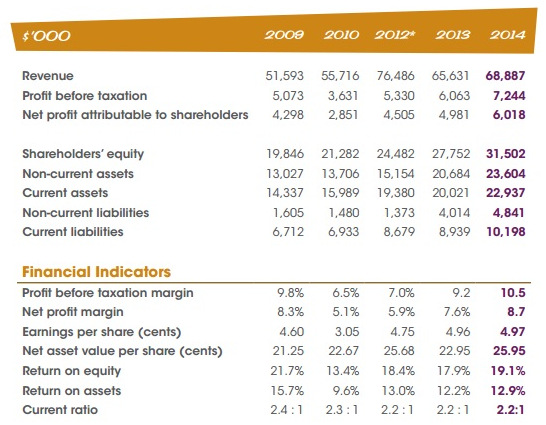

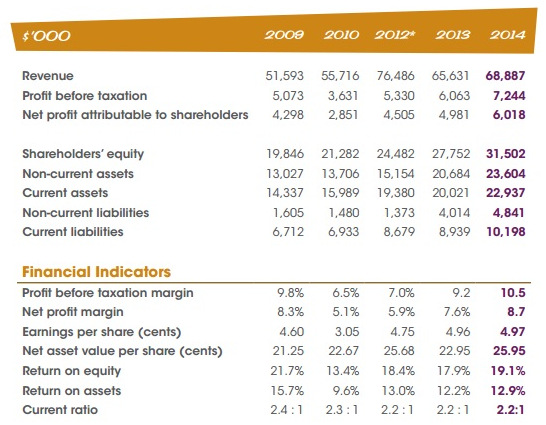

The balance sheets were good, the financial indicators too.

OCK had a cash holding of $13m and a long term debt of $0.5m in 2010. It’s market capitalization was $25.23m. This means you only need to pay $0.136/share for their property, their inventories, their business and their brand.

* The Group had changed its financial year end from 31 December to 31 March. The figures reported for FY2012 comprise 15 months, from 1 January 2011 to 31 March 2012.

* The Group had changed its financial year end from 31 December to 31 March. The figures reported for FY2012 comprise 15 months, from 1 January 2011 to 31 March 2012.

Moral of the story: LET YOUR WINNERS RUN.

Do not let others cloud your own judgments of the company. If you have found yourself a wonderful company to buy at a wonderful price, remind yourself why did you invest in it in the first place. As long as the story is still intact, own it and let the profits run!

I hope you guys found something useful to apply from my mistake. Signing off with a great ache in my heart.

Old Chang Kee and Chip Eng Seng charts by Yahoo!

Old Chang Kee and Chip Eng Seng charts by Yahoo!

* The Group had changed its financial year end from 31 December to 31 March. The figures reported for FY2012 comprise 15 months, from 1 January 2011 to 31 March 2012.

* The Group had changed its financial year end from 31 December to 31 March. The figures reported for FY2012 comprise 15 months, from 1 January 2011 to 31 March 2012. NextInsight

a hub for serious investors

NextInsight

a hub for serious investors