IT WAS spontaneous. Six investors, after a hearty meal of nasi lemak and mee rebus, responded to a spontaneous suggestion: What is your best stock idea(s) currently?

Value (or fundamental) investors, they had just visited a company in MacPherson and then headed to a nearby cafe for lunch.

They are indeed investors who seek to know the fundamentals of a business and decide to buy (or sell) on that basis, as opposed to stock traders who buy or sell on technical indicators, for example.

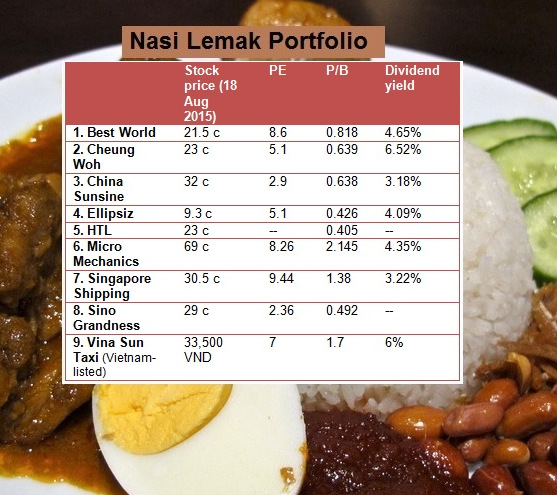

And just as spontaneously, the idea came to me to publicly share here what we later dub as the Nasi Lemak Portfolio.

For now, we are sharing just a list of the stocks with key financial metrics. If your interest is piqued, you might want to do your own research. For reference: The Straits Times Index closed at 3,049 on 18 Aug 2015. Stock prices listed in the table above were from the day before the stock list was compiled at lunch.

For reference: The Straits Times Index closed at 3,049 on 18 Aug 2015. Stock prices listed in the table above were from the day before the stock list was compiled at lunch.

As you know, the stock market has been on a downtrend, and the prices of most of the stocks in the table have already gone lower than the numbers quoted.

Hopefully, in the long run, the stocks will reflate on more positive fundamentals.

NextInsight will revisit this portfolio at end-November (ie about 3 months later), and see how it has done. But if there are significant price movements before that, we can do an article as an update for readers.

Wish us luck -- and if you have views and questions on the stock picks, feel free to post below. Meantime, as we face a volatile market, here's a pretty apt quote to chew on:

|

Read more: http://www.businessinsider.com/why-im-not-selling-stocks-2013-9#ixzz3jX6KL85C |

Note: The above portfolio reflects the diverse investment interests and perspectives of 6 investors and are not a recommendation for investment by any reader. Your risk profile and investment objectives could differ, and are likely to differ, from the investors.