Excerpts from analysts'report

Edison Investment Research analysts: Bridie Barrett, Moira Daw & Dan Ridsdale

|

|

DCF scenarios – upside potential if B2C strategy a success

There are many unknown variables (MAU progression, transaction values over the networks, commission rates on e-commerce, revenue share percentages, SAC), and as a result we have had to make many more assumptions than typical in our forecasts. We present four DCF scenarios. All our scenarios assume a 12.5% WACC, tax rate increasing to 25% by year five and that 20% of revenues are tied up in working capital. We assume a 10-year growth phase where margins plateau after year five, and where revenue growth decreases from year five to 2% in perpetuity.

Current share price: a reverse DCF implies that the current share price discounts a five-year CAGR in revenues of 25% with EBIT margins peaking at c 15%. This scenario would be consistent with the group’s historic focus (ie of a PSP or a B2B network pure developer). For instance, our DCF model returns a value in line with the current share price if MAUs increase by c 3m pa with revenues reaching $200m on EBIT margins of 11% after five years.

Mid-case: if management can grow MAUs by c 10 million pa to reach c 50 million after five years, this would suggest revenues of approximately $400m and peak EBIT margins of 19%. Under this scenario, our DCF returns a value of S$0.81.

Rapid evolution of MAUs: network effect businesses rarely follow a middle ground. If the network effect truly takes hold, exponential growth could continue for longer. If revenues were approximately 50% above our mid-case scenario by year five (ie $600m), either because of higher ARPUs or higher MAUs (eg 20 million net MAU additions each year to give MAUs of c 100m by year five), EBIT margins could reach c 21%, returning a DCF value of c S$1.25.

Slow evolution of networks: equally, if key relationships underperform, or if management fails to bring on significant new partners, revenues could evolve at a slower pace. If 2017 revenues are $250m by year five, with peak margins of 14%, our DCF returns a value of c S$0.35 per share. Our scenario analysis assumes a 12.5% WACC – relatively high given the early stage and the emerging market focus of the B2C initiatives. As the business matures, we would expect the WACC to come down. *Excludes revaluation of franchisee stakes.

*Excludes revaluation of franchisee stakes.

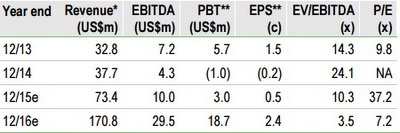

**PBT and EPS are normalised, excluding intangible amortisation, exceptional items and revaluation of franchisee stakes. Peer-driven valuation – discounts legacy B2B focus

For peer multiple comparison, we refer to 2016 forecasts as YuuZoo’s virtual malls will only contribute revenues from May 2015. We look to EBITDA multiples given the differing reporting basis for revenues.

YuuZoo trades on a 2016 EV/EBITDA of 3.5x – at the low end of peers – companies with a focus on B2C e-commerce trade between 4x to 8x , social media 5x to 27x and mobile games 5x to 17x, although small-cap companies tend to trade at the lower end of the spectrum. YuuZoo’s current low rating reflects its historic focus and its early stage in developing its B2C network business.

However, if management can execute according to the strategy, the B2C social e-commerce networks will drive the group’s growth. Although it has little operational track record, it has put in place new relationships that should start to contribute during 2015 and we would expect this discount to start to close as evidence of its progress emerges. Applying a small-cap B2C peer EV/EBITDA multiple implies a SOTP valuation range of 27-59c per share.