Excerpts from analyst's report

|

|

RISKS

Ability to monetise users

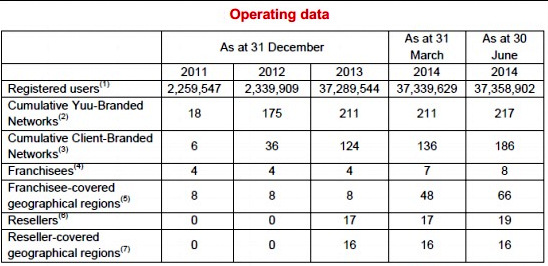

The number of registered subscribers under YuuZoo has grown significantly since 2012 to ~37mil as at 30 Jun 14 (see table below). Despite the large and growing subscriber base, the number of active users currently stands at ~1m only. Active users are defined to be registered users who have logged into a YuuZoo network at least once in the last 30 days. The conversion ratio and quantum of revenues that can be generated from an active user differ from network to network.  Sources: Company reports

Sources: Company reports

Is such technology easily replicated?

The mobile social media and e-commerce industry is fragmented, with relatively low barriers of entry to the business as the technical expertise can be easily replicated. Although YuuZoo differentiates itself through a vertically-integrated solutions offering and is focused on developing markets, it faces intensive competition from more established social media and tech companies such as Facebook, Google and Twitter, which have more resources and stronger market positioning.

FINANCIALS  Thomas Zilliacus, CEO of YuuZoo and formerly Nokia's regional director for the Asia-Pacific. NextInsight file photoLumpy sales but low-cost business

Thomas Zilliacus, CEO of YuuZoo and formerly Nokia's regional director for the Asia-Pacific. NextInsight file photoLumpy sales but low-cost business

During FY11-FY13, the revenue contribution from each business segment varied, with the exception of network development fees.

This is partly attributed to the limited operating history of new business model and lack of recurring income. Its e-commerce segment only started generating sales significantly in FY13 and there were no licence fees recognised in the same year as the company focused on delivering the agreements signed earlier on.

9MFY14 sales grew 26% on a yoy basis, whereas normalised profit jumped 450%, stemming from the small base effect and after accounting for one-off RTO expenses of US$23.6m.

Costs of sales increased from ~60% of sales (FY11-12) to 73% of FY13 sales (attributable to change in product mix), offset by reduced expenses. As a result, net (normalised) profit margins were consistent at ~15% from FY11-13.

VALUATION

Based on its FY13 historical P/E, YuuZoo’s 38.1x valuation is higher than the average of Asia-listed peers but lower than that of US-listed peers. Amongst its peers, YuuZoo has the smallest market capitalisation.

Previous story: YUUZOO buys over IAHGames, on track for listing by 4Q13