Excerpts from analyst's report

|

|

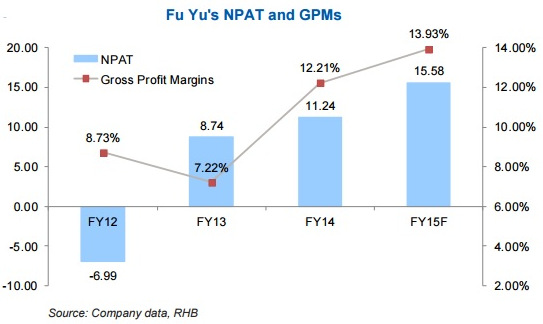

» More cost-cutting could lead to margin boost. We expect Fu Yu’s gross margins to improve significantly to a conservative 13.9% in FY15 from 12.2% in FY14. 1Q15 gross margins actually improved to 14.8% from 8.9% in 1Q14, which further substantiates our view. Going forward, we believe projects with better margins from its precision injection moulding and tooling segments, the increase in automated processes and more cost-cutting from its China factories should continue to contribute positively to gross margins.

» Growth from medical, environment and automobile products. Management is bullish on these three areas as demand has been growing steadily, especially from clients in the medical and environmental space. The company is also keen to expand contributions from the automobile sector and is already in talks with several parties at the moment. Being one of the largest and more experienced key plastic players in the industry, we are confident on Fu Yu’s capabilities on this front.

» Key beneficiary of 3D printing. We believe that Fu Yu may be a potential key beneficiary of 3D printing in the future. Both HewlettPackard (HP) (HPQ US, NR) and Venture Corp (VMS SP, NR) are its existing customers and Fu Yu is one of the key plastic manufacturers for HP. We believe that given Fu Yu’s long-standing capabilities in the plastic segment, any success or rising demand in the 3D printing segment will likely benefit the company, going forward.

» Cash cow ready for milking. With rich cash flow generation from operations of SGD20m-30m a year, we think Fu Yu is a cash cow ready for milking and that FY15 will likely be a key inflection point to reap gains for this treasure chest. We are positive on Fu Yu and project a record FY15 NPAT. Maintain BUY with a DCF-backed TP of SGD0.30 (WACC: 12%, TG: 0%).