Time & date: 15 April 2015

Time & date: 15 April 2015

Venue: Suntec Singapore Convention & Exhibition Centre

I bought SUNTEC in 2012 and I was really looking forward to the AGM to assess if I should sell some when prices are quite high now. But the receptionist stopped me in my tracks and told me my name was not on the Suntec Reit investors list and I was not allowed in to the AGM!

My mind went into hyper drive trying to figure out what happened. I mean, how can I can be wrong? Could it be I sold it unknowingly? Am I going to lose my 35% gain? Or someone hacked into my account? I was pretty sure I held the shares. This, after all, was one of my best performing Reits and I was tracking it closely. I even got my regular statements and annual report.

Then it struck me. I bought Suntec Reit with my SRS account monies. Investors using SRS to invest in stocks actually need to inform their SRS agent (in this case your bank) in advance for them to issue you an authorisation letter to attend the AGM. This is because investors are not recognised as legal owners of the shares but the SRS agent.

In some cases your SRS agent will need as long as 2 weeks notice before they can appoint you as a proxy! Only then, will you be given the right to attend and vote on a show of hands at AGMs (and meal coupon entitlement). Without that appointment, you can only attend as an observer. This means, no questions, no vote and no rights (and no meal entitlement).

Someone did write about this issue to Business Times (here) asking this unfair treatment to end. His letter titled “CPF and SRS investors should be treated on a par with CDP investors” caught the attention of ACRA which said it would propose a change to the Companies Act to allow SRS investors to have similar rights as CDP investors. That was 2014. At the point of writing, I have not heard any news yet.

So what happened in the AGM?

Well, Suntec Reit was gracious enough to allow me in as an observer and I got to hear the challenges and future plans for this REIT. Here are my nuggets of information I captured:

General:

- It has been 10 years since the REIT's IPO and the size of the property under management has grown from $2.2B at the beginning to $8.8B now. It is the second biggest REIT listed in Singapore based on AUM.

- Its DPU has also grown to 9.400 cents in 2014, which translates to about 5.0% dividend yield.

- The REIT started building a commercial building (177 Pacific Highway) in Australia last year. Expected completion date is early 2016.

Good

- The REIT still has a few projects under development and AEI. Specifically the Australian building and phase 3 of Suntec redevelopment. Not forgetting they still have an opportunity to do AEI at Park Mall. So the potential for income upside is there.

- They recognized the challenges of trends in retail and are planning to go head on to win customers back. Ideas include investing more in retail technology (like beacon) to make shopping more targeted and setting up a royalty program. They are also planning to house more higher end F&B as part of the Phase 3 development to attract a different profile of consumers.

- On top of that, they are also changing their rental model from pure fix rental amount to a mix with GTO (Gross Turn Over) component. This, they hope will better align the stores and REIT’s objective and in the long run get a higher rental.

Not so good

- The Singapore retail scene is facing strong headwinds. One is the tightening labor market (shop need sales folks to sell) and ever increasing popularity of buying on-line. I personally have been buying more from online stores than ever before. The conveniences and lower prices are too hard to resist.

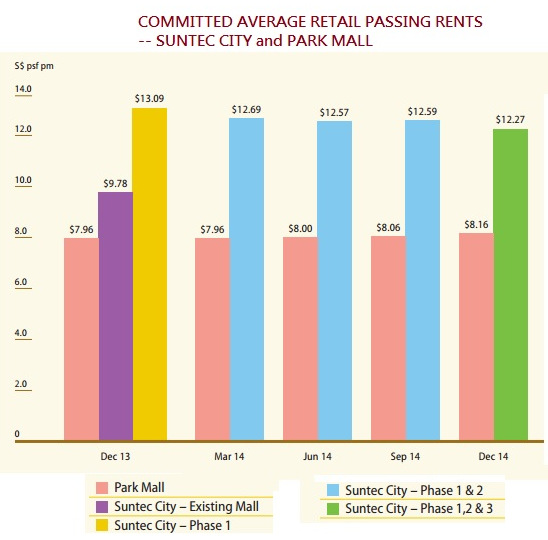

- You can see that trend by looking at the average retail passing rent chart below. Since Dec 13, average rents have been going downwards and looks like this trend will continue to go that direction.

- You can see that trend by looking at the average retail passing rent chart below. Since Dec 13, average rents have been going downwards and looks like this trend will continue to go that direction.

- More retail spaces are coming on board. The clear and present competitor is the South Beach Development just across the street. It is a joint venture between City Developments Limited and IOI Group, it will seamlessly blend the four historic buildings on site with two new towers to feature offices (46k sqm), luxury residences, a designer hotel, retail spaces (60k sqf). That is about 50% of Suntec’s 143k sqf current retail space coming on board.

Summary

Suntec Reit has been good for me. But I think it's time to start to look for another dividend counter to switch to. Don’t get me wrong, the fundamentals of this Reit are still quite strong. It has low Debt to Equity Ratio, high Interest Cover and long WALE. But looking ahead I think it will be challenging for them to keep the DPU growing. Roland Liew (left) is co-owner of Wealth Directions Pte Ltd. He has more than 10 years of stock investing experience, and is a strong advocate of long term value investing and mid term high yield investment. His article was recently published on Wealth Directions, and is republished here with permission.

Roland Liew (left) is co-owner of Wealth Directions Pte Ltd. He has more than 10 years of stock investing experience, and is a strong advocate of long term value investing and mid term high yield investment. His article was recently published on Wealth Directions, and is republished here with permission.