Nomura analysts: Wee Lee Chong & Abhishek Nigam

|

|

Transocean and Diamond Offshore have decided in 4Q14 to scrap 17 lower-specification floaters (equals to 5% of global fleet), and we expect other rig owners to follow this lead. The potential market for yards is huge, as we estimate that 36% of deepwater rigs and 52% of jackup rigs globally are at least 30 years old.

1) rig attrition exercise should return some stability to declining DCR (even as global demand falls in 2015F), which should subsequently catalyse the supply-push rig replacement cycle for deepwater rigs;

2) there are supply constraints to meet longer-term demand, due to the diminishing uncontracted rig deliveries (equals a high 47% of total deliveries in 2015F), and the fact that new orders are unlikely to result in a deepwater rig delivery till 2018F, and

3) oil prices are likely to rise h-h in 2H15F. But, we are negative on jackup rig orders outlook for 2015F. This is due to near-record newbuild jackup rig deliveries (only 7% is contracted) in 2015F, which implies the availability of units that can be offered at distressed prices to rig owners, who might otherwise place orders with the yards.

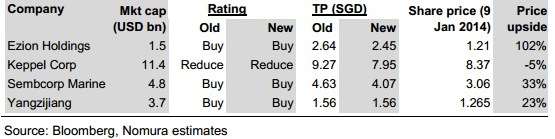

We suggest a pair trade of Buy SMM (TP: SGD4.07) and Reduce KEP (TP:SGD7.95), given the former’s higher exposure to drillship orders, and the latter’s traditional dominance of global jackup rig orders.

YZJ chairman Ren YuanlinYangzijiang (YZJ) is a Buy on dry bulk carrier orders revival from 2Q15F

YZJ chairman Ren YuanlinYangzijiang (YZJ) is a Buy on dry bulk carrier orders revival from 2Q15FWe are positive on the revival of dry bulk carrier orders from 2Q15F, which have 0.7 correlation with the Baltic Dry Index (BDI). We expect the BDI to benefit from seasonal dry bulk demand uplift from late-1Q15F. Buy YZJ (TP:SGD1.56), due to its high exposure to newbuild dry bulk carrier orders.

Recent story: "Keep YZJ As An Outperform With Increased Target Price Of S$1.55"