Shanghai Turbo, at 7.8 cents share price, has a market cap of only S$21 m. Chart: Yahoo!

Shanghai Turbo, at 7.8 cents share price, has a market cap of only S$21 m. Chart: Yahoo!

Excerpts from analyst's report NRA Capital analyst: Jacky Lee (left)

NRA Capital analyst: Jacky Lee (left)

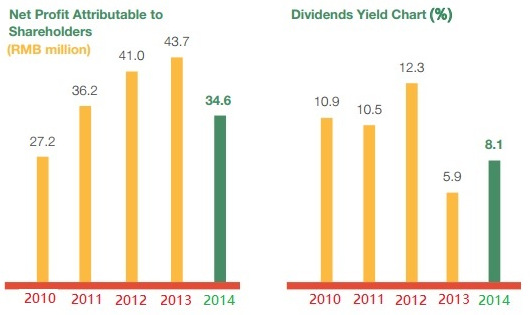

Shanghai Turbo share price trades at only 0.3x PBR and 3x historical PER. We consider its share price undemanding given its good track record on profitability since 2008 with net cash positions, and consistent dividend pay-out since 2010.

Background

Shanghai Turbo was founded in 1997, a unique player in China capable of producing complete vane products for different type of turbine generators. Based in Changzhou City, Jiangsu, China, its core business is in precision engineering that specializes in the production of precision vane products, namely stationary vanes, moving vanes and nozzles. The vane products mostly for thermal power plants, gas and steam power projects, and a small number for nuclear power plants.

Major customers include DongFang Steam Turbines (approximately 45% of its FY14 total sales), Beijing Full Dimension Power Tech (Beijing 4D) (40%) and to Mitsubishi Heavy Industries (13%).

Listed on mainboard of SGX-ST since January 2006, Shanghai Turbo is a promising player in the growing sector of clean energy. The group utilizes advanced manufacturing technology as its competitive edge by using the latest precision engineering machinery from Korea, Japan, Switzerland and Germany.

Key takeaway from analyst briefing:

- Business overview:

2011 Invested Rmb38.5m in advanced machinery to meet stringent technical requirement standards in order to secure business with Japan’s Mitsubishi Heavy Industries, Germany’s MAN TURBO, Siemens China and American’s Dresser-Rand in 2012.

2012 Secured economic and technological cooperation with Mitsubishi Heavy Industries to developed supercritical and ultra-supercritical high-power turbine, nuclear turbine, heavy gas turbine and steam-gas combined cycle units.

2013 Achieved ISO9001:2008 certification on its quality management system and invested in high tech machinery such as high precision integrated turn-mill centres.

2014 Obtain ISO14001 and OSHAS18001 certifications as well as 2 patents for milling processes adding a total of 14 patents to date. The group capabilities increased to be able to produce individual vane product pieces for gas and steam combined-cycle turbine power generators with generating capacity of up to 1,000 megawatts.

2015 Strengthening its corporate governance, the board separated the roles of Chairman and CEO to ensure an appropriate balance of power, increased accountability and greater capacity for independent decision making by the board.

- FY14 results review

- Shanghai Turbo FY14 revenue declined by 3.1% due to lower sales in domestic market. Net profit decline by 21.5% yoy to Rmb34.6m due to higher outsourcing costs coupled with the absence of refunds from deferred tax provisions granted for 2013.

- Trade receivables remain a point of concern as the receivable days for FY14 is 376 days versus 266 days in FY 13. China’s State-Owned Enterprises contributed 97% of the total trade receivables.

- Balance sheet remains healthy with net cash of Rmb53.7m in FY14 with zero debt.

- The group declared a final cash dividend of Rmb0.025 per share in FY14. It has paid consistent dividend payouts since 2010.

- In 2014, the group diversified its portfolio by forming a business cooperation with Japan’s Mitsubishi Heavy Industries. Revenue growth in Japan rose from Rmb13m in FY13 to Rmb20m in FY14.

- Shanghai Turbo is currently in talks with European and USA customers. Should that be successful, it will negate the risk of over dependency in the Chinese market.

- The group is expecting business to pick up as it diversifies its operations overseas to reduced reliance on China markets which contribute to 86% in FY14 versus 87% in FY13 of its total revenue.

- In China, potential catalyst includes the government increasing attention to environmentally friendly means of power generation, which may lead to the replacement of older turbine generators with new energy efficient generators.

|

We view Shanghai Turbo’s business to have high barriers to entry due to industry technology constantly being updated, strict quality system and qualification audit from customers and heavy capex spending. So far, less than 30 players in China are capable to compete with Shanghai Turbo. At S$0.078, Shanghai Turbo share price trades only at 0.3x PBR and 3x historical PER. Despite its high dependency on customers with long credit term (more than 300 AR days), we view its share price to be undemanding given its good track record on profitability since 2008 with net cash positions and consistent dividend pay-out since 2010. Major shareholders include private equity backed by major Japanese institutions. So far, Shanghai Turbo has maintained a zero-rejection rate from its customers, building its reputation within the industry. We see the board now strengthening its corporate governance and increasing the group transparency to be positive moves, and going forward, could help to improve its liquidity eventually. The company proposed a consolidation of every 10 shares into 1 share, share transfer books of the company will be closed 12 May 2015. |