The baijiu market is expected to stabilise in 2015, according to Dukang.

The baijiu market is expected to stabilise in 2015, according to Dukang.

Photo: CompanyFIL LIMITED bought into S-chip Dukang Distillers last week as the baijiu industry shows signs of a tentative recovery and Dukang reported its second consecutive month of profitability.

FIL added 239,100 shares at an average price of 13.58 cents each, on 19 May, according to a filing on the Singapore Exchange.

That raised FIL's deemed interest from 6.98% to 7.01%, or 55,993,100 shares.

In 3QFY15 (ended March 2015), Dukang registered profit attributable to shareholders of RMB1.8 million, a 28.9% year-on-year decline but it was Dukang's second consecutive proftiable month. The 2QFY 15 profit was RMB3.7 million. Dukang Chairman and CEO Zhou Tao. NextInsight file photo.3Q sales amounted to RMB250.3 million, a 76.2% y-o-y decrease but it was higher than the RMB231.6 million achieved in 2Q which, in turn, was 11.6% higher than 1Q.

Dukang Chairman and CEO Zhou Tao. NextInsight file photo.3Q sales amounted to RMB250.3 million, a 76.2% y-o-y decrease but it was higher than the RMB231.6 million achieved in 2Q which, in turn, was 11.6% higher than 1Q.

And what's Dukang's take on the industry outlook?

In its 3Q ended March 2015 results announcement, the executive chairman and CEO, Zhou Tao, said: “Although there might be a slight turnaround in the baijiu market according to some reports, China’s baijiu market has yet to indicate a clear trend."

|

The 3Q results announcement also said: "Since the start of the anti-corruption campaign in 2012, the baijiu industry has shifted drastically from a stage of rapid growth to a phase of adjustment. The price of high-end baijiu has plunged significantly, and the competition among mid-to-low end products became more intense

"Nonetheless, the baijiu market is expected to stabilise in 2015."

Amid the tough circumstances, Dukang's 3Q15 gross profit margin dropped 4.8 points to 29.0% from a year earlier.

More info in the 3QFY15 Powerpoint materials here.

Peers in China have outperformed

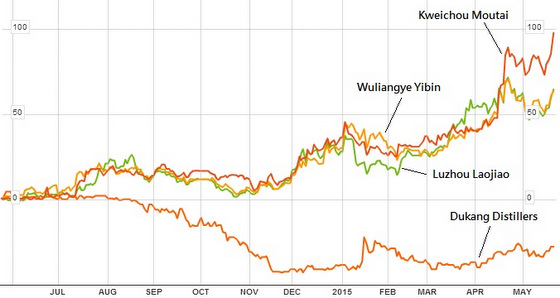

The chart below shows that Kweichow Moutai and Wuliangye Yibin share prices have continued to recover in the past 12 months. These are the leading baijiu brands in China and are multi-billion dollar companies.

A closer comparable to Dukang, in terms of product pricing, is Luzhou Laojiao, which has a market cap of about S$7.7 billion -- way above Dukang's S$113 million.

Luzhou Laojiao's share price has risen about 70% in the past 12 months but Dukang is down about 28%.

The three China-listed companies were buoyed perhaps by a rally in Chinese stocks. This chart compares how the above stocks have done in the past 12 months. Dukang is down about 28% while its three China-listed peers (which have much bigger market caps) have shot up. Best performer Kweichou Moutai has achieved a return of almost 100%.

This chart compares how the above stocks have done in the past 12 months. Dukang is down about 28% while its three China-listed peers (which have much bigger market caps) have shot up. Best performer Kweichou Moutai has achieved a return of almost 100%.

Chart: Bloomberg